Top 10 Payroll Software Solutions for Small Business

By Richard "Rick" Callahan | Published: Analysis Reference: SBPR24Q3 | Category: Payroll For Small Business

About Payroll For Small Business

Payroll software automates the process of paying employees, calculating taxes, and managing filings for businesses. Solutions tailored for small businesses typically emphasize ease of use, affordability, and core payroll functionalities.

Scoring Criteria

- → Ease of Use

- → Payroll Features

- → HR Features

- → Pricing Value

- → Integrations

- → Customer Support

The Best Payroll For Small Business

#10

#10

Justworks

By Justworks, Inc.

Professional Employer Organization (PEO) providing payroll, benefits, HR tools, and compliance support under a co-employment model.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Businesses seeking PEO services, Companies wanting access to large-group benefits, Businesses prioritizing compliance support

Key Features

- ✓PEO Services: Acts as a co-employer, handling payroll, taxes, benefits, and compliance. (Co-employment model)

- ✓Access to Benefits: Offers competitive health insurance and other benefits typically available to larger companies.

- ✓Compliance Support: Assistance with employment regulations, workers' comp, and HR best practices.

- ✓Integrated Platform: Combines payroll, HR, benefits, and compliance tools.

Scorecard (Overall: 8.4 / 10.0)

Pricing

Basic

$59.00 / monthly

- Per employee/month (volume discounts available)

- Payroll processing

- Tax filings

- HR tools & consulting

- Compliance support

- Reporting

Limitations: Benefits access costs extra (Plus plan)

Plus

$99.00 / monthly

- Per employee/month (volume discounts available)

- Includes Basic features

- Access to medical, dental, and vision insurance

- HSA/FSA options

- 401(k) access

Limitations: Higher per-employee cost, PEO model may not suit all businesses

Pros

- + Access to better benefits packages

- + Strong compliance support (PEO model)

- + Integrated HR and payroll platform

- + Excellent customer service reputation

Cons

- - PEO model involves co-employment relationship

- - Generally more expensive than basic payroll software

- - Pricing is per employee, can add up quickly

Verdict

"Excellent choice for businesses wanting the benefits and compliance advantages of a PEO, particularly access to competitive health insurance."

#9

#9

SurePayroll

By Paychex, Inc.

Online payroll service focused on small businesses, including specific options for household employers.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Very small businesses, Household employers (nannies, caregivers), Businesses needing simple, reliable payroll

Key Features

- ✓Full-Service Payroll: Automated payroll runs and tax filing.

- ✓Multiple Pay Options: Direct deposit, paper checks.

- ✓Nanny Payroll Option: Specialized service for household employers.

- ✓Mobile Payroll App: Allows running payroll from mobile devices.

Scorecard (Overall: 7.4 / 10.0)

Pricing

Self-Service

$19.99 / monthly

- Base fee + $4/employee

- Run payroll online

- Calculates taxes, user files/pays

- Direct deposit

- Standard reports

Limitations: Requires user to handle tax payments and filings

Full-Service

$29.99 / monthly

- Base fee + $5/employee

- Includes Self-Service features

- Automated tax calculation, filing, and payment

- W-2s and 1099s handled

Limitations: Fewer integrations than some competitors

Pros

- + Relatively affordable Full-Service option

- + Specific plan for household employers

- + Easy-to-use interface

- + Mobile app available

Cons

- - Owned by Paychex, potentially complex support structure

- - Limited HR features

- - Fewer integrations than broader platforms

Verdict

"A solid, straightforward payroll option, particularly good for very small businesses or household employers seeking simplicity and automation."

#8

#8

Rippling

By Rippling

Unified workforce platform combining HR, IT, and Finance, including a powerful payroll module.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Tech-savvy businesses, Companies wanting unified HR/IT/Finance, Businesses needing strong automation and integration

Key Features

- ✓Unified Platform: Payroll is integrated with HR (onboarding, benefits) and IT (app provisioning, device management).

- ✓Global Payroll: Supports payroll processing for employees in multiple countries.

- ✓Workflow Automations: Automates tasks across departments based on employee events (e.g., hiring, promotion).

