Comparative Review of Top Payroll Software Solutions

By Lucy Chen | Published: 2023-10-27 | Category: Payroll

About Payroll

Payroll software automates the process of paying employees, including calculating wages, withholding taxes, and managing deductions. These systems help businesses ensure accuracy, compliance, and timeliness in their compensation processes.

Scoring Criteria

- → Ease of Use

- → Payroll Features

- → HR & Benefits Features

- → Integrations

- → Customer Support

- → Pricing & Value

The Best Payroll

#10

#10

TriNet Zenefits

By TriNet Group, Inc.

HR-focused platform with integrated payroll, benefits administration, and compliance features, popular among SMBs and tech startups.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Small Businesses, Medium Businesses, Tech Startups, HR-focused companies

Key Features

- ✓HR Platform Core: Strong foundation in HRIS, onboarding, time tracking, and performance management.

- ✓Integrated Payroll: Payroll module syncs directly with HR data changes.

- ✓Benefits Administration: Streamlined management of health insurance and other benefits (brokerage available).

- ✓Compliance Tools: Features to help manage ACA reporting and other compliance requirements.

- ✓Mobile App: Well-regarded mobile application for employees and admins.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Essentials

$8.00 / Monthly Per Employee

- Core HR

- Time & Scheduling

- Integrations

- Mobile App

Limitations: Payroll is an add-on, Limited benefits admin

Growth

$16.00 / Monthly Per Employee

- Essentials features

- Compensation Management

- Performance Management

Limitations: Payroll is an add-on

Zen

$27.00 / Monthly Per Employee

- Growth features

- Employee Engagement Surveys

- People Hub

Limitations: Payroll is an add-on

Payroll Add-on

$6.00 / Monthly Per Employee (Added to HR Plan)

- Full-service payroll

- Tax filing

- Direct deposit

- Tip reporting

Pros

- + Strong HR features and workflow automation

- + Good mobile app experience

- + Well-designed user interface

- + Integrated benefits administration

Cons

- - Payroll is an add-on, increasing the total cost

- - Customer support reviews are mixed

- - Pricing based solely on PEPM can get expensive quickly

Verdict

"A solid choice for businesses prioritizing a strong HR platform with integrated payroll, particularly SMBs comfortable with a modern tech stack."

#9

#9

Paycor

By Paycor, Inc.

Comprehensive Human Capital Management (HCM) platform including payroll, HR, talent management, and workforce management, targeted at mid-market businesses.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Medium Businesses, Large Businesses, Companies needing integrated HCM

Key Features

- ✓Integrated HCM Suite: Combines payroll with HR, talent acquisition, timekeeping, and reporting.

- ✓Payroll & Tax Compliance: Robust payroll engine with proactive compliance features.

- ✓Analytics & Reporting: Provides insights into workforce data and trends.

- ✓Talent Management: Includes features for recruiting, onboarding, performance, and learning.

- ✓Employee Self-Service: Mobile and web access for employees to manage their information.

Scorecard (Overall: 8.4 / 10.0)

Pricing

Basic

$99.00 / Monthly + Per Employee Fee

- Essential Payroll & Tax Filing

- Onboarding

- Employee Self-Service

- Basic Reporting

Limitations: Limited HR functionality

Essential

$149.00 / Monthly + Per Employee Fee

- Basic features

- HR Administration

- Compensation Planning

- Advanced Reporting

Complete

$199.00 / Monthly + Per Employee Fee

- Essential features

- Career Management

- Talent Development

- Analytics

HCM

Contact Vendor

- Complete features

- Enhanced Analytics

- Full Talent Management Suite

Pros

- + Unified HCM platform

- + Strong analytics and reporting

- + Good range of HR and talent management tools

- + Scalable for growing companies

Cons

- - Pricing can be high, especially lower tiers relative to features

- - Interface can be complex due to the breadth of features

- - Some users report integration issues

Verdict

"A powerful HCM solution for mid-sized to larger businesses needing integrated payroll, HR, and talent management capabilities."

#8

#8

Patriot Payroll

By Patriot Software, LLC

Affordable and easy-to-use payroll software designed for small businesses, offering basic and full-service options.

Platforms & Use Cases

Platforms: Web

Best For: Very Small Businesses, Budget-Conscious Businesses, Businesses with Simple Payroll Needs

Key Features

- ✓Choice of Service Levels: Basic Payroll (DIY taxes) and Full Service Payroll (taxes handled).

- ✓Affordable Pricing: Low monthly base fee and per-employee cost.

- ✓Ease of Use: Simple interface designed for non-experts.

- ✓Free Setup & Support: Assistance with initial setup and ongoing phone/chat support.

