Comparison of Intuit Payroll Solutions

By Jordan Patel | Published: Not Applicable | Category: Intuit Payroll

About Intuit Payroll

Software designed to manage employee compensation, tax filing, and compliance specifically offered by Intuit, often integrated with QuickBooks accounting software. These solutions cater to various business sizes and needs, from basic paycheck calculation to full-service payroll and HR support.

Scoring Criteria

- → Payroll Processing

- → Tax Filing & Compliance

- → HR Features

- → Integration

- → Ease of Use

- → Pricing

- → Support

The Best Intuit Payroll

#6

#6

QuickBooks Desktop Basic Payroll

By Intuit

Calculates paychecks and payroll taxes within QuickBooks Desktop; user handles all tax forms, filings, and payments manually.

Platforms & Use Cases

Platforms: Desktop (Windows)

Best For: Small businesses with very simple payroll using QB Desktop, Users who prefer complete manual control over tax process, Budget-focused users needing only calculations

Key Features

- ✓Paycheck Calculation: Calculates gross pay, deductions, and net pay. (Included)

- ✓Payroll Tax Calculation: Calculates Federal & State taxes based on current tables (requires subscription). (Included)

- ✓Tracks Payroll Liabilities: Helps track tax amounts owed. (Included)

Scorecard (Overall: 4.6 / 10.0)

Pricing

Basic Payroll Subscription

$35.00 / Monthly

- Paycheck calculations

- Tax liability tracking

- Integration with QB Desktop

- +$5/employee/month

Limitations: No tax form generation, No electronic filing/payment features, No direct deposit included, Requires manual tax table updates (via subscription)

Pros

- + Lowest cost Intuit payroll option for Desktop

- + Basic calculation integrated with QB Desktop

- + Provides fundamental calculation support

Cons

- - Completely manual tax handling (forms, filing, payment)

- - High compliance burden and risk on user

- - Does not generate tax forms (W-2s, 941s, etc.)

- - No direct deposit without additional fees/services

Verdict

"Only recommended for QB Desktop users with extremely simple payroll needs who are experts in manually preparing and filing all payroll tax forms and payments."

#5

#5

QuickBooks Desktop Enhanced Payroll

By Intuit

Handles payroll calculations and tax form preparation within QuickBooks Desktop, but user manages filing and payments.

Platforms & Use Cases

Platforms: Desktop (Windows)

Best For: QB Desktop users comfortable managing their own tax filings/payments, Businesses needing W-2s and federal/state tax forms generated, Cost-conscious Desktop users needing more than basic calculations

Key Features

- ✓Automatic Tax Calculations: Calculates federal and state payroll taxes. (Included)

- ✓Payroll Tax Form Generation: Creates federal and most state tax forms (e.g., 941, 940, W-2). (Included)

- ✓Direct Deposit Option: Ability to pay employees via direct deposit. (Available)

- ✓E-file & E-pay Options: Tools to electronically file forms and pay taxes (user initiated). (Available)

Scorecard (Overall: 5.7 / 10.0)

Pricing

Enhanced Payroll Subscription

$50.00 / Monthly

- Payroll Calculations

- Tax Form Generation (Federal/State)

- Direct Deposit

- E-file/E-pay tools

- Integration with QB Desktop

- +$5/employee/month

Limitations: User responsible for timely tax filing and payments, Compliance risk remains with the user, Requires manual steps for submission

Pros

- + Integrates directly with QB Desktop

- + Generates necessary tax forms automatically

- + More affordable than Assisted Payroll

- + Includes direct deposit capability

Cons

- - User must handle all tax filings and payments manually or via e-file tools

- - Significant compliance responsibility falls on the user

- - Potential for errors or missed deadlines

Verdict

"Suitable for QB Desktop users who need calculation help and form generation but are knowledgeable and confident in handling their own payroll tax submissions."