- ✓Robust Reporting: Customizable reports across HR, payroll, and IT data.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Modular Pricing

$8.00 / monthly

- Starts at $8/user/month for the core platform (Unity)

- Payroll module is an add-on (requires quote)

- Choose required modules (HR, IT, Finance)

- Full-service US payroll

- Global payroll options

- Time & attendance

- Benefits admin

Limitations: Requires quote for full pricing, Can become expensive as modules are added, Payroll cannot be purchased standalone

Pros

- + Powerful unified platform concept

- + Extensive automation capabilities

- + Strong integration features

- + Modern interface

- + Global capabilities

Cons

- - Complex pricing requires a quote

- - Payroll cannot be bought separately from core platform

- - May be too complex for very simple needs

Verdict

"Ideal for tech-forward companies seeking a deeply integrated HR, IT, and payroll system with robust automation, but requires commitment to their platform."

#7

#7

Patriot Payroll

By Patriot Software, LLC

Affordable and easy-to-use online payroll software targeted at small business owners.

Platforms & Use Cases

Platforms: Web

Best For: Budget-conscious small businesses, Businesses prioritizing simplicity, Companies comfortable with DIY tax filing (Basic plan)

Key Features

- ✓Two Payroll Tiers: Offers Basic Payroll (DIY taxes) and Full Service Payroll (automated taxes).

- ✓Ease of Use: Simple interface designed for users without payroll expertise.

- ✓Free Setup & Support: Assistance with setup and ongoing support included.

- ✓Optional Add-ons: Time tracking and HR software available for additional fees.

Scorecard (Overall: 7.9 / 10.0)

Pricing

Basic Payroll

$10.00 / monthly

- Base fee + $4/employee

- Run payroll

- Direct deposit or print checks

- Employee portal

- Setup & support

- Requires user to handle payroll tax deposits & filings

Limitations: Does not handle tax filings/payments

Full Service Payroll

$30.00 / monthly

- Base fee + $4/employee

- Includes Basic features

- Handles all federal, state, and local payroll tax filings and deposits

- W-2 and 1099 filing included

Limitations: HR and Time Tracking are extra costs

Pros

- + Highly affordable, especially the Basic plan

- + Very easy to learn and use

- + Good customer support

- + Transparent pricing

Cons

- - Basic plan requires manual tax handling

- - Limited HR features (add-on required)

- - Fewer integrations than larger platforms

Verdict

"Best value for budget-conscious small businesses prioritizing ease of use and low cost, especially if comfortable with DIY tax filing or opting for Full Service."

#6

#6

OnPay

By OnPay, Inc.

All-inclusive payroll, HR, and benefits service with simple, flat-rate pricing for small businesses.

Platforms & Use Cases

Platforms: Web

Best For: Small businesses wanting predictable pricing, Companies needing integrated HR tools, Businesses in specific industries (e.g., agriculture, nonprofits)

Key Features

- ✓Full-Service Payroll: Payroll processing for W-2 employees and 1099 contractors across all 50 states. (Multi-state included)

- ✓Integrated HR Tools: Onboarding, offer letters, PTO tracking, document storage, and compliance resources.

- ✓Benefits Administration: Health insurance, retirement plans, and workers' comp integration.

- ✓Industry Specializations: Specific features and tax handling for industries like farming, restaurants, and nonprofits.

Scorecard (Overall: 8.5 / 10.0)

Pricing

All-Inclusive Plan

$40.00 / monthly

- Base fee + $6/person

- Full payroll features

- Multi-state payroll

- All HR tools included

- Benefits admin (carrier fees may apply)

- Extensive integrations

- No hidden fees

Limitations: No mobile app, Interface slightly less modern than some

Pros

- + Simple, transparent flat-rate pricing

- + Includes HR features at no extra base cost

- + Strong customer support reputation

- + Good for specific industry needs

Cons

- - No dedicated mobile application

- - User interface is functional but less sleek than some competitors

Verdict

"Excellent value proposition offering comprehensive payroll and HR features for a straightforward flat monthly fee."