- ✓Optional Add-ons: Time tracking and HR software available for an additional fee.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Basic Payroll

$10.00 / Monthly + Per Employee Fee

- Payroll processing

- Direct deposit/Print checks

- Employee portal

- Setup & Support

Limitations: User handles all tax deposits and filings

Full Service Payroll

$30.00 / Monthly + Per Employee Fee

- Basic features

- Automated tax filings and deposits (Federal, State, Local)

- W-2/1099 Filing

- Guaranteed accurate tax filings

Pros

- + Highly affordable pricing

- + Very easy to navigate and use

- + Excellent customer support reputation

- + Flexible service levels (Basic vs Full Service)

Cons

- - Limited HR features (requires add-on)

- - Fewer integrations compared to larger platforms

- - Basic plan requires manual tax handling

- - No dedicated mobile app

Verdict

"An outstanding choice for budget-conscious small businesses with straightforward payroll needs, offering simplicity and value."

#7

#7

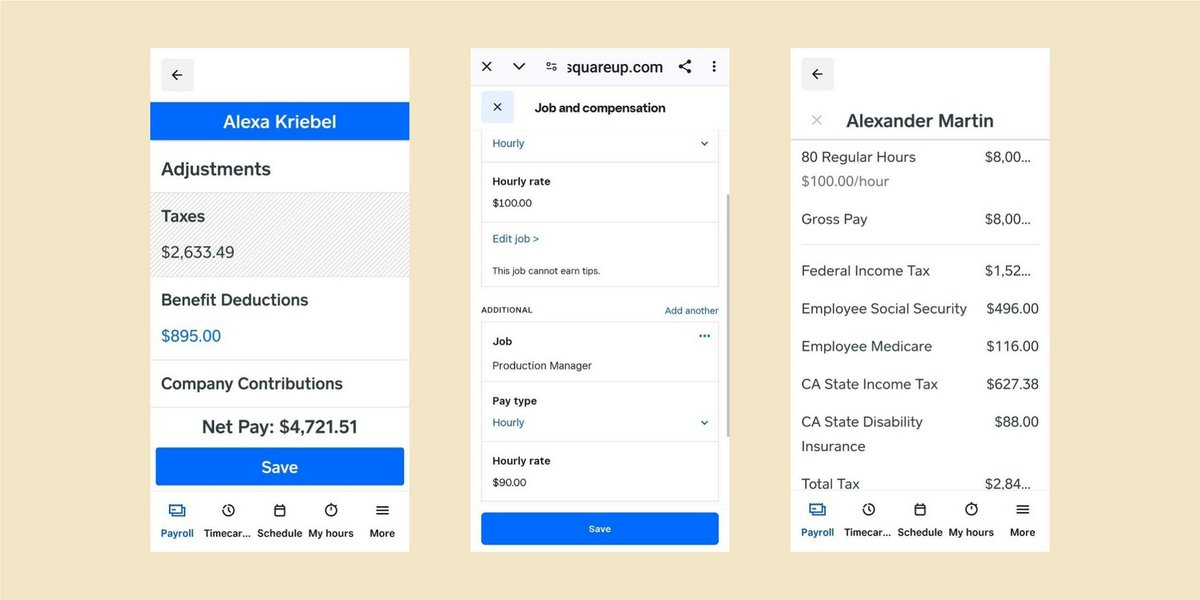

Square Payroll

By Block, Inc.

Payroll service integrated with the Square ecosystem, particularly well-suited for retail and service businesses already using Square POS.

Platforms & Use Cases

Platforms: Web, Mobile (via Square Dashboard app)

Best For: Retail Businesses, Restaurants, Square POS users, Businesses paying contractors

Key Features

- ✓Square Ecosystem Integration: Syncs employee hours from Square POS and timecards automatically.

- ✓Simple Pricing: Clear pricing plans, including a contractor-only option.

- ✓Automated Tax Filing: Handles federal and state payroll tax filings and payments.

- ✓Employee Management: Includes basic onboarding and employee self-service features.

- ✓Instant Payments: Option for employees to access funds instantly via Square Cash App.

Scorecard (Overall: 8.2 / 10.0)

Pricing

Pay Contractors Only

$6.00 / Monthly Per Contractor Paid

- 1099-NEC filing

- Direct deposit

- No monthly subscription fee

Limitations: Only for paying independent contractors

Pay Employees & Contractors

$35.00 / Monthly + Per Person Paid Fee

- Full-service payroll

- Automated tax filing

- W-2 and 1099 support

- Multi-state payroll

- Time tracking integration

- Benefits admin options

Pros

- + Excellent integration with Square POS

- + Very easy to use, especially for simple payroll

- + Affordable contractor-only plan

- + Transparent pricing

Cons

- - Limited HR features compared to dedicated HR platforms

- - Fewer integrations outside the Square ecosystem

- - Customer support quality can be inconsistent

Verdict

"The best option for businesses heavily utilizing Square POS, offering seamless integration and simplicity."

