Top Financial Planning Software Comparison

By Amanda Reyes | Published: 2025-03-29 | Category: Financial Planning Software

About Financial Planning Software

Financial planning software helps individuals and professional advisors organize finances, track investments, create budgets, and model future financial scenarios to achieve long-term goals. These tools range from simple budgeting apps to comprehensive platforms for complex wealth management.

Scoring Criteria

- → Comprehensive Planning Features

- → Ease of Use / User Interface

- → Integration Capabilities

- → Reporting & Analytics

- → Client Experience / Portal

- → Cost / Value

- → Support & Training

The Best Financial Planning Software

#11

#11

Wealthfront

By Wealthfront Corporation

Leading robo-advisor offering automated investing, financial planning tools, and banking features with a strong digital focus.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Robo-Advising, Automated Financial Planning, Investment Management, College Savings (529 Plans), High-Yield Cash Account

Key Features

- ✓Path Digital Financial Advisor: Automated planning tool analyzing linked accounts to project retirement and other goals. (High)

- ✓Automated Investment Management: Diversified, low-cost ETF portfolios with tax-loss harvesting. (Excellent)

- ✓Portfolio Line of Credit: Ability to borrow against portfolio value easily. (Good)

- ✓Integration of Banking & Investing: Offers high-yield cash accounts alongside investment portfolios. (High)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Advisory Fee

$0.25 / Annual (% of AUM)

- Automated investing

- Tax-loss harvesting

- Path planning tool

- Account aggregation

- Banking features

Limitations: Limited human advisor interaction, Requires $500 minimum investment

Pros

- + Highly automated and integrated financial platform

- + Strong digital planning tools ('Path')

- + Low advisory fee

- + Excellent user interface and mobile experience

- + Combines banking and investing well

Cons

- - Very limited access to human advisors

- - Planning is automated, less customizable than advisor software

- - Primarily focused on accumulation phase

Verdict

"A top choice for tech-savvy individuals comfortable with a fully digital, automated approach to investing and financial planning."

#10

#10

Betterment

By Betterment LLC

Robo-advisor providing automated investment management combined with goal-based planning tools and optional access to human advisors.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Robo-Advising, Goal-Based Investing, Retirement Planning, Investment Management, Tax-Loss Harvesting

Key Features

- ✓Automated Investing: Builds and manages diversified portfolios based on risk tolerance and goals. (Excellent)

- ✓Goal Setting & Projections: Tools to set financial goals (retirement, house) and project outcomes. (Good)

- ✓Tax-Coordinated Portfolio™: Optimizes asset location across taxable and tax-advantaged accounts. (High)

- ✓Access to Advisors: Offers packages with access to Certified Financial Planners (CFPs) for additional fees. (Good)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Digital

$0.25 / Annual (% of AUM)

- Automated investing

- Goal planning tools

- Account aggregation

- Tax-loss harvesting

Limitations: Limited human advisor access

Premium

$0.40 / Annual (% of AUM)

- Digital features

- Unlimited access to CFPs

- In-depth advice on outside investments

Limitations: Requires $100k minimum balance

Pros

- + Easy-to-use platform for automated investing

- + Strong goal-based planning features

- + Sophisticated tax optimization strategies

- + Option for human advisor guidance

Cons

- - Planning tools less comprehensive than dedicated advisor software

- - Fees based on assets under management

- - Primarily focused on investing

Verdict

"Excellent for individuals seeking automated investment management integrated with solid goal-based planning tools and optional advisor access."

