Top 10 Payroll Billing Software Comparison

By Lucy Chen | Published: 2025-03-26 | Category: Payroll Billing Software

About Payroll Billing Software

Payroll billing software enables businesses, typically accounting firms or payroll service providers, to manage payroll processing for multiple clients and subsequently bill those clients for the services rendered. These platforms automate calculations, tax filings, payments, and client invoicing.

Scoring Criteria

- → Core Payroll Features

- → Client Management & Billing

- → Integrations

- → Ease of Use

- → Reporting

- → Customer Support

- → Pricing Value

The Best Payroll Billing Software

#10

#10

Accounting CS Payroll

By Thomson Reuters

Comprehensive payroll software integrated within the Thomson Reuters CS Professional Suite, designed specifically for accounting firms.

Platforms & Use Cases

Platforms: Desktop, Web-based (via Virtual Office/SaaS)

Best For: Accounting Firms using CS Professional Suite, Firms needing deep integration with tax and accounting modules, High-volume Payroll Processors

Key Features

- ✓Deep CS Suite Integration: Seamless data flow between payroll, accounting (Workpapers CS/Accounting CS), and tax (UltraTax CS).

- ✓Advanced Payroll Capabilities: Handles complex calculations, job costing, certified payroll, multi-state/local taxes.

- ✓Client Portals (myPay Solutions): Offers web portals for client data entry and employee self-service (pay stubs, W-2s).

- ✓Batch Processing: Efficiently process payroll for large numbers of clients.

- ✓Customizable Reporting: Extensive reporting options integrated with other CS Suite modules.

Scorecard (Overall: 7.7 / 10.0)

Pricing

Module/License Pricing

Contact Vendor

- Part of the CS Professional Suite.

- Pricing based on modules, users, and potentially volume.

- Includes support and updates.

Limitations: Significant investment, primarily suitable for firms already using or committing to the CS Suite., Can have a steeper learning curve., Requires contact for pricing.

Pros

- + Unparalleled integration within the Thomson Reuters CS ecosystem.

- + Powerful features for complex payroll scenarios.

- + Robust reporting and customization.

- + Efficient batch processing for high volume.

- + Established vendor with strong support for professionals.

Cons

- - High cost of entry and ownership.

- - Less intuitive interface compared to modern cloud-native solutions.

- - Primarily benefits firms heavily invested in the TR ecosystem.

- - Less focus on modern HR add-ons compared to Gusto/Rippling.

Verdict

"The go-to choice for accounting firms deeply integrated with the Thomson Reuters CS Professional Suite, offering powerful, specialized payroll processing capabilities."

#9

#9

SurePayroll for Partners

By SurePayroll (A Paychex Company)

Online payroll service focused on small businesses, offering a partner program for accountants with co-branding and wholesale pricing.

Platforms & Use Cases

Platforms: Web-based, Mobile App

Best For: Accountants serving Small Businesses, Bookkeepers, Firms wanting Paychex backing

Key Features

- ✓Full-Service Payroll: Automated payroll runs, tax calculations, filings (federal, state, local), and payments.

- ✓Accountant Center: Dashboard to manage client accounts, view payroll status, and run reports.

- ✓Flexible Input Options: Process payroll online or via mobile app.

- ✓Partner Benefits: Includes wholesale pricing, revenue share options, co-branding, and dedicated support.

- ✓Compliance Support: Backed by Paychex expertise for tax compliance.

Scorecard (Overall: 7.3 / 10.0)

Pricing

Partner Pricing

Contact Vendor

- Wholesale rates.

- Revenue sharing potential.

- Co-branding.

- Dedicated support line.

Limitations: Requires contact for specific pricing details., Focuses primarily on payroll; HR features are less robust than Paychex Flex.

Pros

- + Easy-to-use platform tailored for small businesses.

- + Backed by the resources and compliance expertise of Paychex.

- + Competitive partner program benefits.

- + Mobile app available for payroll processing.

- + Guarantees for tax filing accuracy (if using full service).

Cons

- - Fewer integrations than some competitors.

- - Limited built-in HR functionalities.

- - Can be more expensive than options like Patriot or Wagepoint.

Verdict

"A solid choice for accountants prioritizing ease of use for small business clients and valuing the reliability and compliance backing of Paychex, with a good partner program."