#4

#4

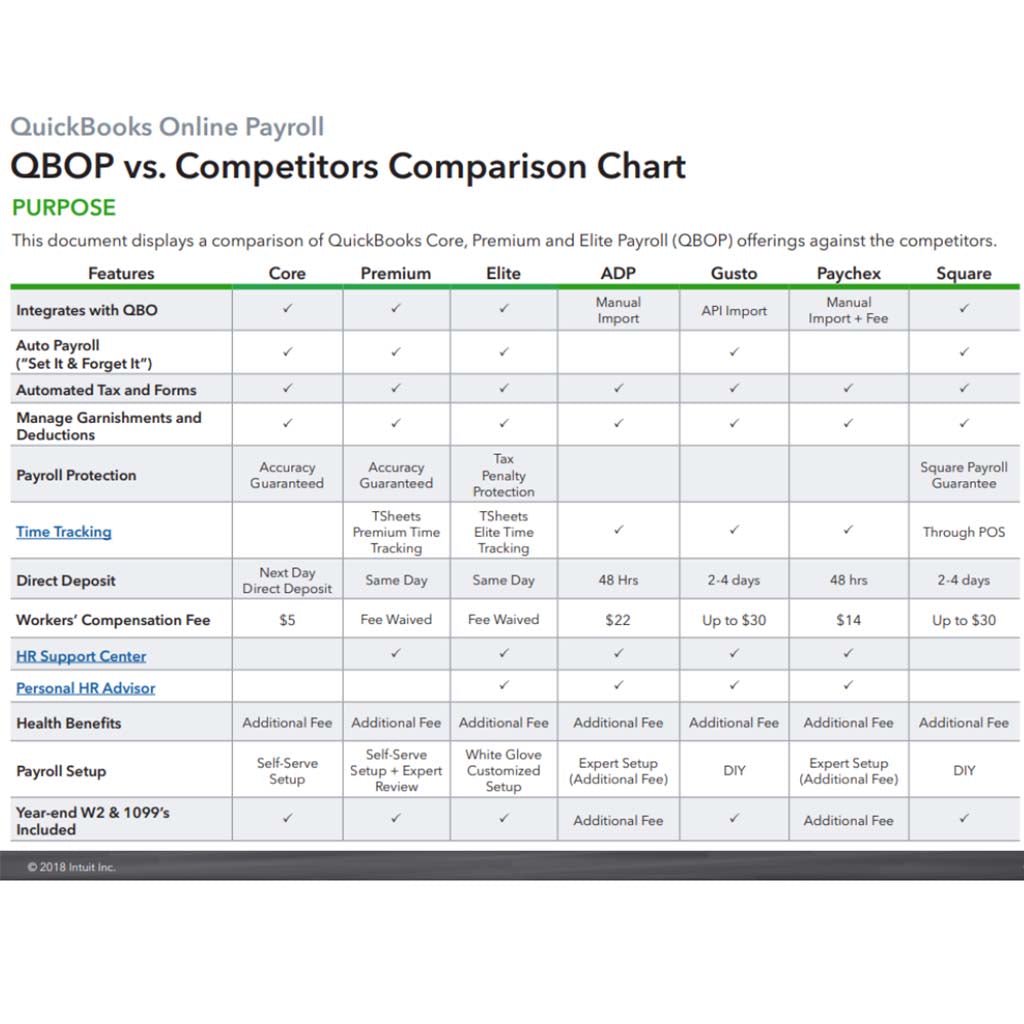

QuickBooks Payroll Core

By Intuit

Basic cloud-based payroll service integrated with QuickBooks Online for small businesses needing automated payroll and tax filing.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Small business payroll, Basic automated tax payments & filing, Contractor payments, Users of QuickBooks Online needing essential payroll

Key Features

- ✓Automated Payroll Runs: Set up recurring payroll schedules for automatic processing. (Included)

- ✓Federal & State Tax Filing: Automated calculation, electronic filing, and payment. (Included)

- ✓Next-Day Direct Deposit: Faster employee payments compared to traditional methods. (Included)

- ✓Contractor Payments: Manage and pay 1099 contractors. (Included)

Scorecard (Overall: 7.0 / 10.0)

Pricing

Core Payroll Add-on

$45.00 / Monthly

- Automated Payroll

- Tax Filing (Federal & State)

- Next-Day Direct Deposit

- Basic Reporting

- +$6/employee/month

Limitations: Limited HR features, No same-day direct deposit, No time tracking included

Pros

- + Affordable entry point for QBO users

- + Seamless QuickBooks Online integration

- + Automates core payroll and tax tasks

- + Easy to use for basic needs

Cons

- - Basic HR support only

- - Next-day direct deposit (not same-day)

- - Lacks features like time tracking or workers' comp admin

Verdict

"Best for very small businesses already using QuickBooks Online who need fundamental, automated payroll processing without extra frills."