#6

#6

OnPay

By OnPay, Inc.

Straightforward payroll and HR solution with a simple, all-inclusive pricing model, catering mainly to small and medium businesses.

Platforms & Use Cases

Platforms: Web

Best For: Small Businesses, Medium Businesses, Specific Industries (Restaurants, Farms)

Key Features

- ✓Full-Service Payroll: Automated tax payments and filings for federal, state, and local taxes.

- ✓Single Pricing Tier: One monthly base fee plus a per-employee charge includes all features.

- ✓Integrated HR Tools: Offers onboarding, offer letters, PTO tracking, and compliance resources.

- ✓Multi-State Payroll: Supports payroll processing across different states at no extra cost.

- ✓Industry Specializations: Features tailored for specific industries like restaurants and agriculture.

Scorecard (Overall: 8.8 / 10.0)

Pricing

All-Inclusive

$40.00 / Monthly + Per Employee Fee

- Full-service payroll

- Unlimited pay runs

- Multi-state payroll

- W-2 and 1099 processing

- Integrated HR tools

- Benefits admin integration

Limitations: Fewer high-end HR features than some competitors, No dedicated mobile app (web is mobile-responsive)

Pros

- + Simple, transparent pricing

- + Includes good HR features in the base price

- + Strong customer support ratings

- + Handles multi-state payroll easily

Cons

- - Fewer third-party integrations than some larger players

- - Lacks a dedicated mobile application

- - Advanced HR functionalities may be limited

Verdict

"A great value proposition for SMBs wanting comprehensive payroll and essential HR features with straightforward pricing."

#5

#5

Rippling

By Rippling

Unified workforce platform that combines HR, IT, and Finance, including a modern, globally-capable payroll system.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Tech Companies, Medium Businesses, Global Companies, Companies needing HR/IT integration

Key Features

- ✓Integrated Platform: Payroll syncs seamlessly with HR data (new hires, comp changes, terminations) and IT (app provisioning).

- ✓Global Payroll: Capability to pay employees and contractors internationally.

- ✓Automated Compliance: Helps manage tax registrations and filings.

- ✓Time & Attendance: Built-in time tracking tools that sync with payroll.

- ✓Custom Reporting: Powerful reporting across HR, IT, and finance data.

Scorecard (Overall: 8.9 / 10.0)

Pricing

Core Platform

$8.00 / Monthly Per User (Requires purchase of modules)

- Employee database

- Onboarding automation

- Workflow automation

- Permissions

Limitations: Base platform fee, modules cost extra

Payroll Module

Contact Vendor

- Full-service US payroll

- Global payroll options

- Automated tax filing

- Time tracking integration

- Direct deposit

Pros

- + Highly integrated modern platform

- + Strong automation capabilities

- + Excellent for managing HR and IT together

- + Global payroll capabilities

Cons

- - Pricing requires adding multiple modules, can become expensive

- - Payroll is not standalone, requires core platform

- - Can be complex to set up initially

Verdict

"Ideal for businesses seeking a unified platform to manage HR, payroll, and IT, particularly those with global operations or a tech focus."

