Comprehensive Comparison of Leading Online Payroll Services

By Dante Holloway | Published: Current Review Period | Category: Online Payroll Services

About Online Payroll Services

Online payroll services automate the complex process of paying employees, including calculating wages, withholding taxes, and managing filings and payments. These platforms offer efficiency, accuracy, and compliance features for businesses.

Scoring Criteria

- → Ease of Use

- → Core Payroll Features

- → HR & Benefits Admin

- → Integrations

- → Pricing Value

- → Customer Support

The Best Online Payroll Services

#10

#10

Paylocity

By Paylocity

Cloud-based HCM and payroll software focused on employee experience and modern HR needs, suitable for mid-sized to larger companies.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Mid-Sized to Large Businesses, Employee Engagement Focus, Modern HR Technology, Integrated Talent Management

Key Features

- ✓Comprehensive HCM Suite: Includes payroll, benefits, talent management, workforce management, and employee engagement tools.

- ✓Employee Engagement Features: Tools like community forums, peer recognition, and surveys.

- ✓Mobile-First Design: Strong mobile app capabilities for both employees and administrators.

- ✓Video Integration: Unique features incorporating video into HR processes like onboarding and communication.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Custom Bundles

$-1.00 / custom

- Quote-based pricing

- Modular approach - select needed functionalities

- Payroll is the core

- Add HR, Benefits, Talent, Workforce Management modules

Limitations: Pricing not publicly available, Complex setup

Pros

- + Modern interface with strong mobile app

- + Focus on employee experience and engagement tools

- + Comprehensive suite of HCM modules

- + Innovative features like video integration

Cons

- - Opaque, quote-based pricing

- - Can be expensive

- - May be too feature-rich for smaller organizations

Verdict

"A leading choice for mid-market and enterprise clients seeking a modern HCM platform with strong payroll and a focus on employee engagement."

#9

#9

Paycor

By Paycor

Comprehensive Human Capital Management (HCM) platform including payroll, targeting mid-market and larger businesses.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Mid-Sized Businesses, Companies Needing Full HCM Suite, Talent Management Focused, Complex HR Needs

Key Features

- ✓Unified HCM Platform: Combines payroll with HR, talent acquisition, workforce management, and benefits administration.

- ✓Advanced Reporting & Analytics: Provides deep insights into workforce data.

- ✓Talent Management Tools: Includes features for recruiting, onboarding, performance management, and learning.

- ✓Industry Solutions: Offers tailored solutions for specific industries like healthcare, manufacturing, and retail.

Scorecard (Overall: 8.4 / 10.0)

Pricing

Basic

$99.00 / monthly

- Approx. base fee + per employee cost varies

- Payroll & Tax compliance

- Basic HR

- Onboarding

Limitations: Quote required for exact pricing, Limited features

Essential

$149.00 / monthly

- Approx. base fee + per employee cost varies

- Adds more robust HR tools

- Employee self-service

Complete

$199.00 / monthly

- Approx. base fee + per employee cost varies

- Adds compensation planning

- Advanced analytics

Perform (HCM)

$-1.00 / custom

- Quote-based pricing

- Full HCM suite including talent management

Pros

- + Robust suite of HCM features beyond payroll

- + Strong talent management capabilities

- + Powerful analytics and reporting

- + Good industry-specific solutions

Cons

- - Pricing can be high and less transparent

- - May be overly complex for small businesses

- - Implementation can be involved

Verdict

"A strong contender for mid-market companies needing a unified platform for payroll, HR, and advanced talent management."

#8

#8

Patriot Payroll

By Patriot Software

Affordable online payroll service focused on simplicity and core payroll functions, targeting very small businesses.

Platforms & Use Cases

Platforms: Web

Best For: Very Small Businesses, Budget-Conscious Companies, Basic Payroll Needs, DIY Tax Filing Option

Key Features

- ✓Affordable Pricing: Offers some of the lowest starting prices in the market.

- ✓Two Service Tiers: Basic Payroll (DIY taxes) and Full Service Payroll (automated tax filings).

- ✓Ease of Use: Simple, straightforward interface designed for non-experts.

