Top Business Bookkeeping Services Comparison

By Unknown Author | Published: 2025-03-30 | Category: Business Bookkeeping Services

About Business Bookkeeping Services

Business bookkeeping services help organizations manage their financial records, track income and expenses, and generate financial reports. This category includes both software solutions for DIY bookkeeping and full-service providers who manage bookkeeping tasks for businesses.

Scoring Criteria

- → Features

- → Ease of Use

- → Pricing

- → Customer Support

- → Scalability

- → Integrations

The Best Business Bookkeeping Services

#10

#10

Bookkeeper360

By Bookkeeper360

A tech-enabled bookkeeping, accounting, and advisory service leveraging platforms like Xero and QuickBooks.

Platforms & Use Cases

Platforms: Web (Proprietary dashboard + QBO/Xero)

Best For: Small Businesses, Medium Businesses, E-commerce Businesses, Businesses seeking integrated advisory services

Key Features

- ✓Dedicated Accounting Team: Access to a team including bookkeepers and accountants. (Core Service)

- ✓Choice of Platform: Services delivered via QuickBooks Online or Xero. (Core)

- ✓Proprietary Reporting Dashboard: Provides real-time KPIs and financial insights. (Core)

- ✓Add-on Services: Offers payroll, tax, CFO advisory, and HR services. (Add-on Service)

- ✓Technology Integrations: Integrates with various business apps (Gusto, Bill.com, etc.). (Core)

Scorecard (Overall: 7.7 / 10.0)

Pricing

Monthly Bookkeeping

$399.00 / Monthly

- Dedicated Bookkeeper

- Monthly Reconciliation

- Financial Reporting

- Choice of QBO or Xero

Limitations: Pricing starts at $399/mo + platform fee, increases with complexity/volume

Weekly Bookkeeping

$549.00 / Monthly

- All Monthly features +

- Weekly Reconciliation

- Enhanced Support

- Accrual Basis Option

Limitations: Pricing starts at $549/mo + platform fee

CFO Advisory

Contact Vendor

- Strategic financial planning

- Budgeting & Forecasting

- Cash Flow Management

Limitations: Custom pricing based on scope

Pros

- + Combines human expertise with technology

- + Leverages leading platforms (QBO/Xero)

- + Proprietary dashboard offers valuable insights

- + Offers a full suite of financial services (payroll, tax, CFO)

Cons

- - Higher cost compared to DIY software or basic services

- - Pricing can increase based on business complexity

- - Requires subscription to underlying platform (QBO/Xero)

Verdict

"A comprehensive outsourced accounting solution ideal for businesses seeking expert support, advanced reporting, and integration with QBO/Xero."

#9

#9

Merritt Bookkeeping

By Merritt Bookkeeping

Ultra-simplified, flat-rate bookkeeping service focused on providing basic monthly reports using QuickBooks Online.

Platforms & Use Cases

Platforms: Web (for communication/reports)

Best For: Very Small Businesses, Businesses needing basic, affordable outsourced bookkeeping, Owners prioritizing simplicity over detailed features

Key Features

- ✓Flat-Rate Pricing: Single low monthly price for core bookkeeping. (Core Service)

- ✓Monthly Reports: Delivers basic P&L and Balance Sheet monthly. (Core Service)

- ✓Use of QuickBooks Online: Performs bookkeeping within a QBO account. (Core)

- ✓Simple Communication: Straightforward communication process. (Core)

Scorecard (Overall: 5.5 / 10.0)

Pricing

Monthly Bookkeeping

$190.00 / Monthly

- Monthly transaction categorization

- Bank/Credit Card Reconciliation

- Monthly Financial Statements (P&L, Balance Sheet)

- Uses QuickBooks Online (client subscription required)

Limitations: Very basic service level, No accounts payable/receivable management, No payroll, inventory, or tax services, Limited communication/support scope

Pros

- + Extremely simple service model

- + Predictable flat-rate pricing

- + Takes basic bookkeeping off owner's hands

- + Uses industry-standard QuickBooks Online

Cons

- - Very limited scope of service

- - Does not handle complex accounting needs

- - Requires separate QBO subscription

- - Not suitable for growing or complex businesses

Verdict

"An affordable, no-frills outsourced bookkeeping option for very small businesses satisfied with basic monthly financial statements."