#9

#9

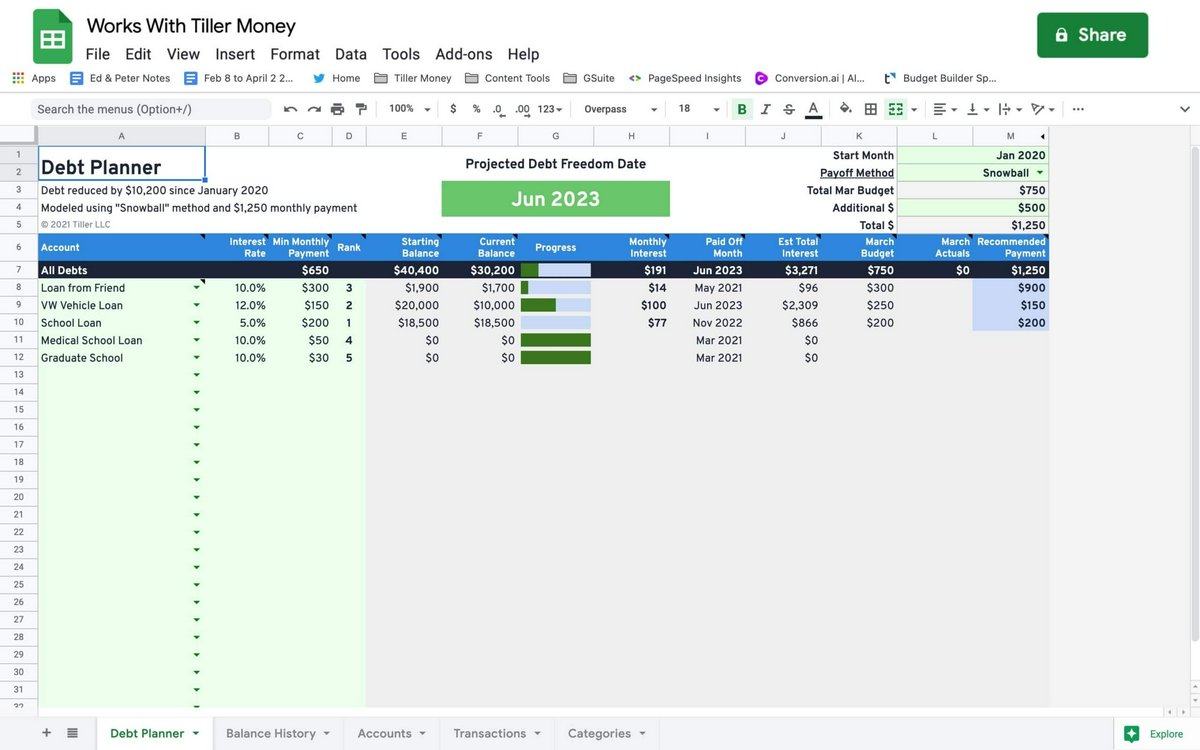

Tiller Money

By Tiller, LLC

Connects financial accounts to customizable Google Sheets or Microsoft Excel spreadsheets for flexible budgeting and tracking.

Platforms & Use Cases

Platforms: Web (via Google Sheets/Excel), iOS (companion), Android (companion)

Best For: Customizable Budgeting, Spreadsheet-Based Tracking, Expense Management, Net Worth Tracking, DIY Financial Analysis

Key Features

- ✓Spreadsheet Integration: Automatically feeds financial data into Google Sheets or Excel. (Excellent)

- ✓Customizable Templates: Provides various pre-built templates (budget, net worth, etc.) or allows full customization. (High)

- ✓Daily Account Updates: Fetches latest transactions and balances daily. (Good)

- ✓AutoCat (Categorization Tool): Rule-based system to automate transaction categorization. (Good)

Scorecard (Overall: 6.5 / 10.0)

Pricing

Subscription

$79.00 / Annual

- Automated bank feeds

- Customizable spreadsheet templates

- Daily updates

- Email support

- Community forum

Limitations: Requires user proficiency with spreadsheets, No dedicated mobile app interface for analysis

Pros

- + Ultimate flexibility via spreadsheets

- + Automates data aggregation into a familiar format

- + Leverages powerful spreadsheet functions

- + Good community support and templates

Cons

- - Requires spreadsheet skills and setup effort

- - No built-in planning calculators or specific modules

- - Reliance on Google/Microsoft platforms

- - No dedicated app experience

Verdict

"Ideal for spreadsheet enthusiasts who want automated bank feeds combined with complete control and customization over their financial tracking and analysis."

#8

#8

YNAB (You Need A Budget)

By YNAB

A popular budgeting software focused on the zero-based budgeting method, helping users gain control over their spending.