#3

#3

QuickBooks Desktop Assisted Payroll

By Intuit

Full-service payroll for QuickBooks Desktop users where Intuit handles payroll tax filing and payments, simplifying compliance.

Platforms & Use Cases

Platforms: Desktop (Windows)

Best For: Businesses using QB Desktop needing full payroll tax service, Companies preferring desktop software but outsourcing tax compliance, Users wanting direct deposit and automated tax payments with Desktop

Key Features

- ✓Full Service Tax Filing: Intuit files and pays federal, state, and local payroll taxes. (Included)

- ✓Direct Deposit: Pay employees via direct deposit (standard timing). (Included)

- ✓Year-End Form Processing: Intuit prepares and files W-2s and other year-end forms. (Included)

- ✓QuickBooks Desktop Integration: Syncs payroll data directly with QuickBooks Desktop. (Core Feature)

Scorecard (Overall: 7.0 / 10.0)

Pricing

Assisted Payroll Subscription

$109.00 / Monthly

- Full Service Payroll Tax Filing

- Direct Deposit

- W-2 Processing

- Integration with QB Desktop

- Support Included

- + Fees per employee per paycheck (approx $2)

Limitations: Requires QuickBooks Desktop subscription, Less flexibility than cloud solutions, No tax penalty guarantee

Pros

- + Handles all payroll tax filings and payments

- + Reduces compliance burden for Desktop users

- + Integrates directly with QuickBooks Desktop

- + Processes year-end W-2 forms

Cons

- - Tied to QuickBooks Desktop platform

- - Can be more expensive than Enhanced Desktop

- - Lacks advanced HR features

- - No equivalent to QBO Elite's tax penalty guarantee

Verdict

"Best full-service payroll option for businesses committed to the QuickBooks Desktop platform who want Intuit to manage tax compliance."

#2

#2

QuickBooks Payroll Premium

By Intuit

Enhanced cloud-based payroll with same-day direct deposit, workers' comp admin, time tracking, and basic HR tools integrated with QuickBooks Online.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Growing businesses using QuickBooks Online, Businesses needing faster payroll processing, Basic time tracking & HR support needs

Key Features

- ✓Same-Day Direct Deposit: Pay employees faster on payroll day. (Included)

- ✓Workers' Comp Administration: Integrated pay-as-you-go workers' compensation management. (Included)

- ✓HR Support Center: Access to HR compliance resources, guides, and document templates. (Included)

- ✓Time Tracking: Mobile time tracking for employees integrates with payroll. (Included)

- ✓Automated Tax Payments & Filing: Handles federal and state payroll tax submissions. (Included)

Scorecard (Overall: 7.4 / 10.0)

Pricing

Premium Payroll Add-on

$80.00 / Monthly

- All Core features

- Same-Day DD

- Workers' Comp Admin

- Time Tracking

- HR Support Center

- +$8/employee/month

Limitations: Expert review and tax penalty protection require Elite

Pros

- + Same-day direct deposit

- + Includes integrated time tracking

- + Workers' comp administration feature

- + Access to HR resources

- + Strong QuickBooks Online integration

Cons

- - Higher cost than Core

- - HR features less comprehensive than Elite

- - No tax penalty protection

Verdict

"A strong middle-ground for QuickBooks Online users needing faster payments and useful HR/time tracking tools alongside robust payroll automation."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