#8

#8

Sage Accounting

By Sage Group plc

Cloud-based accounting software for small businesses, offering core bookkeeping features at an affordable price point.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small Businesses, Freelancers, Startups

Key Features

- ✓Invoicing: Create, send, and track invoices. (Core)

- ✓Expense Tracking: Connect bank accounts and track expenses. (Core)

- ✓Bank Reconciliation: Match bank transactions with recorded entries. (Core)

- ✓Reporting: Generate basic financial reports. (Core)

- ✓Inventory Management: Basic inventory tracking available (Sage Accounting plan). (Tiered)

Scorecard (Overall: 6.5 / 10.0)

Pricing

Sage Accounting Start

$10.00 / Monthly

- Create & Send Invoices

- Track Payments

- Automatic Bank Reconciliation

Limitations: 1 User, Basic features only

Sage Accounting

$25.00 / Monthly

- All Start features

- Unlimited Users

- Quotes & Estimates

- Cash Flow Forecasting

- Purchase Invoice Management

Pros

- + Very affordable entry point

- + Simple interface for basic tasks

- + Unlimited users on the higher tier plan

Cons

- - Limited features compared to QuickBooks/Xero

- - Fewer integrations available

- - Customer support can be difficult to access

- - Not as scalable for complex businesses

Verdict

"A budget-friendly option for small businesses and freelancers needing fundamental bookkeeping features without complexity."

#7

#7

Pilot

By Pilot.com, Inc.

Bookkeeping, tax, and CFO services specifically designed for startups and growing technology companies.

Platforms & Use Cases

Platforms: Web

Best For: Tech Startups, Venture-Backed Companies, Businesses needing accrual basis accounting, Companies seeking CFO advisory services

Key Features

- ✓Accrual Basis Bookkeeping: Provides GAAP-compliant accrual basis bookkeeping suitable for investors. (Core Service)

- ✓Dedicated Finance Expert: Access to a dedicated account manager and team of finance experts. (Core Service)

- ✓Investor-Ready Financials: Delivers clean, accurate financial statements. (Core Service)

- ✓Tax Preparation & Filing: Handles federal, state, and local business tax filings. (Add-on Service)

- ✓CFO Services: Strategic financial advice, forecasting, and modeling. (Add-on Service)

Scorecard (Overall: 7.7 / 10.0)

Pricing

Core

$599.00 / Monthly

- Accrual Bookkeeping

- Dedicated Account Manager

- Monthly Financial Reports

- Software Platform Access (QuickBooks or Xero)

Limitations: Pricing based on monthly expenses, starts at $599/mo

Select

$849.00 / Monthly

- All Core features +

- Advanced financial support

- Burn rate calculations

- Enhanced reporting

Limitations: Higher starting price based on expenses

Plus (CFO Services)

Contact Vendor

- Strategic financial guidance

- Budgeting & Forecasting

- Investor relations support

Limitations: Custom pricing

Pros

- + Expertise in startup finance and accrual accounting

- + High-touch service with dedicated experts

- + Produces investor-ready financials

- + Scales with company growth, offers CFO services

Cons

- - Premium pricing, expensive for early-stage or smaller businesses

- - Focus primarily on tech/VC-backed companies

- - Less direct control over bookkeeping software

Verdict

"A premium bookkeeping and finance service tailored to the specific needs of well-funded startups and growing tech companies."

#6

#6

Bench

By Bench Accounting

An online bookkeeping service combining proprietary software with a dedicated human bookkeeper.

