Comparative Review of Leading Stock Trading Software

By Jordan Patel | Published: 2025-03-22 | Category: Stock Trading Software

About Stock Trading Software

Stock trading software encompasses platforms and applications designed for buying and selling stocks, options, futures, and other securities. These tools provide market data, charting capabilities, order execution, and account management features.

Scoring Criteria

- → Charting & Tools

- → Ease of Use

- → Platform Features

- → Cost & Fees

- → Research & Data

- → Order Execution

- → Customer Support

The Best Stock Trading Software

#9

#9

NinjaTrader

By NinjaTrader, LLC

A platform highly focused on futures trading, offering advanced charting, automated strategy development (NinjaScript), and brokerage services.

Platforms & Use Cases

Platforms: Desktop (Windows), Web, Mobile (iOS, Android - via partners/web)

Best For: Futures Trading, Forex Trading, Active Trading, Algorithmic Trading, Strategy Backtesting

Key Features

- ✓Futures Focus: Specialized tools, data feeds, and order types optimized for futures markets. (Strong)

- ✓Advanced Charting: High-quality charting with numerous indicators, drawing tools, and chart types. (Excellent)

- ✓NinjaScript: C#-based framework for developing, backtesting, and automating trading strategies. (Powerful)

- ✓Trade Simulation: Robust simulated trading environment using real-time data. (Yes)

- ✓Ecosystem: Large third-party ecosystem providing add-on indicators and strategies. (Extensive)

Scorecard (Overall: 7.7 / 10.0)

Pricing

Free

Contact Vendor

- Advanced charting

- Strategy backtesting

- Trade simulation

Limitations: Cannot place live trades without brokerage/license, Higher commissions if used free with NT Brokerage

License (Lifetime/Lease)

$1499.00 / One-time (or Lease options)

- Reduced commissions with NT Brokerage

- Premium features (e.g., Order Flow+)

- Ability to trade live

Limitations: Significant upfront cost for Lifetime license

Pros

- + Excellent platform specifically for futures traders

- + Powerful charting and technical analysis tools

- + Strong capabilities for automated strategy development (NinjaScript)

- + Extensive third-party add-on market

- + Good trade simulation features

Cons

- - Primarily focused on futures and forex; less ideal for stock/options

- - Desktop platform is Windows-only

- - Can be complex for beginners

- - Licensing model or higher commissions add costs

- - Limited fundamental research tools

Verdict

"A leading choice for dedicated futures traders requiring advanced charting, analysis, and automated strategy capabilities, especially on Windows."

#8

#8

Webull

By Webull Financial LLC

A mobile-first platform popular with younger investors, offering commission-free trading, decent charting, and community features.

Platforms & Use Cases

Platforms: Mobile (iOS, Android), Web, Desktop (Windows, Mac)

Best For: Mobile Trading, Beginner Investing, Options Trading (Basic), Community Interaction

Key Features

- ✓Commission-Free Trading: Zero commission on stocks, ETFs, and options trades. (Yes)

- ✓User-Friendly Interface: Clean design, particularly strong on mobile. (Intuitive)

- ✓Extended Hours Trading: Offers pre-market and after-hours trading sessions. (Yes)

- ✓Paper Trading: Virtual trading account for practice. (Yes)

- ✓Community Features: Built-in social feed for user comments and analysis. (Active)

Scorecard (Overall: 7.5 / 10.0)

Pricing

Standard

Contact Vendor

- Commission-free stock/ETF/options trades

- Basic platform access

- Level 2 data requires subscription

Limitations: Limited research tools, No futures or bonds trading

Pros

- + Truly commission-free (including options)

- + Slick and intuitive mobile app

- + Good charting for a free platform

- + Paper trading available

- + Offers fractional shares

Cons

- - Limited research and fundamental data

- - Customer support can be slow

- - Advanced trading tools are lacking compared to leaders

- - Asset classes limited (no futures, fixed income)

Verdict

"A great choice for mobile-focused traders and beginners prioritizing zero commissions and ease of use, but lacks the depth for serious, research-driven traders."