Platforms & Use Cases

Platforms: Web, iOS, Android, WatchOS, Alexa

Best For: Zero-Based Budgeting, Expense Tracking, Debt Management, Goal Setting, Spending Awareness

Key Features

- ✓Zero-Based Budgeting Method: Assign every dollar a job to maximize intentional spending. (Excellent)

- ✓Goal Tracking: Set financial goals (e.g., saving for a down payment) and track progress. (High)

- ✓Reporting: Visualize spending habits, net worth, and income vs. expense. (Good)

- ✓Account Syncing: Connects to bank accounts for automatic transaction import. (Good)

Scorecard (Overall: 6.7 / 10.0)

Pricing

Subscription

$99.00 / Annual

- Full access to budgeting tools

- Account syncing

- Goal tracking

- Reporting

- Workshops

Limitations: Primarily budgeting, not investment or comprehensive planning

Pros

- + Highly effective budgeting methodology

- + Excellent educational resources and support

- + Clean interface and mobile apps

- + Strong community following

Cons

- - Subscription cost for a budgeting tool

- - Steeper learning curve for the methodology

- - No investment tracking or advanced planning features

Verdict

"Best-in-class for users committed to mastering zero-based budgeting and gaining control over spending, but not suitable for broader financial planning."

#7

#7

Quicken

By Quicken Inc.

Long-standing personal finance software for managing budgets, tracking spending, investments, and basic planning on desktop and mobile.

Platforms & Use Cases

Platforms: Windows, macOS, Web (companion), iOS, Android

Best For: Budgeting, Expense Tracking, Investment Tracking, Bill Management, Basic Retirement Planning, Tax Reporting

Key Features

- ✓Comprehensive Tracking: Tracks banking, credit cards, investments, loans, and assets. (Excellent)

- ✓Budgeting Tools: Detailed budgeting creation and progress monitoring. (High)

- ✓Investment Analysis: Monitors portfolio performance, allocation, and generates tax reports. (Good)

- ✓Lifetime Planner: Basic modeling for retirement and major life goals (Premier/H&B). (Moderate)

Scorecard (Overall: 7.3 / 10.0)

Pricing

Deluxe

$59.88 / Annual

- Budgeting

- Tracking

- Savings Goals

Limitations: Limited investment/planning features

Premier

$83.88 / Annual

- Deluxe features

- Advanced investment tracking

- Tax planning tools

- Lifetime Planner

Limitations: Less sophisticated planning than advisor tools

Home & Business

$119.88 / Annual

- Premier features

- Business expense tracking

- Invoicing

Limitations: Overkill for purely personal finance

Pros

- + Robust tracking of all financial accounts

- + Strong budgeting and reporting features

- + Available on desktop platforms

- + One-time purchase feel with annual subscription for updates/services

Cons

- - Planning tools are relatively basic

- - Interface can feel cluttered

- - Syncing issues can occur

- - Primarily for individual use

Verdict

"A solid choice for individuals wanting detailed tracking and budgeting, especially those preferring desktop software, but limited for deep financial planning."

#6

#6

Orion Planning

By Orion Advisor Solutions

Financial planning software integrated within the broader Orion advisor technology platform, offering goals-based and cash-flow planning.

Platforms & Use Cases

Platforms: Web

Best For: Integrated Financial Planning, Portfolio Management Integration, Goals-Based Planning, Cash Flow Analysis, Client Portal Integration

Key Features

- ✓Platform Integration: Seamlessly connects with Orion's portfolio accounting, reporting, and client portal. (Excellent)

- ✓Dual Planning Engines: Offers both goals-based and cash-flow planning methodologies. (High)

- ✓Proposal Generation: Tools to create compelling client proposals integrating planning outputs. (Good)

- ✓Client Portal: Leverages the unified Orion client portal for plan access and interaction. (Good)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Bundled

Contact Vendor

- Financial Planning module

- Integration with Orion Suite

- Client Portal access

Limitations: Requires subscription to the broader Orion platform, Pricing based on Assets Under Management (AUM) or tiered structure

Pros

- + Deep integration with the popular Orion platform

- + Offers flexibility with both planning approaches

- + Leverages existing Orion data and client portal

- + Constantly evolving features

Cons

- - Best suited for advisors already using Orion

- - May not be as feature-rich in standalone planning as dedicated competitors

- - Platform costs can be significant

Verdict

"A strong choice for advisors already invested in the Orion ecosystem, offering seamless integration and solid planning capabilities."