Platforms & Use Cases

Platforms: Web, iOS

Best For: Small Businesses, Startups, Business owners preferring outsourcing, Businesses needing catch-up bookkeeping

Key Features

- ✓Dedicated Bookkeeper: Each client gets a dedicated team of bookkeepers. (Core Service)

- ✓Monthly Financial Statements: Receive accurate P&L and Balance Sheet monthly. (Core Service)

- ✓Proprietary Software: Simple dashboard to view financials and communicate with bookkeepers. (Core)

- ✓Year-End Tax Package: Provides necessary financial reports for tax filing. (Core Service)

- ✓Catch-Up Bookkeeping: Service available for businesses behind on their books (additional cost). (Add-on Service)

Scorecard (Overall: 7.0 / 10.0)

Pricing

Essential

$299.00 / Monthly (billed annually)

- Dedicated Bookkeeper

- Monthly Bookkeeping

- Year-End Financial Package

- Bench Platform Access

Limitations: Up to 15 bank/cc accounts, No income tax filing

Premium

$499.00 / Monthly (billed annually)

- All Essential features

- Annual Income Tax Filing (partnership/corp)

- Unlimited Support

Pros

- + Takes bookkeeping tasks completely off business owners' plates

- + Dedicated human support

- + Simple, easy-to-understand financial reports

- + Tax filing add-on simplifies year-end

Cons

- - Significantly more expensive than DIY software

- - Limited software features (view-only)

- - Fewer integrations than software platforms

- - Not ideal for businesses wanting hands-on control

Verdict

"A top choice for small business owners who want to fully outsource their bookkeeping to professionals and value human interaction."

#5

#5

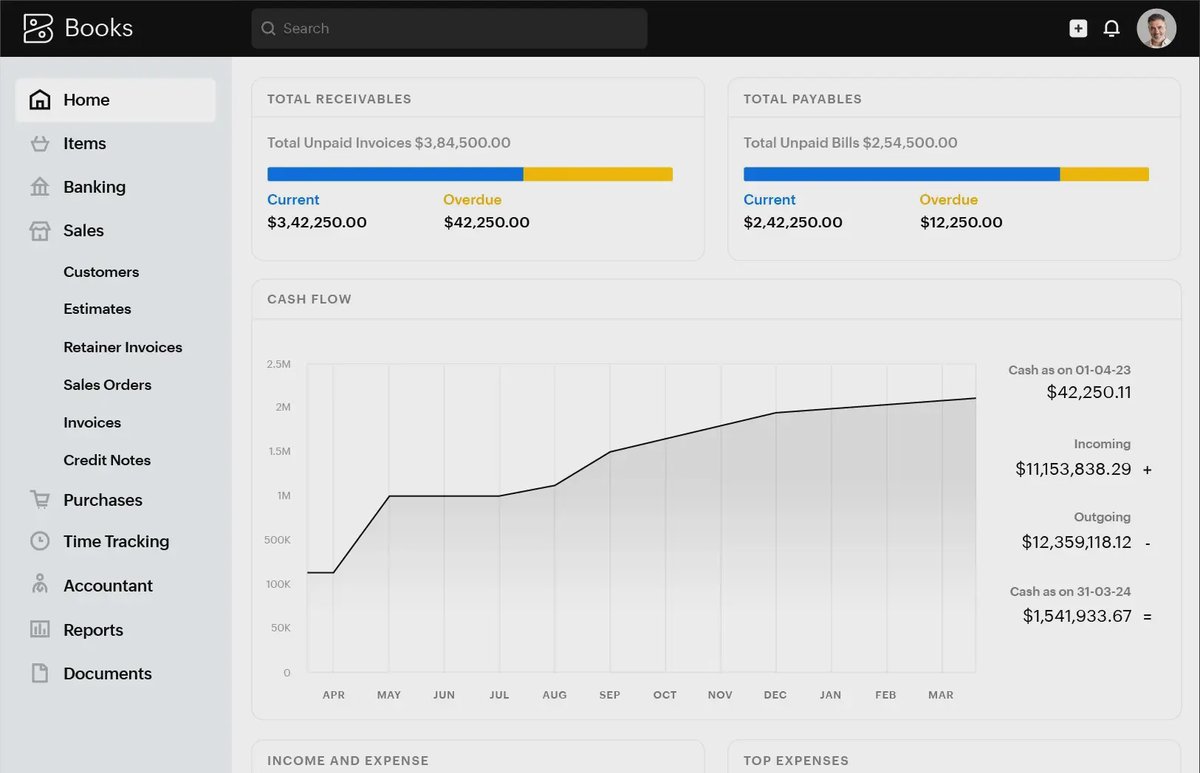

Zoho Books

By Zoho Corporation

Part of the Zoho ecosystem, offering robust cloud accounting with strong automation features and affordable pricing.