#7

#7

tastytrade (formerly tastyworks)

By tastytrade, Inc.

A platform built by options traders, for options traders, focusing on speed, efficiency, and unique analytical tools for derivatives.

Platforms & Use Cases

Platforms: Desktop (Windows, Mac, Linux), Web, Mobile (iOS, Android)

Best For: Options Trading, Futures Trading, Active Trading, Derivatives Analysis

Key Features

- ✓Options Focus: Interface and tools optimized for quickly analyzing and trading options strategies (e.g., curve view, grid view). (Specialized)

- ✓Probability/Volatility Tools: Emphasis on probability of profit (POP), IV Rank, and other volatility metrics. (Integrated)

- ✓Capped Commissions: Unique commission structure capping fees per leg on equity options. (Cost-Effective (Options))

- ✓Content Integration: Direct integration with tastytrade financial network content (shows, analysis). (Unique)

- ✓Quick Order Entry: Designed for rapid order placement and adjustments. (Fast)

Scorecard (Overall: 8.1 / 10.0)

Pricing

Standard

Contact Vendor

- Commission-free stock/ETF trades

- $1 per options contract to open (capped at $10/leg)

- $0 commission to close options

- Futures fees apply

Limitations: Fewer tools for stock-only traders, Research more focused on derivatives

Pros

- + Excellent platform specifically designed for options trading

- + Competitive and unique commission structure for options

- + Fast and efficient order entry

- + Integrated educational and analytical content

- + Good tools for volatility analysis

Cons

- - Charting capabilities are less advanced than competitors

- - Stock trading tools are secondary

- - Research depth lags behind full-service brokers

- - Interface can be initially confusing

Verdict

"The best platform for frequent options traders who value speed, specialized tools, and a cost-effective commission structure for derivatives."

#6

#6

Power E*TRADE

By E*TRADE (from Morgan Stanley)

A user-friendly web and mobile platform geared towards active traders, especially strong in options trading analysis and execution.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Active Trading, Options Trading, Mobile Trading, Technical Analysis

Key Features

- ✓Options Tools: Spectral Analysis, Risk Slide, and Strategy Optimizer tools for options. (Strong)

- ✓Charting: Integrated TradingView charting with numerous indicators and drawing tools. (Excellent)

- ✓Snapshot Analysis: Concise fundamental and technical overview of securities powered by TipRanks and other sources. (Useful)

- ✓Trade Execution: Easy-to-use trade ticket, including multi-leg options orders. (Intuitive)

- ✓Paper Trading: Allows practice trading with virtual funds. (Yes)

Scorecard (Overall: 8.3 / 10.0)

Pricing

Standard

Contact Vendor

- Commission-free US stock/ETF trades

- Full platform access

- Options contract fees apply

Limitations: No dedicated desktop platform

Pros

- + Excellent integration of TradingView charts

- + User-friendly interface, especially for options

- + Strong mobile trading app

- + Good educational resources

- + Commission-free stock/ETF trades

Cons

- - No dedicated downloadable desktop platform

- - Research tools less comprehensive than Fidelity or Schwab

- - Futures trading tools less prominent than competitors like thinkorswim

Verdict

"A strong choice for active traders prioritizing ease of use, excellent charting (via TradingView), and powerful options tools, particularly on web and mobile."

#5

#5

Active Trader Pro

By Fidelity Investments

A robust desktop platform from a major broker, offering comprehensive research, screening tools, and portfolio analysis for active investors.