#8

#8

Wagepoint Partner Program

By Wagepoint

Simple online payroll software designed for small businesses, with a partner program tailored for accountants and bookkeepers.

Platforms & Use Cases

Platforms: Web-based

Best For: Accountants serving Small Businesses, Bookkeepers, Firms prioritizing simplicity

Key Features

- ✓Simple Payroll Processing: Easy-to-use interface for running payroll, direct deposit, and handling basic deductions.

- ✓Automated Tax Filings: Handles federal, state, and local payroll tax calculations and filings.

- ✓Partner Portal: Dashboard for managing client payroll, adding users, and accessing support.

- ✓Integration Friendly: Integrates with QBO, Xero, and time tracking apps like TSheets (QuickBooks Time).

- ✓Transparent Pricing: Simple base fee plus per-employee cost structure.

Scorecard (Overall: 7.4 / 10.0)

Pricing

Partner Pricing

Contact Vendor

- Wholesale discounts.

- Referral bonuses.

- Co-branded portal option.

- Dedicated partner support.

Limitations: Partner specific discount levels require discussion.

Pros

- + Very easy to learn and use.

- + Affordable and transparent pricing.

- + Friendly customer support.

- + Good basic integrations.

- + Well-regarded partner program.

Cons

- - Lacks advanced HR features.

- - Reporting capabilities are basic.

- - May not suit clients with highly complex payroll needs.

Verdict

"Ideal for firms focused on simplicity and ease of use for their small business clients, offering a straightforward payroll solution with good partner support."

#7

#7

Paychex Flex (Accountant)

By Paychex

Comprehensive payroll and HR solution from a major industry player, offering scalable plans and dedicated support for accountants.

Platforms & Use Cases

Platforms: Web-based, Mobile App

Best For: Accounting Firms of all sizes, Firms needing strong HR support, Payroll Service Bureaus

Key Features

- ✓Scalable Payroll Services: Handles simple to complex payroll, multi-state processing, tax filing, and compliance.

- ✓Integrated HR Suite: Offers various HR services including employee screening, onboarding, benefits administration, and PEO options.

- ✓Accountant Dashboard: Provides tools for managing multiple clients, accessing data, running reports, and managing tasks.

- ✓Dedicated Support: Accountants typically get a dedicated specialist for support.

- ✓Reporting & Analytics: Robust reporting features with customizable options and analytics.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Multiple Tiers/Partner Pricing

Contact Vendor

- Varying levels of service (Flex Essentials, Select, Pro).

- Dedicated accountant support.

- Referral programs and potential wholesale pricing.

Limitations: Pricing is not transparent online and requires a custom quote., Can be one of the more expensive options.

Pros

- + Highly scalable, suitable for small clients to large enterprises.

- + Extensive range of payroll and HR services.

- + Strong compliance support and expertise.

- + Dedicated support model.

- + Powerful reporting capabilities.

Cons

- - Can be costly, especially for smaller clients.

- - Interface can feel complex or dated compared to newer platforms.

- - Pricing complexity and lack of transparency.

Verdict

"A robust and reliable choice for firms needing comprehensive, scalable payroll and HR solutions with strong support, especially those serving larger or more complex clients."

#6

#6

Rippling (Partner Edition)

By Rippling

Unified workforce platform combining HR, IT, and Finance (including payroll), offering a powerful, integrated solution for partners.

Platforms & Use Cases

Platforms: Web-based

Best For: Tech-savvy Accounting Firms, Firms providing comprehensive HR/IT services, Payroll Service Bureaus

Key Features

- ✓Global Payroll: Handles US payroll and offers Employer of Record (EOR) services for international employees.

- ✓Unified Platform: Combines payroll with HRIS, benefits administration, time tracking, and even IT management (device/app provisioning).

- ✓Extensive Integrations: Boasts over 500 integrations with various business applications.

- ✓Workflow Automation: Allows building custom workflows across different modules (e.g., onboarding triggers payroll setup).

- ✓Partner Portal & Tools: Specific features for partners to manage clients, potentially white-label, and control access.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Modular Pricing

$8.00 / Per Employee/Month (Starts From)

- Core Workforce Directory

- Choose modules (Payroll, Benefits, HR, IT)

- Partner discounts/structure available

Limitations: Pricing is highly modular and can become expensive as modules are added., Partner pricing requires contact.