#5

#5

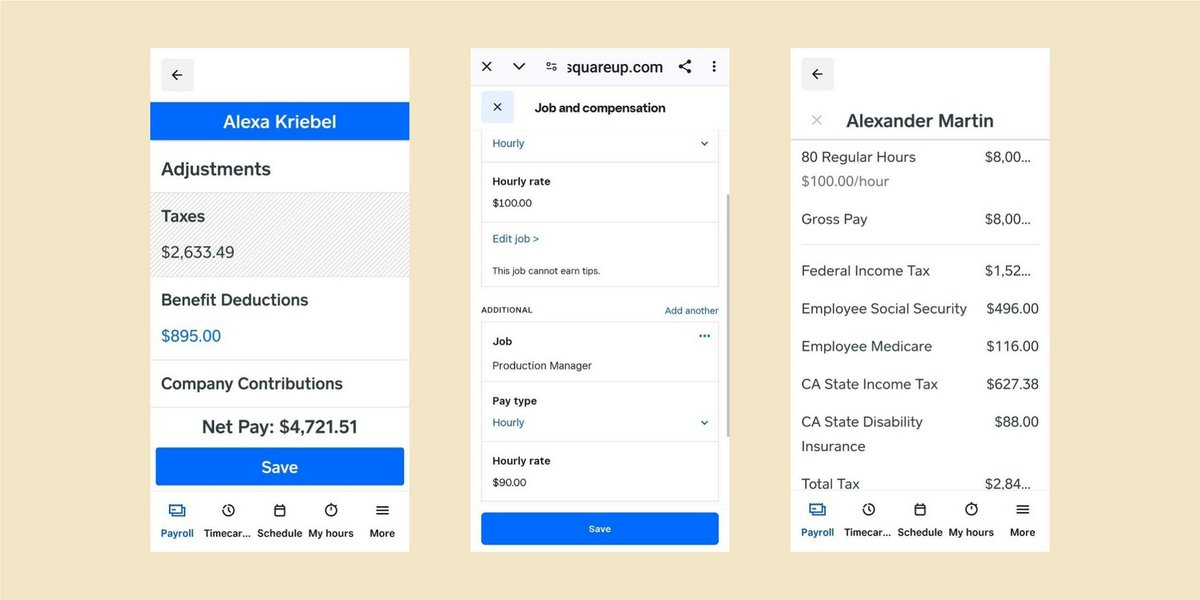

Square Payroll

By Block, Inc.

Simple and affordable payroll solution, especially well-suited for businesses already using the Square POS system.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Square POS users, Retail and restaurants, Contractor-only businesses, Budget-conscious small businesses

Key Features

- ✓Integration with Square POS: Automatically syncs timecards and tips from Square POS for payroll. (Seamless)

- ✓Full-Service Payroll: Automated payroll runs, tax filings, and payments.

- ✓Contractor Payments: Offers a low-cost plan specifically for paying independent contractors.

- ✓Employee Management: Includes employee accounts for accessing pay stubs and tax forms.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Pay Contractors Only

Contact Vendor

- $6/contractor paid per month

- 1099-NEC filing

- Direct deposit

- No monthly subscription fee

Limitations: Only for contractors, no W-2 employees

Pay Employees & Contractors

$35.00 / monthly

- Base fee + $6/person paid per month

- Full-service payroll

- Automated tax filings

- W-2 and 1099 support

- Time tracking integration

- Benefits administration options

Limitations: Benefits admin costs extra, HR features are basic

Pros

- + Excellent integration with Square ecosystem

- + Affordable and transparent pricing

- + Very easy to use

- + Good option for businesses paying mostly contractors

Cons

- - Limited HR features compared to competitors

- - Fewer third-party integrations outside Square

- - Customer support can be harder to reach

Verdict

"Top choice for businesses already using Square POS or those needing a simple, affordable payroll service, especially for contractors."