Platforms & Use Cases

Platforms: Web, iOS, Android, Windows Phone

Best For: Small Businesses, Medium Businesses, Zoho Suite Users, Global Operations

Key Features

- ✓End-to-End Accounting: Covers invoicing, expense tracking, banking, inventory, and reporting. (Core)

- ✓Workflow Automation: Automate tasks like payment reminders and invoice generation. (Advanced)

- ✓Client & Vendor Portals: Portals for client self-service and vendor communication. (Core)

- ✓Zoho Ecosystem Integration: Seamless integration with Zoho CRM, Projects, Inventory, etc. (Core)

- ✓Inventory Management: Track stock levels, manage SKUs, set reorder points. (Tiered)

Scorecard (Overall: 8.0 / 10.0)

Pricing

Free

Contact Vendor

- Basic Invoicing

- Expense Tracking

- Bank Reconciliation

- Client Portal

Limitations: For businesses with < $50K USD annual revenue, 1 User + 1 Accountant, Limited features

Standard

$20.00 / Monthly

- All Free features +

- Up to 3 Users

- 5000 Invoices

- Bill Tracking

- Project Tracking

Professional

$50.00 / Monthly

- All Standard features +

- Up to 5 Users

- Sales Orders

- Purchase Orders

- Inventory Management

Premium

$70.00 / Monthly

- All Professional features +

- Up to 10 Users

- Custom Domain

- Vendor Portal

- Budgeting

Pros

- + Affordable pricing plans

- + Comprehensive feature set, including automation

- + Strong integration within the Zoho suite

- + Good mobile applications

Cons

- - Interface can feel cluttered for some users

- - Customer support can be slow

- - Best value when using other Zoho products

Verdict

"A powerful and affordable accounting solution, especially attractive for businesses already invested in or considering the Zoho ecosystem."

#4

#4

Wave Accounting

By Wave Financial

Free accounting, invoicing, and receipt scanning software designed for freelancers and very small businesses.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Freelancers, Sole Proprietors, Micro Businesses, Budget-Conscious Startups

Key Features

- ✓Free Accounting: Core accounting features including income/expense tracking and reporting are free. (Core)

- ✓Unlimited Invoicing: Create and send unlimited customized invoices. (Core)

- ✓Receipt Scanning: Mobile app allows for capturing and digitizing receipts. (Core)

- ✓Multiple Businesses: Manage books for multiple businesses under one account. (Core)

- ✓Wave Payments: Optional payment processing (pay-per-use fees apply). (Add-on)

Scorecard (Overall: 6.8 / 10.0)

Pricing

Accounting & Invoicing

Contact Vendor

- Unlimited Income & Expense Tracking

- Unlimited Invoicing

- Unlimited Bank Connections

- Basic Reporting

- Receipt Scanning

Limitations: Limited features compared to paid options, Customer support is primarily self-serve/email, No project tracking or inventory

Payments

Contact Vendor

- Accept credit card and bank payments on invoices.

Limitations: Transaction fees apply (e.g., 2.9% + 60¢ per CC transaction)

Payroll

$20.00 / Monthly

- Payroll processing (base fee + per employee fee, varies by state).

Limitations: Only available in specific regions (US/Canada)

Advisors

$149.00 / Monthly

- Bookkeeping support and coaching services.

Pros

- + Core accounting and invoicing are free

- + Very easy to use

- + Good mobile app for receipts and invoicing

- + Suitable for managing multiple simple businesses

Cons

- - Limited features (no inventory, project tracking)

- - Basic reporting capabilities

- - Customer support is limited for free users

- - Not scalable for growing businesses

Verdict

"The best value option for freelancers and micro-businesses needing basic bookkeeping and invoicing without a subscription cost."