#5

#5

NaviPlan

By Advicent Solutions

Enterprise-level financial planning software known for its calculation accuracy, cash-flow planning, and suitability for large institutions.

Platforms & Use Cases

Platforms: Web, Desktop (Historically)

Best For: Detailed Cash Flow Planning, Complex Scenario Modeling, Needs Analysis, Retirement Planning, Estate Planning, Enterprise Implementations

Key Features

- ✓Cash-Flow Based Planning: Highly detailed and accurate engine for modeling financial inflows and outflows. (Excellent)

- ✓Needs Analysis: Comprehensive modules for insurance, education, and other specific financial needs. (High)

- ✓Compliance Focus: Features designed to support regulatory compliance within large firms. (High)

- ✓Customization: Offers customization options suitable for enterprise deployments. (Good)

Scorecard (Overall: 7.9 / 10.0)

Pricing

Multiple Tiers

Contact Vendor

- Varies by tier

- Core planning

- Advanced modules

- Reporting

- Integration options

Limitations: Quote-based pricing, Often perceived as more complex, Interface can feel less modern

Pros

- + Industry-leading calculation engine accuracy

- + Strong in detailed cash-flow planning

- + Robust needs analysis features

- + Suitable for large, compliance-focused institutions

Cons

- - Can have a steeper learning curve

- - User interface perceived as less modern than some rivals

- - Pricing can be high

- - Client portal less interactive than competitors

Verdict

"A powerful and accurate planning tool favored by large institutions needing detailed cash-flow analysis and compliance support, though potentially less intuitive for smaller practices."

#4

#4

Empower Personal Dashboard™ (Personal Capital)

By Empower

Free financial dashboard focusing on account aggregation, net worth tracking, investment analysis, and basic retirement planning tools.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Net Worth Tracking, Investment Monitoring, Spending Analysis, Retirement Planning (Basic), Fee Analysis

Key Features

- ✓Account Aggregation: Connects bank, credit card, investment, and loan accounts. (Excellent)

- ✓Investment Checkup: Analyzes portfolio allocation, risk, and identifies hidden fees. (High)

- ✓Retirement Planner: Basic Monte Carlo simulation tool for retirement readiness. (Good)

- ✓Net Worth Tracker: Provides a clear overview of assets and liabilities. (Excellent)

Scorecard (Overall: 8.1 / 10.0)

Pricing

Free Dashboard

Contact Vendor

- Account aggregation

- Net worth tracking

- Budgeting tools

- Investment checkup

- Retirement planner

Limitations: Planning tools are less comprehensive than dedicated software, Frequent prompts for advisory services

Pros

- + Excellent free tool for aggregation and tracking

- + Intuitive interface and mobile apps

- + Useful investment fee analyzer

- + Good high-level overview of finances

Cons

- - Limited depth in financial planning modules

- - Primary goal is lead generation for advisory services

- - Budgeting features less robust than dedicated apps

Verdict

"Outstanding free tool for tracking net worth, investments, and basic retirement outlook, but not a substitute for comprehensive planning software."

#3

#3

MoneyGuidePro

By Envestnet

Goals-based financial planning software widely used by advisors, focused on helping clients visualize and achieve their financial objectives.

Platforms & Use Cases

Platforms: Web

Best For: Goals-Based Planning, Retirement Planning, Investment Strategy, Insurance Analysis, Client Communication

Key Features

- ✓Goals-Based Approach: Frames financial decisions around specific client goals (retirement, college, etc.). (Excellent)

- ✓Play Zone®: Interactive module for clients to explore 'what-if' scenarios. (High)

- ✓Client Presentation Tools: Strong emphasis on clear, engaging visuals for client meetings. (High)

- ✓Integration with Envestnet Ecosystem: Connects seamlessly with other Envestnet tools for portfolio management and reporting. (High)

Scorecard (Overall: 8.4 / 10.0)

Pricing

MoneyGuidePro

$125.00 / Monthly (Per Advisor, Annual Billing available)

