Comparative Analysis of Small Business Payroll Solutions

By Unknown Author | Published: 2025-04-12 | Category: Square Payroll

About Square Payroll

Small business payroll software automates employee and contractor payment processing, tax calculations, filings, and compliance. These tools aim to simplify complex payroll tasks for businesses without dedicated HR departments.

Scoring Criteria

- → Ease of Use

- → Core Payroll Features

- → Tax Compliance

- → Integrations

- → Pricing Value

- → Customer Support

The Best Square Payroll

Gusto

By Gusto, Inc.

User-friendly payroll platform with strong HR features, benefits administration, and employee onboarding capabilities.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small to Medium Business Payroll, Contractor Payments, Benefits Administration, HR Tools Integration

Key Features

- ✓Full-Service Payroll: Automated payroll processing, tax filing (federal, state, local), W-2/1099 generation. (Included)

- ✓Employee Self-Service: Employees can access pay stubs, tax forms, and manage personal information. (Included)

- ✓Benefits Administration: Integration with health insurance, 401(k), workers' comp. (Add-on/Higher Tiers)

- ✓HR Tools: Onboarding checklists, time tracking, PTO management. (Included/Higher Tiers)

Scorecard (Overall: 8.5 / 10.0)

Pricing

Simple

$40.00 / monthly

- Basic payroll

- W-2/1099s

- Employee self-service

- Direct deposit

Limitations: +$6/person/month, Limited HR features

Plus

$80.00 / monthly

- Simple features +

- Next-day direct deposit

- PTO management

- Onboarding tools

Limitations: +$12/person/month

Premium

Contact Vendor

- Plus features +

- Dedicated support

- HR resource center

- Compliance alerts

Limitations: Quote-based pricing

Pros

- + Intuitive interface

- + Excellent automation

- + Strong HR feature set

- + Good integration options

Cons

- - Can become expensive as headcount grows

- - Base plan lacks some common HR tools

Verdict

"Gusto is a top contender for small businesses seeking a blend of payroll and HR functionality in an easy-to-use package."

QuickBooks Payroll

By Intuit Inc.

Payroll solution integrated directly into the QuickBooks accounting ecosystem, ideal for existing QuickBooks users.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Existing QuickBooks Users, Integrated Accounting and Payroll, Small Business Payroll

Key Features

- ✓Seamless QuickBooks Integration: Payroll data automatically syncs with QuickBooks accounting software. (Core Feature)

- ✓Full-Service Payroll & Tax Filing: Automated payroll runs and tax payments/filings. (Included)

- ✓Same-Day Direct Deposit: Option for faster employee payments. (Available (Higher Tiers))

- ✓Workers' Comp Administration: Pay-as-you-go workers' compensation integration. (Available)

Scorecard (Overall: 8.0 / 10.0)

Pricing

Core

$45.00 / monthly

- Basic payroll

- Tax filing (federal/state)

- Next-day direct deposit

Limitations: +$5/employee/month

Premium

$75.00 / monthly

- Core features +

- Same-day direct deposit

- HR support center

- Time tracking

Limitations: +$8/employee/month

Elite

$125.00 / monthly

- Premium features +

- Expert setup review

- Tax penalty protection

- Personal HR advisor

Limitations: +$10/employee/month

Pros

- + Excellent integration with QuickBooks

- + Familiar interface for QuickBooks users

- + Comprehensive payroll features

- + Tax penalty protection on higher tiers

Cons

- - Less value if not using QuickBooks accounting

- - Customer support can be inconsistent

- - Per-employee fees add up

Verdict

"The default choice for businesses already heavily invested in the QuickBooks ecosystem, offering seamless integration."

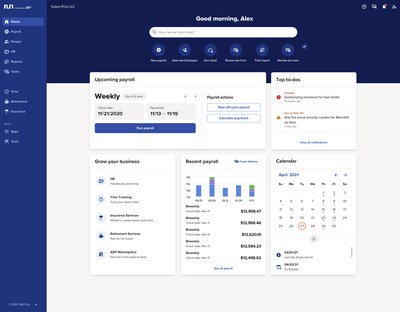

RUN Powered by ADP

By ADP, Inc.