- ✓Optional Add-ons: Time tracking and HR software available for an additional fee.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Basic Payroll

$10.00 / monthly

- Base fee + $4/employee

- Payroll processing

- Direct deposit

- Employee portal

- Requires manual tax filing

Limitations: User must handle tax deposits and filings

Full Service Payroll

$30.00 / monthly

- Base fee + $4/employee

- Includes all Basic features

- Automated tax filings and payments

Limitations: HR and Time Tracking are paid add-ons

Pros

- + Highly affordable, especially for very small businesses

- + Extremely easy to set up and use

- + Transparent pricing

- + Option for full-service tax handling

Cons

- - Limited HR features compared to competitors

- - Fewer integrations than larger platforms

- - Basic tier requires manual tax handling

Verdict

"An excellent choice for very small businesses prioritizing affordability and ease of use for core payroll functions."

#7

#7

OnPay

By OnPay

Full-service payroll and HR solution with straightforward, all-inclusive pricing, suitable for small to medium-sized businesses.

Platforms & Use Cases

Platforms: Web

Best For: Small to Mid-Sized Businesses, Companies Needing Simple Pricing, Specific Industries (e.g., Agriculture, Nonprofits), Integrated HR

Key Features

- ✓All-Inclusive Pricing: One monthly base fee plus a per-employee charge covers all payroll and HR features.

- ✓Full-Service Payroll: Handles all tax filings and payments (federal, state, local), multiple pay rates/schedules.

- ✓Integrated HR Tools: Includes offer letters, onboarding workflows, PTO management, and document storage.

- ✓Industry Specialization: Experience handling payroll for specific verticals like restaurants, farms, and nonprofits.

Scorecard (Overall: 8.7 / 10.0)

Pricing

All-Inclusive

$40.00 / monthly

- Base fee + $6/employee

- Full-service payroll for W-2/1099

- Multi-state payroll

- All HR tools included

- Benefits admin integration

Limitations: No dedicated mobile app (web is mobile-responsive)

Pros

- + Simple, transparent, all-inclusive pricing

- + Good set of integrated HR features for the price

- + Strong customer support reputation

- + Handles payroll for specific industries well

Cons

- - Lacks a dedicated mobile application

- - Interface is functional but less sleek than some competitors

Verdict

"Offers excellent value with its straightforward pricing covering robust payroll and HR features, great for SMBs wanting predictability."

#6

#6

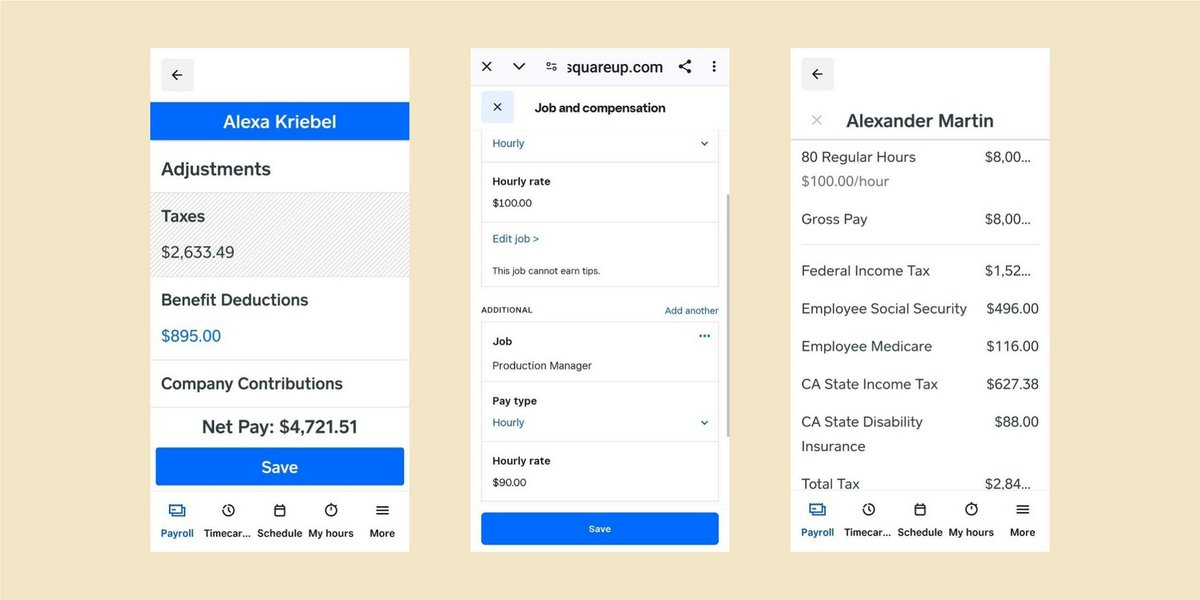

Square Payroll

By Square

Simple payroll service integrated into the Square ecosystem, ideal for retailers, restaurants, and businesses using Square POS.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Square POS Users, Retail & Restaurants, Businesses Paying Contractors, Simple Payroll Needs

Key Features

- ✓Square Ecosystem Integration: Seamlessly syncs with Square POS, appointments, and timecards.