Pros

- + Extremely powerful and integrated platform.

- + Vast number of integrations.

- + Strong automation capabilities.

- + Modern user interface.

- + Handles both US and international payroll needs.

Cons

- - Can be significantly more expensive than competitors, especially with multiple modules.

- - May be overly complex for firms needing only basic payroll.

- - Newer player compared to ADP/Paychex, support structure still evolving.

Verdict

"Best suited for forward-thinking firms that need a highly integrated, automated platform for managing payroll alongside HR and potentially IT for their clients."

#5

#5

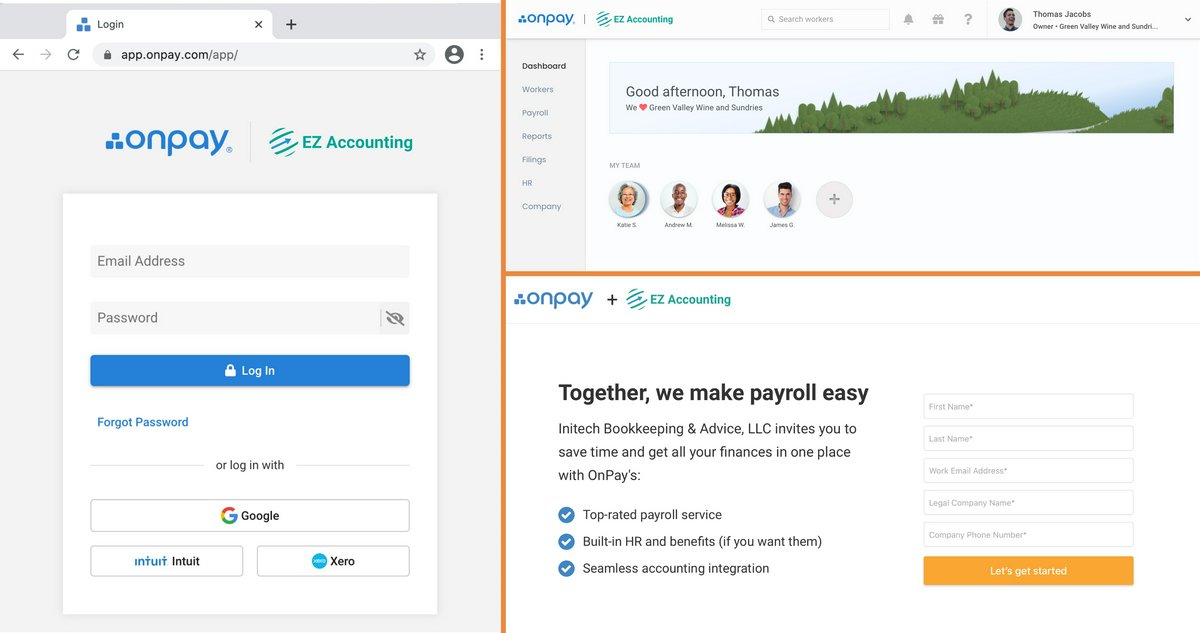

OnPay Partner Program

By OnPay

All-inclusive payroll, HR, and benefits solution charging a flat monthly fee per employee, with a partner program for accountants.

Platforms & Use Cases

Platforms: Web-based

Best For: Accounting Firms, Bookkeepers, Firms serving clients needing integrated HR

Key Features

- ✓Full-Service Payroll: Includes unlimited payroll runs, multi-state payroll, tax filings (federal, state, local), W-2/1099 processing.

- ✓Integrated HR Tools: Offers HR features like offer letters, onboarding checklists, document storage at no extra cost.

- ✓Partner Dashboard: Central console for managing client accounts, permissions, and accessing consolidated reports.

- ✓Transparent Pricing: Simple pricing model with one base fee plus a per-employee charge, including most features.

- ✓Integrations: Connects with QuickBooks, Xero, and various time tracking applications.

Scorecard (Overall: 7.7 / 10.0)

Pricing

Partner Pricing

Contact Vendor

- Discounted pricing or revenue share.

- Partner dashboard.