Scalable payroll and HR platform from a major industry player, suitable for small businesses planning to grow.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Growing Small Businesses, Businesses Needing Strong Compliance Support, Companies Seeking Scalability

Key Features

- ✓Robust Payroll Processing: Handles complex payroll scenarios, garnishments, multiple pay rates. (Included)

- ✓Tax Filing Guarantee: ADP handles tax calculations, filings, and responds to agency inquiries. (Included)

- ✓HR Support & Resources: Access to HR forms, compliance database, and expert support. (Included (Varies by Tier))

- ✓Employee Access Portal: Online portal for employees to view pay info and tax forms. (Included)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Essential

$59.00 / monthly

- Payroll processing

- Tax filing

- Direct deposit

- Reporting

Limitations: Quote-based per-employee fee, Basic HR tools

Enhanced

Contact Vendor

- Essential features +

- Check signing/stuffing

- State Unemployment Insurance management

- Background checks

Limitations: Quote-based pricing

Complete

Contact Vendor

- Enhanced features +

- HR HelpDesk

- Employee handbook wizard

Limitations: Quote-based pricing

HR Pro

Contact Vendor

- Complete features +

- Enhanced HR support

- Training tools

Limitations: Quote-based pricing

Pros

- + Industry leader with strong reputation

- + Comprehensive compliance support

- + Scalable platform for growth

- + Wide range of HR add-ons

Cons

- - Pricing isn't transparent (quote-based)

- - Can be more expensive than competitors

- - Interface can feel dated or complex

Verdict

"A solid, reliable option for businesses prioritizing compliance and scalability, offered by a payroll giant."

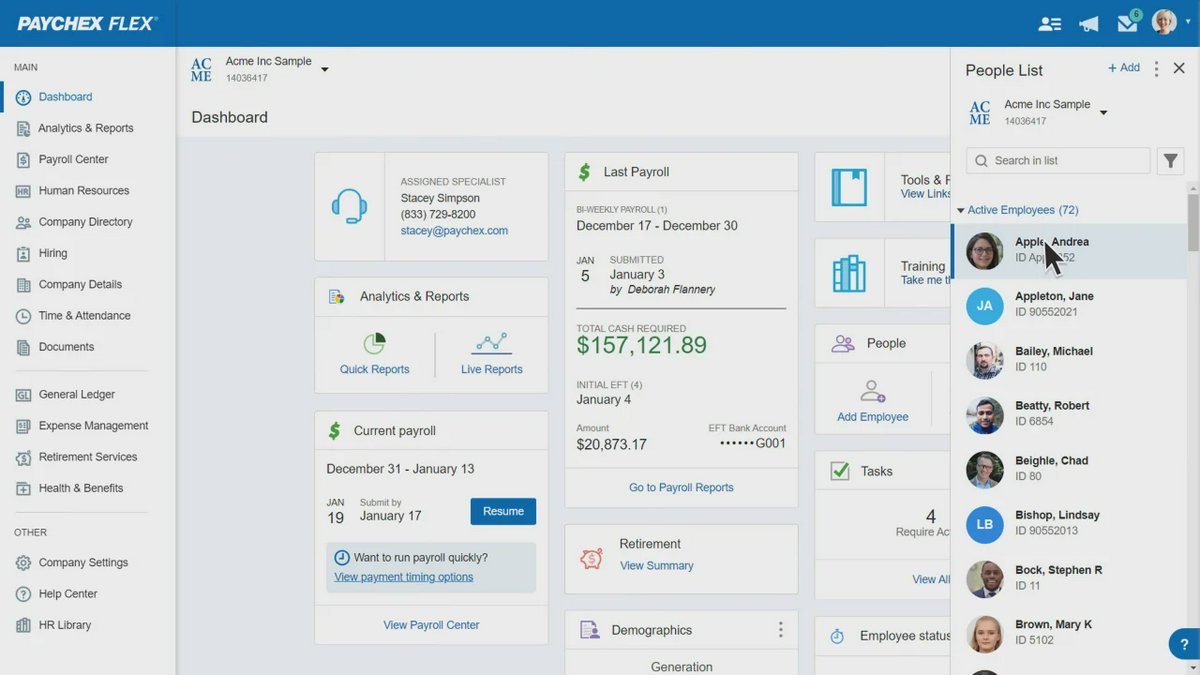

Paychex Flex

By Paychex, Inc.