- ✓Simple Pricing: Transparent pricing structure, including a contractor-only plan.

- ✓Full-Service Payroll: Automated tax calculations, payments, and filings.

- ✓Employee Management Tools: Includes basic time tracking, tip reporting, and employee app.

Scorecard (Overall: 8.2 / 10.0)

Pricing

Pay Contractors Only

$6.00 / monthly

- $6/person paid per month

- 1099 filings

- Direct deposit

Limitations: No W-2 employees

Pay W-2 Employees & Contractors

$35.00 / monthly

- Base fee + $6/person paid per month

- Full-service payroll

- Multi-state payroll

- Employee app

Limitations: Basic HR features, Limited integrations outside Square

Pros

- + Excellent integration with Square POS

- + Very simple and transparent pricing

- + Easy to use, especially for existing Square customers

- + Good contractor payment option

Cons

- - Limited HR and benefits administration features

- - Integrations outside the Square ecosystem are minimal

- - Less suitable for complex payroll needs

Verdict

"An excellent, straightforward payroll solution for businesses already using Square products, particularly retail and service industries."

#5

#5

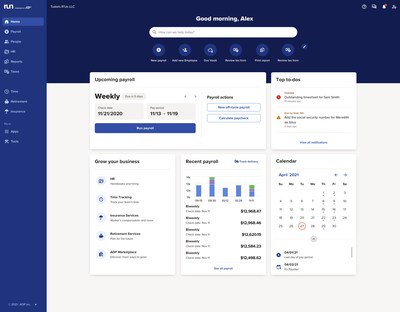

ADP RUN

By ADP

Payroll and HR platform designed for small businesses (typically under 50 employees) from a major industry player.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small Business Payroll (1-49 Employees), Companies Needing Strong Compliance, Businesses Seeking Brand Reputation

Key Features

- ✓Tailored Small Business Plans: Multiple package options designed specifically for the needs of small businesses.

- ✓Automated Payroll & Tax Filing: Handles calculations, deductions, filings, and payments accurately.

- ✓HR Support & Compliance: Access to HR forms, compliance database, and expert support options.

- ✓Mobile App: Robust mobile app for admins and employees.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Essential

$-1.00 / custom

- Quote-based pricing

- Core payroll processing

- Tax filing

- Direct deposit

- Basic reporting

Enhanced

$-1.00 / custom

- Quote-based pricing

- Adds check signing, state unemployment insurance management

- Background checks

Complete

$-1.00 / custom

- Quote-based pricing

- Adds basic HR support, handbook wizard

HR Pro

$-1.00 / custom

- Quote-based pricing

- Adds enhanced HR support, training tools, legal assistance

Pros

- + Strong brand reputation and reliability

- + Comprehensive payroll and tax features

- + Good range of HR support options

- + Scales to larger ADP platforms if needed

Cons

- - Pricing is not transparent (quote-based)

- - Can be more expensive than alternatives

- - Interface may feel dated to some users

Verdict

"A solid, dependable payroll and HR solution for small businesses that value brand stability and robust compliance features, despite opaque pricing."