- Dedicated partner support.

- Co-branding options.

Limitations: Partner-specific pricing details require direct contact.

Pros

- + Simple, all-inclusive pricing.

- + Includes basic HR tools at no extra cost.

- + Good customer support.

- + Handles multi-state payroll and specialized industries (e.g., agriculture, non-profits).

- + User-friendly partner dashboard.

Cons

- - Fewer third-party integrations than some competitors.

- - Reporting could be more customizable.

- - Benefits administration options might be less extensive than Gusto or Rippling.

Verdict

"A great value proposition for firms wanting straightforward pricing with included HR features, especially effective for clients in niche industries OnPay specializes in."

#4

#4

Patriot Software Payroll (Partner Program)

By Patriot Software

Affordable online payroll software focused on small businesses, with a partner program offering accountants discounted pricing and management tools.

Platforms & Use Cases

Platforms: Web-based

Best For: Accountants serving Small Businesses, Bookkeepers, Budget-conscious Firms

Key Features

- ✓Basic & Full-Service Payroll: Offers two tiers: Basic (firm handles taxes) and Full Service (Patriot handles tax filings).

- ✓Partner Portal: Dashboard for managing multiple clients, accessing reports, and controlling user permissions.

- ✓Affordable Pricing: Known for its competitive pricing structure, particularly for firms with many small business clients.

- ✓Optional Add-ons: Offers integrated time tracking and HR software modules at additional cost.

- ✓Free Setup & Support: Provides free setup assistance and ongoing US-based customer support.

Scorecard (Overall: 7.4 / 10.0)

Pricing

Partner Pricing

Contact Vendor

- Discounted wholesale pricing.

- Option to bundle with Patriot Accounting.

- Client management portal.

- Free support.

Limitations: Fewer advanced features compared to larger providers., Integrations primarily focused on its own accounting software or QuickBooks.

Pros

- + Very competitive pricing, excellent value.

- + Simple, easy-to-navigate interface.

- + Good customer support.

- + Flexible partner program with wholesale pricing.

- + Choice between Basic and Full-Service payroll.

Cons

- - Limited third-party integrations compared to Gusto or Rippling.

- - Fewer bells and whistles (e.g., advanced HR features) than premium providers.

- - Reporting options are adequate but not as extensive as ADP/Paychex.

Verdict

"A strong contender for firms focused on serving small businesses, offering excellent value and simplicity, particularly when cost is a primary concern."