Platforms & Use Cases

Platforms: Desktop (Windows, Mac), Web, Mobile (iOS, Android)

Best For: Active Trading, Long-term Investing, Research & Analysis, Portfolio Management, Options Trading

Key Features

- ✓Extensive Research: Access to numerous third-party research reports (Argus, Zacks, etc.) and Fidelity's own insights. (Comprehensive)

- ✓Customizable Layout: Highly configurable workspace with docking tiles for charts, news, watchlists, etc. (Flexible)

- ✓Advanced Screening: Powerful stock, ETF, and mutual fund screeners with many criteria. (Robust)

- ✓Real-time Analytics: Streaming quotes, portfolio analysis tools, and real-time profit/loss tracking. (Yes)

- ✓Trade Armor: Tool for setting conditional orders, alerts, and visualizing trade entries/exits. (Useful)

Scorecard (Overall: 8.6 / 10.0)

Pricing

Standard

Contact Vendor

- Commission-free US stock/ETF trades

- Full platform access (often requires minimum trades/assets)

- Access to extensive research

Limitations: Platform access sometimes requires meeting activity/asset criteria

Pros

- + Outstanding research resources

- + Excellent customer support

- + Commission-free stock/ETF trades

- + Solid charting and technical analysis tools

- + Good platform stability and reliability

- + No platform fees (though activity reqs may apply)

Cons

- - Platform interface feels slightly dated compared to newest competitors

- - Charting less advanced than thinkorswim or TradingView

- - Primarily focused on US markets

Verdict

"A top contender for research-focused traders and investors who value a stable platform and excellent support from a large, reputable broker."

#4

#4

TradingView

By TradingView Inc.

A web-based platform renowned for its superior charting, social networking features, and broad broker integration capabilities.

Platforms & Use Cases

Platforms: Web, Desktop (Windows, Mac, Linux), Mobile (iOS, Android)

Best For: Chart Analysis, Technical Trading, Social Trading, Market Screening, Broker Integration

Key Features

- ✓Exceptional Charting: Smooth, intuitive, highly customizable HTML5 charts with vast indicator/drawing tool library. (Best-in-class)

- ✓Social Network: Large community sharing trading ideas, scripts, and analysis. (Active)

- ✓Pine Script: User-friendly language for creating custom indicators and strategies. (Accessible)

- ✓Broad Market Data: Extensive data coverage across stocks, forex, crypto, futures, bonds. (Global)

- ✓Broker Integration: Trade directly from charts via numerous integrated brokers (e.g., IBKR, TradeStation, FOREX.com). (Wide)

Scorecard (Overall: 8.4 / 10.0)

Pricing

Basic

Contact Vendor

- Basic charting

- 1 chart per layout

- Limited indicators

- Ad-supported

Limitations: Delayed data on some exchanges, Limited alerts

Pro

$14.95 / Monthly

- 5 indicators per chart

- 2 charts per layout

- 20 server-side alerts

- Ad-free

Limitations: Still some limitations on layouts/indicators

Pro+

$29.95 / Monthly

- 10 indicators per chart

- 4 charts per layout

- 100 alerts

- Intraday Renko/Kagi etc.

- Multiple watchlists

Limitations: Limits on alerts and layouts exist

Premium

$59.95 / Monthly

- 25 indicators per chart

- 8 charts per layout

- 400 alerts

- Second-based intervals

- Publish invite-only scripts

Limitations: Highest cost tier

Pros

- + Best-in-class charting experience

- + Intuitive and user-friendly interface

- + Large active community for idea generation

- + Wide broker integration allows flexibility

- + Powerful Pine Script for custom tools

Cons

- - Core platform is not a direct broker (requires integration)

- - Subscription costs for advanced features add up

- - Customer support primarily via tickets for lower tiers

- - Research tools less fundamental-focused than broker platforms

Verdict

"Unparalleled for charting and technical analysis with a great user experience and social features, best used alongside an integrated broker."

#3

#3

TradeStation

By TradeStation Technologies, Inc.

A high-performance platform known for its excellent charting, automated strategy building (EasyLanguage), and reliable execution for active traders.