- Core goal planning

- Retirement

- Insurance

- Basic Estate

Limitations: Less complex cash-flow based planning than Elite

MoneyGuideElite

$175.00 / Monthly (Per Advisor, Annual Billing available)

- All Pro features

- Advanced lifetime protection

- Total income modeling

- Advanced Estate Planning

Limitations: Higher cost

Pros

- + Excellent for goals-based planning conversations

- + Interactive client tools

- + Widely adopted and well-supported

- + Strong presentation capabilities

Cons

- - Interface can feel slightly dated compared to newest competitors

- - Less emphasis on granular cash-flow analysis than some

- - Primarily web-based

Verdict

"A leading choice for advisors prioritizing goals-based planning and client engagement, particularly strong within the Envestnet ecosystem."

#2

#2

RightCapital

By RightCapital Inc.

Modern financial planning software for advisors known for its user-friendly interface, tax planning capabilities, and competitive pricing.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Retirement Planning, Tax Planning, Investment Analysis, Insurance Needs Analysis, Student Loan Planning, Client Collaboration

Key Features

- ✓Tax-Efficient Planning: Sophisticated tools for modeling Roth conversions, withdrawal strategies, and overall tax impact. (Excellent)

- ✓Interactive Client Portal: Engaging interface for clients with mobile access and task management. (High)

- ✓Ease of Use: Generally considered more intuitive and quicker to learn than some competitors. (High)

- ✓Budgeting Tools: Integrated budgeting features accessible to both advisor and client. (Good)

Scorecard (Overall: 8.9 / 10.0)

Pricing

Basic

$125.00 / Monthly (Per Advisor, Annual Billing available)

- Core planning modules

- Account aggregation

- Client portal

Limitations: Fewer advanced modules than Premium

Premium

$150.00 / Monthly (Per Advisor, Annual Billing available)

- All Basic features

- Advanced tax planning

- Estate planning module

Limitations: May lack some niche features of top-tier competitors

Pros

- + Strong focus on tax planning

- + Intuitive and modern interface

- + Competitive pricing

- + Good mobile access for clients

Cons

- - Reporting options slightly less customizable than some

- - Newer player compared to established giants

Verdict

"Excellent value for advisors seeking robust, modern planning software with standout tax features and a user-friendly design."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

eMoney Advisor

By Fidelity Investments

A comprehensive wealth management platform for financial advisors, offering deep planning capabilities, account aggregation, and a robust client portal.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Comprehensive Financial Planning, Investment Analysis, Retirement Planning, Estate Planning, Client Collaboration, Account Aggregation

Key Features

- ✓Advanced Planning Modules: Covers intricate scenarios including estate, tax, and retirement distribution planning. (High)

- ✓Client Portal: Interactive portal for client access to plans, accounts, and document storage. (High)

- ✓Account Aggregation: Connects with thousands of institutions for a holistic financial view. (Excellent)

- ✓Marketing Tools: Features to help advisors engage clients and prospects. (Good)

Scorecard (Overall: 8.8 / 10.0)

Pricing

Multiple Tiers

Contact Vendor

- Varies by tier (Plus, Pro, Premier)

- Core planning

- Client portal

- Aggregation

- Analytics

Limitations: Quote-based pricing, typically higher cost, Primarily for professional advisors

Pros

- + Extremely comprehensive planning tools

- + Excellent client portal experience

- + Strong integrations and aggregation

- + Good support resources

Cons

- - Expensive compared to some alternatives

- - Can be complex to master

- - Primarily designed for professional advisors

Verdict

"Top-tier choice for advisors needing deep, sophisticated planning capabilities and a premium client experience, albeit at a higher price point."

Final Thoughts

The financial planning software landscape offers diverse tools, from comprehensive advisor platforms like eMoney and RightCapital to powerful individual tracking tools like Empower Personal Dashboard and automated robo-advisors like Wealthfront and Betterment. Advisor platforms excel in depth and customization but come at a higher cost, while individual and robo-advisor tools prioritize ease of use, aggregation, and automated investing. The best choice depends heavily on whether the user is a professional advisor or an individual, and their specific planning needs and budget.