#4

#4

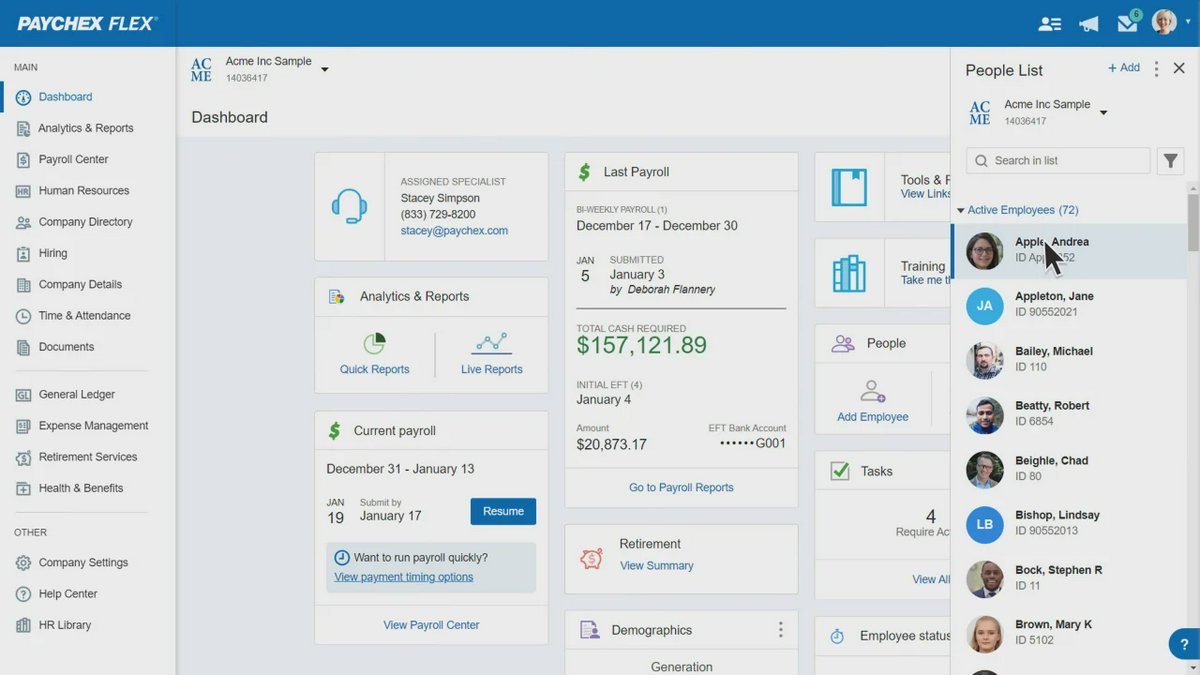

Paychex Flex

By Paychex, Inc.

Flexible payroll and HR platform offering a wide range of services, suitable for businesses of various sizes, including small ones.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Businesses seeking all-in-one HR/payroll, Companies needing dedicated support, Scalability from small to large

Key Features

- ✓Scalable Payroll Services: Handles payroll processing, tax administration, and various payment options.

- ✓Integrated HR Suite: Offers HR administration, benefits management, time tracking, and hiring tools.

- ✓Dedicated Support: Provides access to dedicated payroll specialists depending on the plan.

- ✓Compliance Monitoring: Helps businesses stay updated on changing regulations.

Scorecard (Overall: 7.9 / 10.0)

Pricing

Flex Essentials

$39.00 / monthly

- Base fee + $5/employee

- Online payroll processing

- Tax administration

- Direct deposit/pay cards

- Standard reporting

- Employee self-service

Limitations: Basic features, Limited HR support

Flex Select

Contact Vendor

- Quote-based pricing

- Includes Essentials features

- Dedicated payroll specialist

- More integrations (e.g., accounting)

- Paper check option

Limitations: Requires quote

Flex Pro

Contact Vendor

- Quote-based pricing

- Includes Select features

- Workers' comp reporting

- State unemployment insurance service

- Employee screening

- Garnishment payment service

Limitations: Requires quote, More complex features

Pros

- + All-in-one platform potential

- + Scalable for growth

- + Dedicated support available

- + Strong compliance resources

Cons

- - Interface can be less intuitive than competitors

- - Pricing for higher tiers requires a quote

- - Can become expensive with add-ons

Verdict

"A comprehensive option, particularly strong for businesses anticipating growth or needing dedicated support, though transparency lacks in higher tiers."

#3

#3

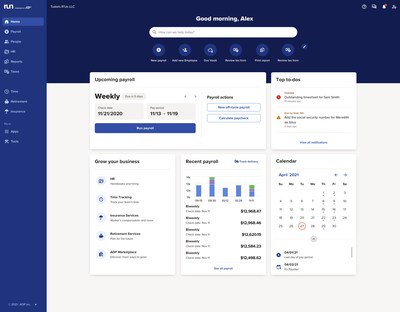

ADP Run

By ADP, LLC

Scalable payroll and HR solution from a major industry player, suitable for small businesses planning to grow.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Growing small businesses, Businesses needing robust compliance support, Companies looking for scalable solutions

Key Features

- ✓Comprehensive Payroll Processing: Handles payroll, tax filing, direct deposit, and reporting.

- ✓HR Support & Compliance: Access to HR forms, compliance database, background checks, and expert support options.

- ✓Multiple Plan Tiers: Offers various packages catering to different levels of payroll and HR needs.