#3

#3

FreshBooks

By FreshBooks

Accounting software focused on freelancers and service-based businesses, excelling in invoicing and time tracking.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Freelancers, Consultants, Service-Based Businesses, Self-Employed Professionals

Key Features

- ✓Professional Invoicing: Create customized invoices, send reminders, and accept online payments. (Core)

- ✓Time Tracking: Track billable hours easily via desktop or mobile app. (Core)

- ✓Expense Tracking: Connect bank accounts, track expenses, and capture receipts. (Core)

- ✓Project Management: Manage projects, collaborate with clients, and track profitability. (Core)

- ✓Client Portal: Clients can view invoices, make payments, and comment. (Core)

Scorecard (Overall: 7.5 / 10.0)

Pricing

Lite

$19.00 / Monthly

- Unlimited Invoices

- Unlimited Expense Tracking

- Time Tracking

Limitations: 5 Billable Clients, No accountant access, Basic reporting

Plus

$33.00 / Monthly

- All Lite features

- Unlimited Billable Clients

- Accountant Access

- Recurring Billing

- Proposals

Premium

$60.00 / Monthly

- All Plus features

- Project Profitability Tracking

- Customized Email Templates

Select

Contact Vendor

- All Premium features

- Dedicated Account Manager

- Lower Credit Card Rates

Limitations: Requires custom quote

Pros

- + Excellent ease of use

- + Strong invoicing and time tracking features

- + Great customer support

- + Good for client collaboration

Cons

- - Limited inventory management

- - Less comprehensive reporting than competitors

- - Can become expensive for larger client bases

Verdict

"Ideal for freelancers and service-based businesses prioritizing ease of use, invoicing, and time tracking over complex accounting features."