#3

#3

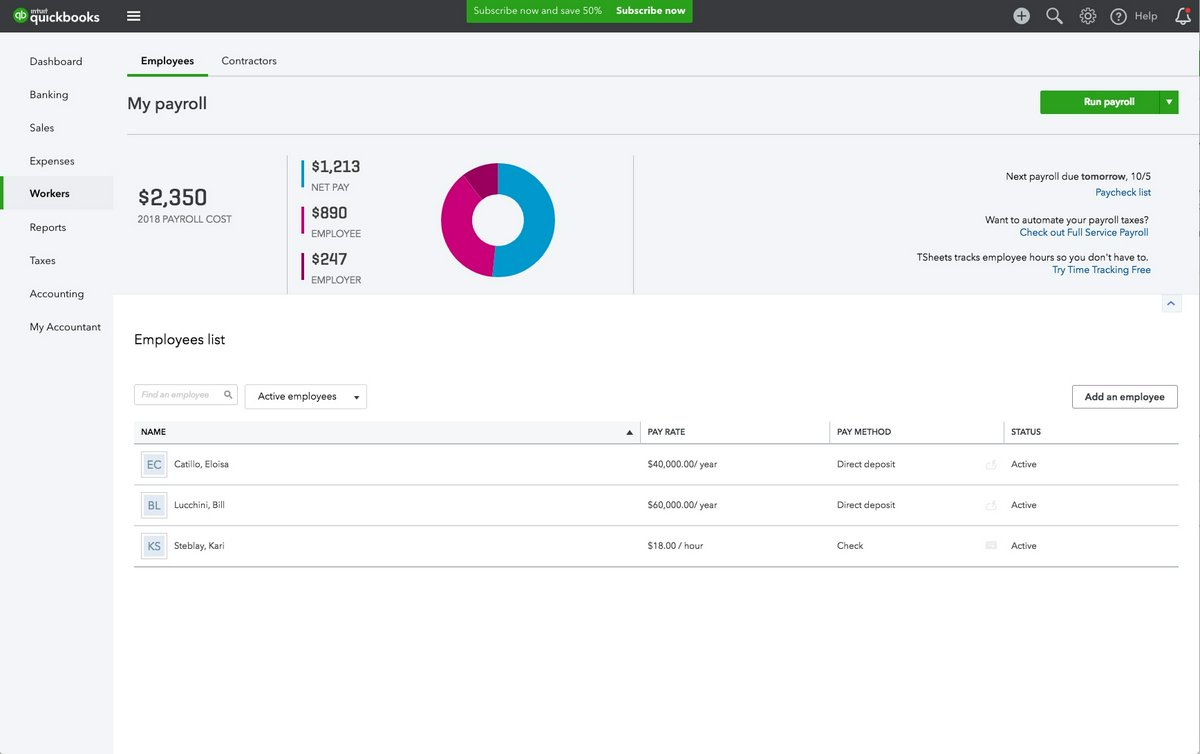

QuickBooks Online Payroll (Accountant)

By Intuit

Integrated payroll solution within the QuickBooks ecosystem, offering streamlined payroll processing for accountants managing clients on QBO.

Platforms & Use Cases

Platforms: Web-based

Best For: Accounting Firms using QBOA, Bookkeepers, Small Business Accountants

Key Features

- ✓Seamless QBO Integration: Payroll data flows directly into QuickBooks Online Accountant for simplified bookkeeping.

- ✓Automated Payroll & Taxes: Calculates paychecks, handles federal and state tax filings and payments automatically.

- ✓Multi-Client Payroll Management: Manage payroll for multiple clients from the QuickBooks Online Accountant dashboard.

- ✓Direct Deposit: Offers next-day or same-day direct deposit options depending on the plan.

- ✓Accountant-Specific Features: Includes tools for batch processing, consolidated client views, and preferred pricing for accountants.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Accountant Preferred Pricing

Contact Vendor

- Discounted rates for QBO Payroll subscriptions.

- Integrated client management within QBOA.

- Direct billing to firm or client.

Limitations: Best suited for clients already using or willing to use QuickBooks Online., Advanced HR features might require higher tiers or add-ons.

Pros

- + Unmatched integration with QuickBooks Online.

- + Easy to use, especially for those familiar with the QB ecosystem.

- + Automated tax filings.

- + Competitive pricing for accountants.

- + Consolidated client view within QBOA.

Cons

- - Primarily beneficial for firms heavily invested in the QuickBooks ecosystem.

- - Customer support experiences can be inconsistent.

- - Reporting options less robust than some dedicated payroll providers.

Verdict

"The ideal choice for accounting firms that standardize on QuickBooks Online, offering seamless integration and workflow efficiency for managing client payroll."

#2

#2

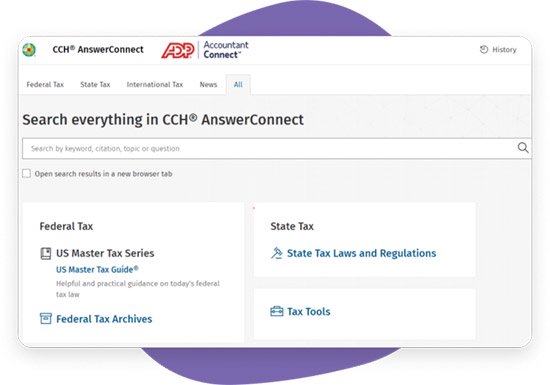

Accountant Connect (ADP Run)

By ADP

ADP's platform tailored for accounting professionals, providing tools to manage payroll, tax, and HR for multiple clients using the robust ADP Run engine.

Platforms & Use Cases

Platforms: Web-based, Mobile App

Best For: Accounting Firms, Payroll Specialists, Large Service Bureaus

Key Features

- ✓Comprehensive Payroll Processing: Handles complex payroll scenarios, multi-state processing, garnishments, and tax filings across all jurisdictions.

- ✓Accountant Dashboard: Centralized view of client payrolls, compliance deadlines, and reporting tools.