- ✓Reporting & Analytics: Provides detailed reports on payroll, taxes, and employee data.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Essential

Contact Vendor

- Quote-based pricing

- Core payroll processing

- Tax filing

- Direct deposit

- Employee access

- Basic HR tools

Limitations: Requires quote, Limited HR features

Enhanced

Contact Vendor

- Quote-based pricing

- Includes Essential features

- Check signing & stuffing

- State unemployment insurance management

- Background checks

- ZipRecruiter access

Limitations: Requires quote

Complete

Contact Vendor

- Quote-based pricing

- Includes Enhanced features

- HR help desk

- Employee handbook wizard

- Salary benchmarks

Limitations: Requires quote

HR Pro

Contact Vendor

- Quote-based pricing

- Includes Complete features

- Enhanced HR support

- Learning management

- Legal assistance

Limitations: Requires quote, Most comprehensive & likely expensive

Pros

- + Highly scalable platform

- + Strong compliance features

- + Reputable brand with extensive experience

- + Good range of HR add-ons

Cons

- - Pricing is not transparent (requires quote)

- - Can be more complex than simpler solutions

- - May be overkill for very small businesses

Verdict

"A robust, scalable solution for growing businesses needing strong compliance and HR support, but requires contacting sales for pricing."

#2

#2

QuickBooks Payroll

By Intuit Inc.

Payroll solution integrated directly into the QuickBooks accounting ecosystem, ideal for existing QuickBooks users.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: QuickBooks users, Small businesses needing accounting integration, Businesses prioritizing tax accuracy

Key Features

- ✓Seamless QuickBooks Integration: Payroll data automatically syncs with QuickBooks accounting software.

- ✓Automated Payroll & Taxes: Calculates, files, and pays federal and state payroll taxes. (Guaranteed Accurate)

- ✓Multiple Pay Options: Supports direct deposit (including same-day/next-day options) and manual checks.

- ✓Time Tracking Integration: Connects with QuickBooks Time for streamlined payroll based on tracked hours.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Core

$45.00 / monthly

- Base fee + $5/employee

- Full-service payroll

- Automated taxes & forms

- Next-day direct deposit

- Employee portal

Limitations: Basic HR support

Premium

$75.00 / monthly

- Base fee + $8/employee

- Same-day direct deposit

- Automated payroll

- HR support center

- Expert review

- Time tracking via QuickBooks Time Elite

Limitations: Higher cost for advanced features

Elite

$125.00 / monthly

- Base fee + $10/employee

- Dedicated HR advisor

- Tax penalty protection

- White glove setup

- 24/7 expert support

- Time tracking via QuickBooks Time Elite

Limitations: Most expensive tier

Pros

- + Unbeatable QuickBooks integration

- + Strong tax calculation and filing features

- + Multiple direct deposit speeds

- + Comprehensive payroll options

Cons

- - Can be expensive, especially higher tiers

- - Best value primarily for existing QuickBooks users

- - HR features less robust than dedicated HR platforms

Verdict

"Ideal choice for businesses already embedded in the QuickBooks ecosystem seeking seamless payroll integration."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Gusto

By Gusto, Inc.

Comprehensive payroll, benefits, and HR platform designed for modern small to medium-sized businesses, known for its user-friendly interface.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Startups, Small Businesses, Businesses needing integrated HR, Companies seeking ease of use

Key Features

- ✓Full-Service Payroll: Automated payroll processing across all 50 states, including tax calculations and filings. (Automated)

- ✓Employee Self-Service: Portals for employees to access pay stubs, tax forms, and manage personal information.

- ✓Benefits Administration: Integrated health benefits, 401(k)s, and workers' comp administration.

- ✓HR Tools: Onboarding, time tracking, PTO management, and compliance assistance.

Scorecard (Overall: 8.8 / 10.0)

Pricing

Simple

$40.00 / monthly

- Base fee + $6/person

- Full-service single-state payroll

- Employee self-service

- Basic hiring & onboarding

- Integrations

Limitations: Single-state payroll only, Limited HR tools

Plus

$80.00 / monthly

- Base fee + $12/person

- Multi-state payroll

- Next-day direct deposit

- Advanced hiring & onboarding

- PTO management

- Time tracking

Limitations: Higher per-employee cost

Premium

Contact Vendor

- Quote-based pricing

- Dedicated support

- HR resource center

- Compliance alerts

- Full-service payroll migration

Limitations: Requires custom quote

Pros

- + Excellent user interface

- + Strong HR and benefits integration

- + Automates most payroll tasks

- + Good third-party integrations

Cons

- - Higher price point than some basic competitors

- - Customer support responsiveness can vary

Verdict

"Best overall for small businesses needing a user-friendly, integrated payroll and HR solution."

Final Thoughts

The small business payroll market offers diverse solutions, from easy-to-use, affordable options like Patriot and Square Payroll to comprehensive HR and payroll platforms like Gusto and Rippling. Integration with existing systems (like QuickBooks) and the need for specific HR features or PEO benefits (Justworks) are key differentiators. OnPay stands out for its simple, all-inclusive pricing.