#4

#4

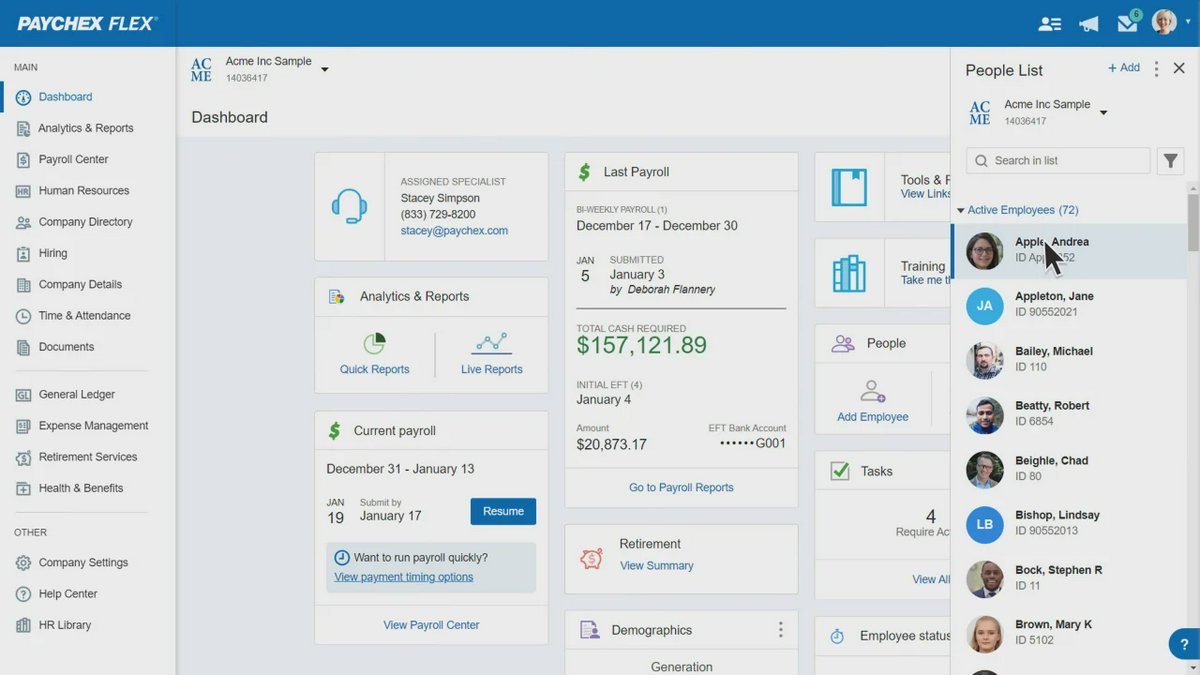

Paychex Flex

By Paychex

Scalable payroll and HR solution from a long-standing provider, suitable for businesses of various sizes, from small to enterprise.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Scalable Payroll Needs, Businesses Seeking Comprehensive HR Support, Compliance Focused Companies, All Business Sizes

Key Features

- ✓Scalable Solutions: Offers plans tailored for small businesses up to enterprise-level needs.

- ✓Dedicated Support: Provides access to dedicated payroll specialists.

- ✓Robust HR Features: Includes options for recruiting, onboarding, performance management, and extensive compliance resources.

- ✓Multiple Input Methods: Allows payroll data entry via web, mobile app, or phone.

Scorecard (Overall: 8.6 / 10.0)

Pricing

Flex Essentials

$39.00 / monthly

- Base fee + $5/employee

- Online payroll processing

- Tax administration

- Standard reporting

Limitations: Basic features, Limited HR tools

Flex Select

$-1.00 / custom

- Custom pricing

- Dedicated payroll specialist

- More HR features

- Check signing options

Flex Pro

$-1.00 / custom

- Custom pricing

- Advanced HR analytics

- Employee screening

- Full HCM suite options

Pros

- + Highly scalable platform for growth

- + Strong compliance and tax handling reputation

- + Comprehensive HR service offerings

- + Dedicated support available

Cons

- - Pricing is often opaque (quote-based)

- - Interface can feel less modern than some competitors

- - Can be more expensive than SMB-focused options

Verdict

"A reliable and scalable choice for businesses prioritizing compliance, comprehensive HR features, and dedicated support, suitable for various sizes."

#3

#3

Rippling

By Rippling

Unified workforce platform that combines HR, IT, and Finance, including robust payroll capabilities, targeting tech-savvy companies.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Technology Companies, Businesses Needing IT/HR Integration, Global Payroll, Automated Workflows

Key Features

- ✓Unified Platform: Combines Payroll, Benefits, HR, App Management, and Device Management.

- ✓Global Payroll: Supports payroll processing for international employees and contractors.

- ✓Workflow Automations: Powerful tools to automate processes across HR, IT, and Finance.

- ✓Strong Integrations: Connects with hundreds of third-party applications.