#2

#2

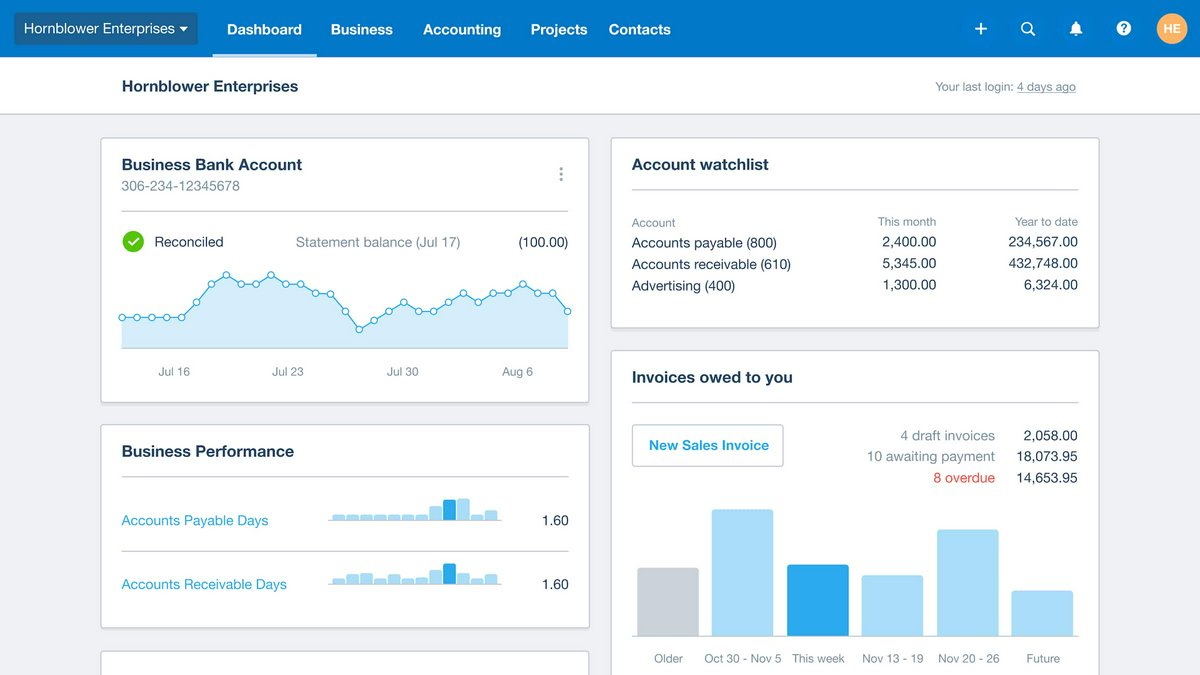

Xero

By Xero Limited

Cloud-based accounting software known for its user-friendly interface, unlimited users, and strong inventory features.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small Businesses, Medium Businesses, E-commerce, Global Businesses

Key Features

- ✓Bank Reconciliation: Automated bank feeds and reconciliation tools. (Core)

- ✓Unlimited Users: All plans include unlimited user access. (Core)

- ✓Inventory Management: Track inventory items, manage stock, and view reports. (Core)

- ✓Project Tracking: Track time and costs for projects (Established plan). (Tiered)

- ✓Multi-currency Support: Handle transactions in multiple currencies (Established plan). (Tiered)

Scorecard (Overall: 8.0 / 10.0)

Pricing

Early

$15.00 / Monthly

- Bank Reconciliation

- Hubdoc Receipt Capture

- Basic Inventory

Limitations: Limited invoices (20/mo), Limited bills (5/mo)

Growing

$42.00 / Monthly

- All Early features

- Unlimited Invoices & Bills

- Bulk Reconcile Transactions

Established

$78.00 / Monthly

- All Growing features

- Multi-currency Support

- Project Tracking

- Expense Claims

Pros

- + Unlimited users on all plans

- + Strong feature set

- + Clean user interface

- + Good integration options

Cons

- - Entry-level plan is quite limited

- - Phone support is not readily available

- - Payroll integration often requires third-party add-ons (like Gusto)

Verdict

"A strong QuickBooks competitor, particularly appealing for businesses needing unlimited users and a slightly more intuitive interface."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

QuickBooks Online

By Intuit

Comprehensive cloud-based accounting software for small to medium-sized businesses with strong reporting and invoicing features.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small Businesses, Medium Businesses, Accountant Collaboration, Inventory Management

Key Features

- ✓Invoicing & Payments: Create custom invoices, accept online payments, and track payment status. (Core)

- ✓Expense Tracking: Connect bank accounts, categorize expenses automatically, and capture receipts. (Core)

- ✓Reporting: Generate detailed financial reports (P&L, Balance Sheet, Cash Flow). (Advanced)

- ✓Inventory Management: Track stock levels, cost of goods sold, and receive low-stock alerts (Plus/Advanced plans). (Tiered)

- ✓Payroll Integration: Optional integrated payroll processing. (Add-on)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Simple Start

$30.00 / Monthly

- Income & Expense Tracking

- Invoicing

- Basic Reporting

- Receipt Capture

Limitations: 1 User, No inventory tracking, Limited reporting

Essentials

$60.00 / Monthly

- All Simple Start features

- Bill Management

- Time Tracking

- 3 Users

Plus

$90.00 / Monthly

- All Essentials features

- Inventory Tracking

- Project Profitability Tracking

- 5 Users

Advanced

$200.00 / Monthly

- All Plus features

- Batch Invoicing

- Custom User Permissions

- Advanced Reporting

- 25 Users

Pros

- + Extensive features

- + Scalable for growing businesses

- + Large integration ecosystem

- + Widely used by accountants

Cons

- - Can be complex for beginners

- - Pricing can add up with payroll and users

- - Customer support quality can vary

Verdict

"A robust and scalable accounting solution ideal for SMBs needing comprehensive features and strong accountant collaboration."

Author information could not be loaded for this review.

Final Thoughts

The business bookkeeping market offers diverse solutions, from powerful DIY software like QuickBooks Online and Xero to fully outsourced services like Bench and Pilot. Software options provide control and integration at varying price points, with Wave offering a compelling free tier. Outsourced services reduce the burden on business owners but come at a higher cost, often tailored to specific needs like startups (Pilot) or simplicity (Merritt).