Comprehensive payroll, HR, and benefits solution targeting small to medium-sized businesses, known for its flexibility.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Businesses Needing HR and Payroll, Companies Seeking All-in-One Solution, Scalable Payroll Needs

Key Features

- ✓Flexible Payroll Entry: Multiple ways to enter payroll data (online, mobile app, phone). (Included)

- ✓All-in-One Platform: Combines payroll, HR, time tracking, and benefits administration. (Available (Modular))

- ✓Dedicated Support Specialist: Access to a dedicated payroll specialist. (Available (Higher Tiers))

- ✓Extensive Reporting: Wide range of standard and customizable reports. (Included)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Flex Essentials

$39.00 / monthly

- Online payroll

- Tax services

- Direct deposit

- Standard reporting

Limitations: +$5/employee/month, Limited HR features

Flex Select

Contact Vendor

- Essentials features +

- Dedicated payroll specialist

- Check signing option

- Labor compliance poster kit

Limitations: Quote-based pricing

Flex Pro

Contact Vendor

- Select features +

- Wage garnishment service

- SUI service

- Integrated HR admin

Limitations: Quote-based pricing

Pros

- + Highly scalable platform

- + Comprehensive feature set (Payroll, HR, Benefits)

- + Dedicated support options

- + Strong compliance track record

Cons

- - Pricing structure lacks transparency

- - Can be costly, especially with add-ons

- - Interface might seem overwhelming initially

Verdict

"Paychex Flex is a robust, scalable solution for businesses wanting an integrated HR and payroll system from an established provider."

OnPay

By OnPay, Inc.

All-inclusive payroll and HR service with simple, transparent pricing, covering employees and contractors.

Platforms & Use Cases

Platforms: Web

Best For: Simple Pricing Needs, Mixed W2/1099 Workforce, Basic HR Integration, Businesses in Niche Industries

Key Features

- ✓Single Tier Pricing: One monthly base fee plus a per-employee charge covers all features. (Core Feature)

- ✓Full-Service Payroll: Automated payroll, multi-state payroll, tax filings (federal, state, local), W-2/1099s. (Included)

- ✓Integrated HR Tools: Onboarding, offer letters, PTO tracking, compliance resources. (Included)

- ✓Industry Specializations: Specific features for industries like restaurants, farms, non-profits. (Included)

Scorecard (Overall: 8.5 / 10.0)

Pricing

All-Inclusive

$40.00 / monthly

- Full-service payroll

- Unlimited pay runs

- Multi-state payroll

- W-2 & 1099 processing

- Integrated HR tools

- Benefits integration options

Limitations: +$6/person/month

Pros

- + Transparent, simple pricing

- + Includes HR features in base price

- + Strong customer support reputation

- + Handles complex payroll like multi-state

Cons

- - Fewer third-party integrations than some competitors

- - No dedicated mobile app (web responsive)

Verdict

"OnPay offers excellent value with its straightforward pricing and comprehensive feature set, making it ideal for budget-conscious small businesses."

Patriot Payroll

By Patriot Software, LLC

Affordable and easy-to-use payroll software focused on core payroll functions, with optional accounting integration.