Scorecard (Overall: 8.7 / 10.0)

Pricing

Modular Pricing

$8.00 / monthly

- Starts at $8/user/month for the core platform

- Payroll is an add-on module (pricing varies)

- Choose needed modules (HR, IT, Finance)

Limitations: Can become expensive as modules are added, Complex setup

Pros

- + Extremely powerful integration capabilities (HR/IT/Finance)

- + Highly customizable and scalable

- + Strong global payroll features

- + Modern interface

Cons

- - Pricing based on modules can add up quickly

- - Can be overly complex for simple payroll needs

- - Steeper learning curve

Verdict

"Best suited for mid-sized to larger companies, especially those in tech, needing a unified platform for workforce management beyond just payroll."

#2

#2

QuickBooks Payroll

By Intuit

Payroll service tightly integrated with the QuickBooks accounting ecosystem, suitable for businesses already using QuickBooks.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Existing QuickBooks Users, Small Business Accounting & Payroll, Contractor Payments

Key Features

- ✓Seamless QuickBooks Integration: Payroll data syncs automatically with QuickBooks accounting software.

- ✓Full-Service Payroll Options: Automated payroll runs, tax calculations, filings, and payments across different tiers.

- ✓Same-Day Direct Deposit: Available on higher tiers for faster employee payments.

- ✓Basic HR Support: Access to HR advisors and compliance resources available in premium plans.

Scorecard (Overall: 8.5 / 10.0)

Pricing

Core

$45.00 / monthly

- Base fee + $5/employee

- Full-service payroll

- Next-day direct deposit

- Basic reporting

Limitations: Limited HR features

Premium

$75.00 / monthly

- Base fee + $8/employee

- Same-day direct deposit

- Time tracking

- HR support center

Limitations: HR support is not dedicated

Elite

$125.00 / monthly

- Base fee + $10/employee

- Expert setup review

- Tax penalty protection

- Personal HR advisor

Pros

- + Excellent integration with QuickBooks accounting

- + Familiar interface for QuickBooks users

- + Competitive pricing tiers

- + Same-day deposit option

Cons

- - HR features are less robust compared to dedicated HR platforms

- - Best value primarily for existing QuickBooks customers

Verdict

"The ideal choice for businesses already embedded in the QuickBooks ecosystem, offering seamless payroll and accounting integration."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Gusto

By Gusto

All-in-one platform combining payroll, benefits, and HR, favored by small to medium-sized businesses for its user-friendly interface.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small Business Payroll, Startup HR & Payroll, Benefits Administration, Employee Onboarding

Key Features

- ✓Full-Service Payroll: Automated calculations, tax filings (federal, state, local), direct deposit, year-end W-2s/1099s.

- ✓Employee Self-Service Portal: Allows employees to view pay stubs, access tax documents, and update personal information.

- ✓Integrated Benefits: Offers health insurance, 401(k) plans, workers' comp, and other benefits directly within the platform.

- ✓HR Tools: Includes hiring and onboarding tools, time tracking, PTO management, and compliance assistance.

Scorecard (Overall: 8.8 / 10.0)

Pricing

Simple

$40.00 / monthly

- Base fee + $6/employee

- Single-state payroll

- Basic HR suite

- Employee self-service

Limitations: Limited HR support, Single-state only

Plus

$80.00 / monthly

- Base fee + $12/employee

- Multi-state payroll

- Next-day direct deposit

- Advanced HR tools

- Time tracking

Limitations: Higher per-employee cost

Premium

$-1.00 / custom

- Custom pricing

- Dedicated support

- HR resource center

- Full HR suite

Pros

- + Highly intuitive interface

- + Strong integration of payroll, HR, and benefits

- + Excellent employee self-service features

- + Good onboarding tools

Cons

- - Pricing can become costly for larger teams

- - Customer support experiences can vary

Verdict

"Gusto excels for SMBs seeking an easy-to-use, integrated platform for payroll, benefits, and core HR functions."

Final Thoughts

The online payroll landscape offers solutions ranging from affordable, basic payroll for small businesses to sophisticated Human Capital Management suites for larger enterprises. Key differentiators include ease of use, integration capabilities (especially with accounting or HRIS), pricing transparency, HR feature depth, and customer support quality. Choosing the right service depends heavily on business size, complexity, budget, and specific needs beyond core payroll processing.