#4

#4

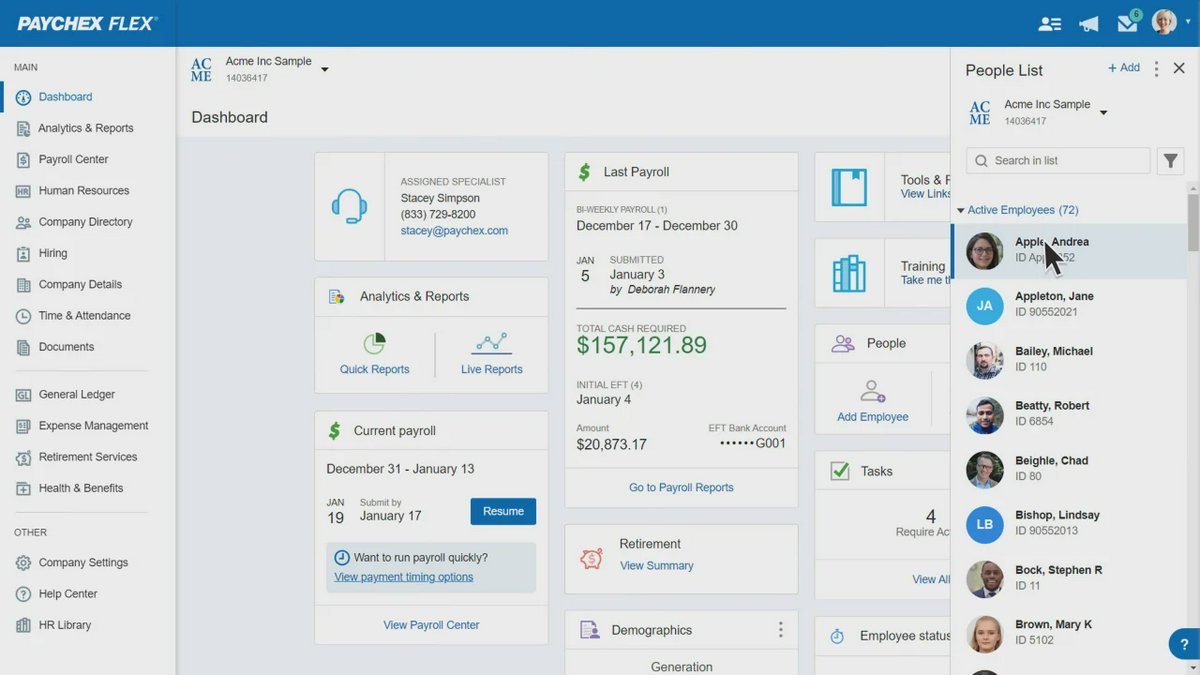

Paychex Flex

By Paychex, Inc.

All-in-one HR platform offering payroll, HR, benefits, and insurance services, catering to businesses of various sizes.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Small Businesses, Medium Businesses, Large Enterprises

Key Features

- ✓Flexible Payroll Entry: Multiple ways to input payroll data, including online and via mobile app.

- ✓Tax Services: Handles payroll tax calculation, remittance, and filing.

- ✓HR Administration: Includes tools for onboarding, performance management, and compliance.

- ✓Benefits Management: Administers health insurance, retirement plans, and other benefits.

- ✓Dedicated Support: Access to dedicated payroll specialists.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Flex Essentials

$39.00 / Monthly + Per Employee Fee

- Online Payroll

- Tax Services

- Direct Deposit/Paycards

- Standard Reporting

- New Hire Reporting

Limitations: Basic HR features, Limited integrations

Flex Select

Contact Vendor

- Essentials features

- Dedicated Payroll Specialist

- Paper check option

- Learning Management System

Flex Pro

Contact Vendor

- Select features

- State Unemployment Insurance Service

- Workers' Comp Reporting

- Employee Screening Essentials

- HR Administration tools

Pros

- + Scalable platform suitable for growth

- + Comprehensive HR and benefits options

- + Dedicated support available

- + Robust reporting capabilities

Cons

- - Pricing can be complex and requires quotes for higher tiers

- - Interface might seem dated to some users

- - Can be overkill for very small businesses with simple needs

Verdict

"A strong contender for businesses looking for a scalable, all-in-one HR and payroll solution with dedicated support."

#3

#3

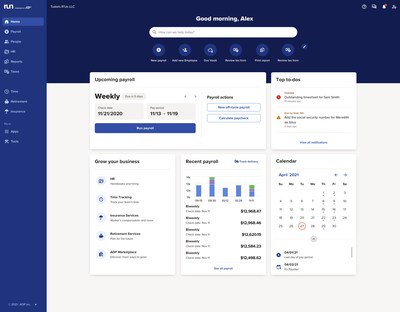

ADP RUN

By ADP, Inc.

Scalable payroll and HR platform from a large, established provider, suitable for small to mid-sized businesses needing robust compliance support.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Small Businesses, Medium Businesses, Compliance-focused companies

Key Features

- ✓Comprehensive Payroll Processing: Handles complex payroll calculations, tax filings across all states, and deductions.

- ✓HR Support & Resources: Access to HR forms, job descriptions, compliance database, and expert support (tier-dependent).

- ✓Time & Attendance: Integrated options for tracking employee hours.

- ✓Talent Acquisition: Tools for hiring and onboarding new employees.