Platforms & Use Cases

Platforms: Web

Best For: Budget-Conscious Businesses, Simple Payroll Needs, Startups, Companies Needing Basic Payroll

Key Features

- ✓Affordable Pricing: Low base fee and per-employee cost. (Core Feature)

- ✓Choice of Service Level: Option for Basic (DIY taxes) or Full Service (automated tax filing). (Core Feature)

- ✓Ease of Use: Simple interface designed for non-experts. (Core Feature)

- ✓Free Setup & Support: Assistance with initial setup and ongoing support included. (Included)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Basic Payroll

$10.00 / monthly

- Payroll processing

- Direct deposit

- Employee portal

- Print checks/W-2s

Limitations: +$4/employee/month, User handles tax filings

Full Service Payroll

$30.00 / monthly

- Basic features +

- Automated tax filing (federal, state, local)

- Guaranteed tax filings

Limitations: +$4/employee/month

Pros

- + Highly affordable pricing structure

- + Very easy to learn and use

- + Excellent customer support

- + Full-service option handles taxes effectively

Cons

- - Limited HR features compared to competitors

- - Fewer integrations

- - No dedicated mobile app

Verdict

"Patriot Payroll is an outstanding choice for small businesses prioritizing affordability and ease of use for core payroll tasks."

Rippling

By Rippling

Unified workforce platform combining HR, IT, and Finance, including a powerful payroll module.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Tech-Savvy Businesses, Companies Needing Integrated HR/IT/Finance, Global Payroll Needs, Automation Focus

Key Features

- ✓Unified Platform: Seamlessly connects Payroll with HR (onboarding, benefits) and IT (app/device management). (Core Feature)

- ✓Global Payroll: Ability to pay employees and contractors internationally. (Included)

- ✓Workflow Automations: Build custom workflows across different business functions. (Included)

- ✓Robust Reporting & Analytics: Deep insights across payroll, HR, and IT data. (Included)

Scorecard (Overall: 8.7 / 10.0)

Pricing

Modular Pricing

$8.00 / monthly

- Starts with Rippling Unity Platform

- Add modules like US Payroll, Global Payroll, Benefits Admin, App/Device Management as needed

Limitations: Per user/month base fee, Payroll module costs extra, Can become expensive with many modules

Pros

- + Powerful integration across HR, IT, Finance

- + Extensive automation capabilities

- + Modern, user-friendly interface

- + Strong global payroll support

Cons

- - Pricing can be complex and potentially high

- - May be overkill for businesses needing only basic payroll

- - Requires base platform subscription

Verdict

"Rippling excels for businesses seeking a truly unified platform to manage employees, payroll, apps, and devices, especially those with automation needs."

Justworks

By Justworks, Inc.

PEO (Professional Employer Organization) providing payroll, benefits, HR tools, and compliance support under a co-employment model.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Businesses Seeking PEO Services, Access to Large-Group Benefits, Compliance Offloading, Integrated HR Support

Key Features

- ✓PEO Model: Acts as co-employer, taking on certain employer responsibilities and providing access to better benefits. (Core Feature)

- ✓Full-Service Payroll & Tax: Handles all payroll processing and tax compliance. (Included)

- ✓Benefits Access: Access to large-group health insurance plans, 401(k), etc. (Included)

- ✓HR Consulting & Compliance: Expert HR support, compliance resources, harassment prevention training. (Included)

Scorecard (Overall: 8.3 / 10.0)

Pricing

Basic

$59.00 / monthly

- Payroll

- Compliance support

- HR consulting

- Basic benefits access (commuter, health advocates)

Limitations: Per employee/month, Price decreases slightly at 50+ employees, Limited benefits

Plus

$99.00 / monthly

- Basic features +

- Access to medical, dental, vision insurance

- 401(k) options

Limitations: Per employee/month, Price decreases slightly at 50+ employees

Pros

- + Access to competitive large-group benefits

- + Strong compliance support (PEO model)

- + Integrated HR tools and expert support

- + User-friendly platform

Cons

- - PEO model isn't suitable for all businesses

- - Higher per-employee cost than basic payroll software

- - Less control compared to direct payroll processing

Verdict

"Justworks is a leading PEO option for small businesses looking to outsource HR and compliance burdens and gain access to better employee benefits."

Author information could not be loaded for this review.

Final Thoughts

The small business payroll market offers diverse solutions, from simple, affordable options like Patriot Payroll to comprehensive HR and payroll platforms like Gusto and PEOs like Justworks. Integration capabilities (QuickBooks Payroll, Rippling) and transparent pricing (OnPay) are key differentiators. Established providers like ADP and Paychex offer scalability and robust compliance, while newer platforms emphasize user experience and automation.