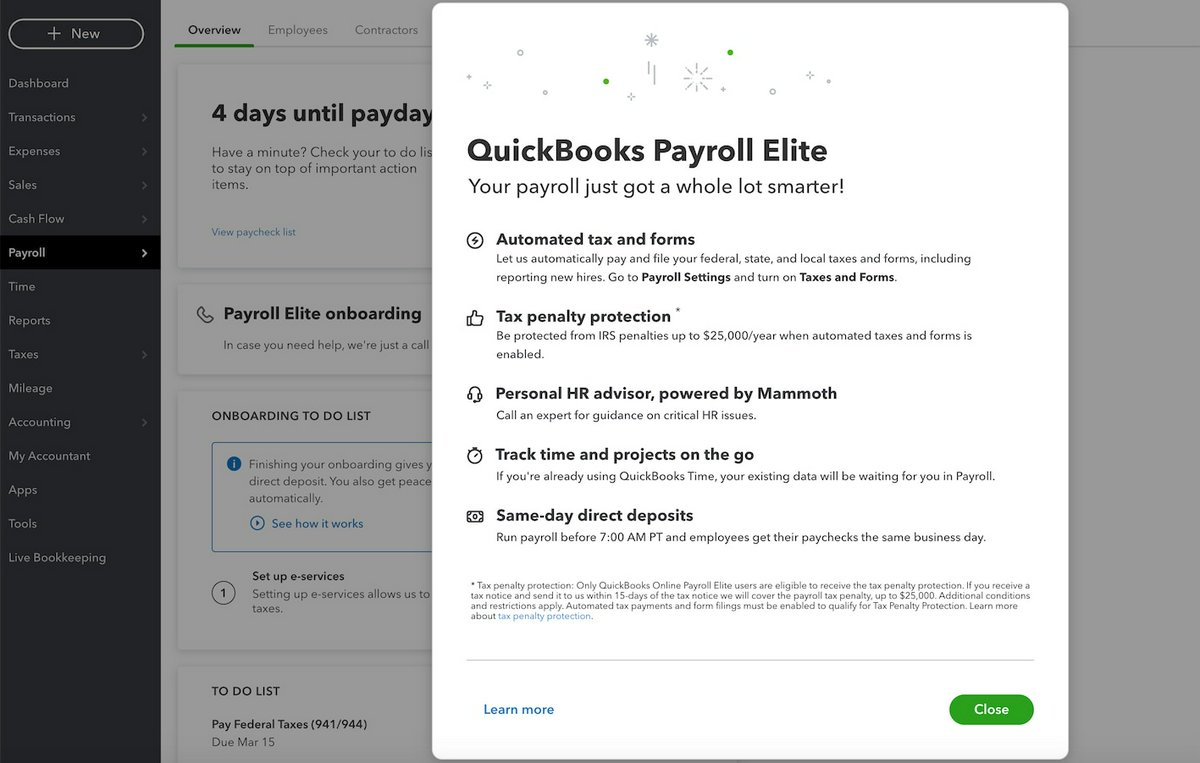

QuickBooks Payroll Elite

By Intuit

Top-tier cloud-based payroll service with tax penalty protection, personalized HR advising, 24/7 support, and advanced features integrated with QuickBooks Online.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Businesses prioritizing compliance, Companies needing dedicated HR support, Organizations wanting maximum protection and support, Users of QuickBooks Online

Key Features

- ✓Tax Penalty Protection: Intuit covers up to $25,000 in payroll tax penalties caused by errors. (Included)

- ✓Personal HR Advisor: Dedicated access to certified HR professionals for guidance. (Included)

- ✓24/7 Expert Product Support: Round-the-clock premium assistance. (Included)

- ✓Setup Assistance: White-glove setup service to ensure correct configuration. (Included)

- ✓Same-Day Direct Deposit: Option for faster employee payments. (Included)

Scorecard (Overall: 8.3 / 10.0)

Pricing

Elite Payroll Add-on

$125.00 / Monthly

- All Premium features

- Tax Penalty Protection

- Personal HR Advisor

- 24/7 Support

- Expert Setup

- +$10/employee/month

Limitations: Highest price point in QBO Payroll suite

Pros

- + Tax penalty guarantee provides peace of mind

- + Personalized HR advising

- + Premium 24/7 support

- + Comprehensive feature set including time tracking

- + Seamless QuickBooks Online integration

Cons

- - Most expensive option

- - May be overkill for very small businesses

Verdict

"The premium choice for businesses using QuickBooks Online seeking maximum compliance assurance, personalized HR support, and top-tier service."

Final Thoughts

Intuit provides a range of payroll solutions tailored to users of its QuickBooks platform, spanning both Online and Desktop versions. Offerings scale from basic calculation tools (Desktop Basic) and automated cloud payroll (Online Core) to full-service tax handling (Desktop Assisted, Online Premium/Elite) and advanced HR support with compliance guarantees (Online Elite). The primary distinction lies between the cloud-based, more automated QuickBooks Online Payroll tiers and the QuickBooks Desktop Payroll options which offer varying levels of user involvement in tax processing.