- ✓Reporting & Analytics: Wide range of standard and customizable reports.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Essential

Contact Vendor

- Payroll processing

- Tax filing

- Direct deposit

- Employee access

- Basic reporting

Limitations: Limited HR tools

Enhanced

Contact Vendor

- Essential features

- Check signing & stuffing

- State Unemployment Insurance management

- Background checks

Complete

Contact Vendor

- Enhanced features

- HR HelpDesk

- Employee handbook wizard

- Salary benchmarks

HR Pro

Contact Vendor

- Complete features

- Enhanced HR support

- Learning management

- Applicant tracking system

Pros

- + Strong compliance features

- + Scalable for growing businesses

- + Established reputation and extensive support resources

- + Comprehensive HR features available

Cons

- - Pricing is not transparent (quote-based)

- - Can be more expensive than some competitors

- - Interface can feel less modern than newer platforms

Verdict

"A reliable and scalable solution for businesses prioritizing compliance and extensive HR support, backed by a major industry player."

#2

#2

QuickBooks Payroll

By Intuit Inc.

Payroll solution integrated directly into the QuickBooks accounting ecosystem, ideal for existing QuickBooks users.

Platforms & Use Cases

Platforms: Web, Mobile (via QuickBooks App)

Best For: Small Businesses, QuickBooks Accounting Users, Self-Employed

Key Features

- ✓Seamless QuickBooks Integration: Payroll data automatically syncs with QuickBooks accounting software.

- ✓Automated Tax Handling: Calculates, files, and pays federal and state payroll taxes.

- ✓Direct Deposit Options: Offers next-day and same-day direct deposit options (tier-dependent).

- ✓Time Tracking: Integrated time tracking available via QuickBooks Time (formerly TSheets).

- ✓Workers' Comp Admin: Pay-as-you-go workers' compensation administration.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Core

$45.00 / Monthly + Per Employee Fee

- Full-service payroll

- Automated taxes & forms

- Next-day direct deposit

- Employee self-service

Limitations: Limited HR support, Single-state only initially

Premium

$75.00 / Monthly + Per Employee Fee

- Everything in Core

- Same-day direct deposit

- HR support center

- Automated time tracking (QuickBooks Time Essentials)

Elite

$125.00 / Monthly + Per Employee Fee

- Everything in Premium

- Expert setup review

- Tax penalty protection

- Personal HR advisor

- QuickBooks Time Elite

Pros

- + Excellent integration with QuickBooks Accounting

- + Automated tax filing

- + Choice of direct deposit speeds

- + Familiar interface for QuickBooks users

Cons

- - HR features are less robust than competitors unless on higher tiers

- - Can be costly, especially with added employees

- - Best value primarily for existing QuickBooks ecosystem users

Verdict

"The go-to choice for businesses already invested in QuickBooks, offering seamless payroll integration."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Gusto

By Gusto, Inc.

User-friendly payroll platform with integrated HR tools, benefits administration, and compliance support, primarily targeting small to medium-sized businesses.

Platforms & Use Cases

Platforms: Web, Mobile (iOS, Android)

Best For: Small Businesses, Medium Businesses, Startups

Key Features

- ✓Full-Service Payroll: Automated calculation, payment, and filing of federal, state, and local payroll taxes.

- ✓Employee Self-Service: Portal for employees to view pay stubs, W-2s, and manage personal information.

- ✓Benefits Administration: Integrated health insurance, 401(k), workers' comp, and commuter benefits.

- ✓HR Tools: Onboarding, time tracking, PTO management, and compliance assistance.

- ✓Integrations: Connects with popular accounting, time tracking, and expense management software.

Scorecard (Overall: 9.0 / 10.0)

Pricing

Simple

$40.00 / Monthly + Per Employee Fee

- Full-service single-state payroll

- Employee self-service

- Basic hiring & onboarding

- Integrations

Limitations: Limited HR features, Single-state payroll only

Plus

$80.00 / Monthly + Per Employee Fee

- Everything in Simple

- Multi-state payroll

- Next-day direct deposit

- Advanced hiring & onboarding

- PTO management

- Time tracking

Premium

Contact Vendor

- Everything in Plus

- Dedicated support

- HR Resource Center

- Compliance alerts

- Full-service payroll migration

Pros

- + Intuitive interface

- + Strong automation features

- + Good range of HR tools

- + Transparent pricing for lower tiers

Cons

- - Customer support can have delays

- - Higher tiers can become expensive

- - Mobile app functionality somewhat limited compared to web

Verdict

"Excellent choice for SMBs seeking an easy-to-use, comprehensive payroll and basic HR solution."

Final Thoughts

The payroll software market offers diverse solutions, from simple, affordable options for very small businesses to comprehensive HCM suites for larger organizations. Key differentiators include the breadth of HR features, integration capabilities (especially with accounting software), ease of use, pricing transparency, and customer support quality. Evaluating specific business needs regarding size, complexity, budget, and required HR functionalities is crucial for selecting the right platform.