- ✓Flexible Service Levels: Allows firms to offer varying levels of service, from full processing to client self-service with oversight.

- ✓Compliance Expertise: Strong focus on payroll tax compliance with built-in checks and expert support.

- ✓Integrated HR Solutions: Optional add-ons for HR support, talent management, benefits administration.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Partner Pricing

Contact Vendor

- Dedicated Accountant Support

- Multi-Client Management

- Revenue Opportunities

- Compliance Resources

Limitations: Pricing structure is complex and requires direct consultation.

Pros

- + Industry leader with extensive payroll and tax expertise.

- + Scalable solutions suitable for firms with diverse client sizes.

- + Robust compliance features and support.

- + Strong reporting capabilities.

- + Dedicated resources for accounting partners.

Cons

- - Can be more expensive than other options.

- - Interface may seem less modern or intuitive compared to newer platforms.

- - Integration with non-ADP systems can sometimes be limited.

Verdict

"A top choice for established firms needing robust, scalable payroll processing with a strong emphasis on compliance and support, particularly those with complex client needs."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

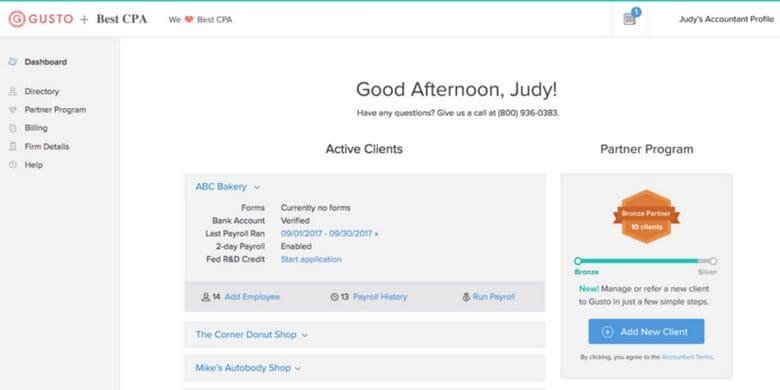

Gusto Partner Program

By Gusto

Cloud-based payroll, benefits, and HR platform with a dedicated partner program for accountants and bookkeepers offering consolidated client management.

Platforms & Use Cases

Platforms: Web-based

Best For: Accounting Firms, Bookkeepers, Payroll Service Providers

Key Features

- ✓Full-Service Payroll: Automated payroll processing, tax calculation, filing (federal, state, local), and year-end forms (W-2s, 1099s).

- ✓Partner Dashboard: Centralized dashboard to manage all clients, access payroll details, and oversee tasks.

- ✓Flexible Billing Options: Options for firms to bill clients directly or have Gusto bill the client, with potential revenue share/discounts.

- ✓HR Tools & Benefits: Integrated HR features like onboarding, time tracking, and benefits administration available for clients.

- ✓Accounting Integrations: Syncs with popular accounting software like QuickBooks Online, Xero, and others.

Scorecard (Overall: 8.4 / 10.0)

Pricing

Partner Pricing

Contact Vendor

- Dedicated Support

- Partner Dashboard

- Revenue Share/Discount Options

- Client Management Tools

Limitations: Specific pricing details require contacting Gusto.

Pros

- + User-friendly interface for both firms and clients.

- + Strong automation for payroll and taxes.

- + Good integration capabilities.

- + Comprehensive HR and benefits options.

- + Dedicated partner support and resources.

Cons

- - Pricing can be higher than some competitors, especially for clients needing advanced HR features.

- - Limited customization in some areas.

Verdict

"Excellent all-around choice for firms prioritizing ease of use, strong integrations, and a modern interface, especially those offering broader HR advisory services."

Final Thoughts

The payroll billing software market offers diverse solutions catering to accounting firms and service bureaus. Leading options like Gusto and Rippling provide modern interfaces and strong integrations, while established players like ADP and Paychex offer robust, scalable solutions with extensive compliance support. Value-focused options like Patriot and Wagepoint appeal to firms serving smaller clients, and integrated suite products like QuickBooks Payroll and Accounting CS Payroll excel within their respective ecosystems. Selection depends on the firm's client base, technological preferences, budget, and need for integrated HR or other services.