Platforms & Use Cases

Platforms: Desktop (Windows), Web, Mobile (iOS, Android)

Best For: Active Trading, Algorithmic Trading, Strategy Backtesting, Technical Analysis, Futures Trading, Options Trading

Key Features

- ✓EasyLanguage: Proprietary programming language for creating, backtesting, and automating custom trading strategies. (Powerful)

- ✓RadarScreen: Real-time market scanning tool monitoring hundreds of symbols based on custom criteria. (Advanced)

- ✓Portfolio Maestro: Advanced portfolio-level backtesting and performance analysis tool. (Yes)

- ✓Charting: High-quality, customizable charting package with historical data and numerous indicators. (Excellent)

- ✓Order Execution: Focus on speed and reliability of order fills. (Reliable)

Scorecard (Overall: 8.3 / 10.0)

Pricing

TS Select

Contact Vendor

- Commission-free stock/ETF trades

- Full platform access

- Options/Futures fees apply

Limitations: Requires $2000 minimum funding

TS Go

Contact Vendor

- Commission-free stock/ETF trades

- Mobile and web access focus

Limitations: Limited desktop features, Higher options contract fees

Pros

- + Outstanding charting and technical analysis tools

- + Powerful strategy automation with EasyLanguage

- + Excellent backtesting capabilities

- + Reliable order execution

- + Good range of tradable assets

Cons

- - Desktop platform is Windows-only

- - Can be complex for beginners

- - Higher fees for low-volume traders or small accounts historically (check current structure)

- - Research tools less extensive than some competitors

Verdict

"A top choice for systematic traders and those focused on technical analysis and automated strategies, particularly if using Windows."

#2

#2

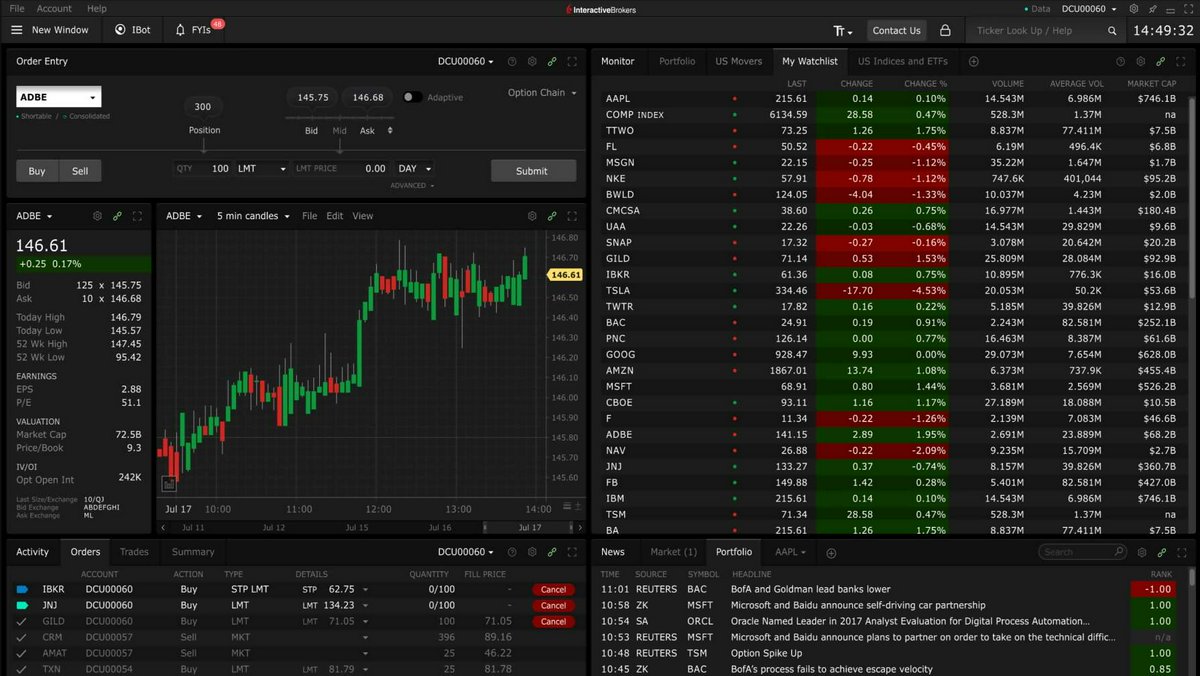

Trader Workstation (TWS)

By Interactive Brokers

A professional-grade platform offering global market access, low commissions, and a vast array of tools for sophisticated traders and institutions.

Platforms & Use Cases

Platforms: Desktop (Windows, Mac, Linux), Web, Mobile (iOS, Android)

Best For: Active Trading, Algorithmic Trading, Global Investing, Options Trading, Futures Trading, Institutional Trading

Key Features

- ✓Global Market Access: Trade stocks, options, futures, forex, bonds, and funds on over 150 markets worldwide. (Unmatched)

- ✓Low Commissions: Highly competitive tiered or fixed commission structures, especially for high-volume traders. (Very Low)

- ✓Advanced Order Types: Extensive library of over 100 order types and algorithms. (Comprehensive)

- ✓API Access: Robust APIs (incl. FIX) for building custom trading applications and automating strategies. (Yes)

- ✓Risk Management Tools: Sophisticated real-time risk monitoring and portfolio analysis tools. (Advanced)

Scorecard (Overall: 8.4 / 10.0)

Pricing

IBKR Pro (Tiered/Fixed)

$0.00 / Per Share (min $0.35)

- Lowest commissions for active traders

- Access to all tools

- SmartRouting order execution

- API access

Limitations: Potential data subscription fees

IBKR Lite

Contact Vendor

- Commission-free US stock/ETF trades

- Simplified web/mobile platforms

Limitations: Limited order types, No SmartRouting, Less competitive forex/international rates

Pros

- + Extensive global market access

- + Exceptionally low margin rates and commissions (Pro)

- + Powerful tools for professionals and institutions

- + Wide range of tradable assets

- + Strong API support for algorithmic trading

Cons

- - Very steep learning curve; interface is complex

- - TWS can be overwhelming for casual investors

- - Customer support can be inconsistent

- - IBKR Lite lacks many advanced features

Verdict

"Ideal for sophisticated, high-volume traders and global investors who prioritize low costs and extensive market access, but requires significant user commitment."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

thinkorswim

By Charles Schwab

A sophisticated trading platform favored by active and technical traders for its advanced charting, analytics, and options trading tools.

Platforms & Use Cases

Platforms: Desktop (Windows, Mac), Web, Mobile (iOS, Android)

Best For: Active Trading, Options Trading, Futures Trading, Technical Analysis, Strategy Backtesting

Key Features

- ✓Advanced Charting: Highly customizable charts with hundreds of technical studies and drawing tools. (Extensive)

- ✓Options Analytics: Tools like Option Hacker, probability analysis, and risk graphs for complex options strategies. (Comprehensive)

- ✓Paper Trading: Realistic simulated trading environment (paperMoney) to practice strategies. (Yes)

- ✓Complex Order Types: Supports advanced conditional orders, OCO (One-Cancels-Other), and multi-leg options orders. (Advanced)

- ✓Market Scanners: Customizable stock, options, and futures scanners based on technical and fundamental criteria. (Powerful)

Scorecard (Overall: 8.8 / 10.0)

Pricing

Standard

Contact Vendor

- Commission-free US stock/ETF trades

- Full platform access

- Options contract fees apply

- Futures contract fees apply

Limitations: Potential data fees for non-pros

Pros

- + Industry-leading charting and analytical tools

- + Excellent for options and futures traders

- + Powerful scanning and backtesting features

- + Comprehensive educational resources

- + Robust paper trading environment

Cons

- - Steep learning curve for beginners

- - Platform can be resource-intensive

- - Interface may feel overwhelming initially

Verdict

"The gold standard for active traders demanding powerful tools, particularly for options and technical analysis, despite a challenging learning curve."

Final Thoughts

The stock trading software landscape offers diverse options catering to different needs. Active traders benefit most from platforms like thinkorswim and Trader Workstation, offering unparalleled tools but steep learning curves. TradeStation and NinjaTrader excel in automated strategies and futures, respectively. TradingView leads in charting and usability, often paired with another broker. Fidelity provides the best research, while Power E*TRADE and tastytrade offer strong options capabilities. Webull appeals to mobile-first, cost-conscious beginners.