Top Payroll Providers Comparison

By Sheila Morgan | Published: Current Review | Category: Best Payroll Providers

About Best Payroll Providers

Payroll providers offer software solutions designed to automate and manage employee compensation, including wage calculations, tax withholding and filing, direct deposits, and compliance reporting. These systems streamline payroll processes, reduce errors, and ensure timely and accurate employee payments.

Scoring Criteria

- → Ease of Use

- → Payroll Features

- → HR & Benefits Features

- → Integrations

- → Pricing & Value

- → Customer Support

The Best Best Payroll Providers

#10

#10

Zenefits

By TriNet Zenefits

An HR-centric platform with integrated payroll, focusing on simplifying onboarding, benefits administration, and HR tasks.

Platforms & Use Cases

Platforms: Web-based, Mobile (iOS, Android)

Best For: Small to mid-sized businesses, Companies prioritizing HR and benefits administration, Businesses looking for a strong onboarding experience

Key Features

- ✓HR Platform Core: Strong focus on HRIS, onboarding, performance management, compensation tools. (HR-Focused)

- ✓Integrated Payroll: Payroll module syncs with HR data, time tracking, and benefits. (Add-on Module)

- ✓Benefits Administration: Robust tools for managing health insurance and other benefits (often acts as broker). (Strong)

- ✓Time & Scheduling Tools: Includes time tracking, scheduling, and PTO management. (Integrated)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Essentials

$10.00 / Per employee per month + platform fee

- Core HR (Hiring, Onboarding, Employee records)

- Time & Scheduling

- Integrations

- Mobile App

Growth

$18.00 / Per employee per month + platform fee

- Essentials features

- Compensation Management

- Performance Management

Zen

$27.00 / Per employee per month + platform fee

- Growth features

- Employee Engagement Surveys

- People Hub (Intranet)

Payroll Add-on

$6.00 / Per employee per month (added to base HR plan)

- Full-service payroll

- Automated tax filing

- Direct deposit

- Unlimited pay runs

Pros

- + Strong HR features, particularly onboarding and benefits administration

- + Well-designed user interface

- + Good mobile app

- + Modular approach allows selecting needed HR features

Cons

- - Payroll is an add-on and requires an HR plan subscription

- - Pricing can be higher compared to payroll-first solutions

- - Some users report issues with customer support responsiveness

- - Acquired by TriNet, potential for future changes

Verdict

"A solid HR platform with integrated payroll, best suited for businesses that prioritize HR and benefits management capabilities."

#9

#9

Patriot Payroll

By Patriot Software

Affordable and easy-to-use online payroll software aimed at small businesses, offering basic and full-service options.

Platforms & Use Cases

Platforms: Web-based

Best For: Very small businesses, Budget-conscious companies, Businesses needing simple, core payroll functions

Key Features

- ✓Affordable Pricing: One of the lowest cost options on the market. (Low Cost)

- ✓Choice of Service Levels: Offers Basic Payroll (DIY taxes) and Full Service Payroll (handled taxes). (Flexible)

- ✓Ease of Use: Simple interface designed for business owners without payroll expertise. (High)

- ✓Optional Add-ons: Time tracking and HR software available for additional fees. (Modular)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Basic Payroll

$4.00 / Per employee per month + $10 base fee

- Payroll processing

- Direct deposit or printable checks

- Employee portal

- Payroll reports

- Setup assistance

- Requires user to handle tax filings

Limitations: User responsible for all tax deposits and filings

Full Service Payroll

$4.00 / Per employee per month + $37 base fee

- All Basic features

- Automated tax filings and payments (federal, state, local)

Pros

- + Highly affordable, especially the Basic plan

- + Very easy to learn and use

- + Good customer support reputation

- + Flexible choice between DIY and full-service tax handling

Cons

- - Limited HR features (basic available as add-on)

- - Fewer integrations compared to larger platforms

- - Basic plan requires manual tax handling

- - Interface is functional but less modern

Verdict

"An excellent choice for very small businesses prioritizing affordability and ease of use over extensive features."

#8

#8

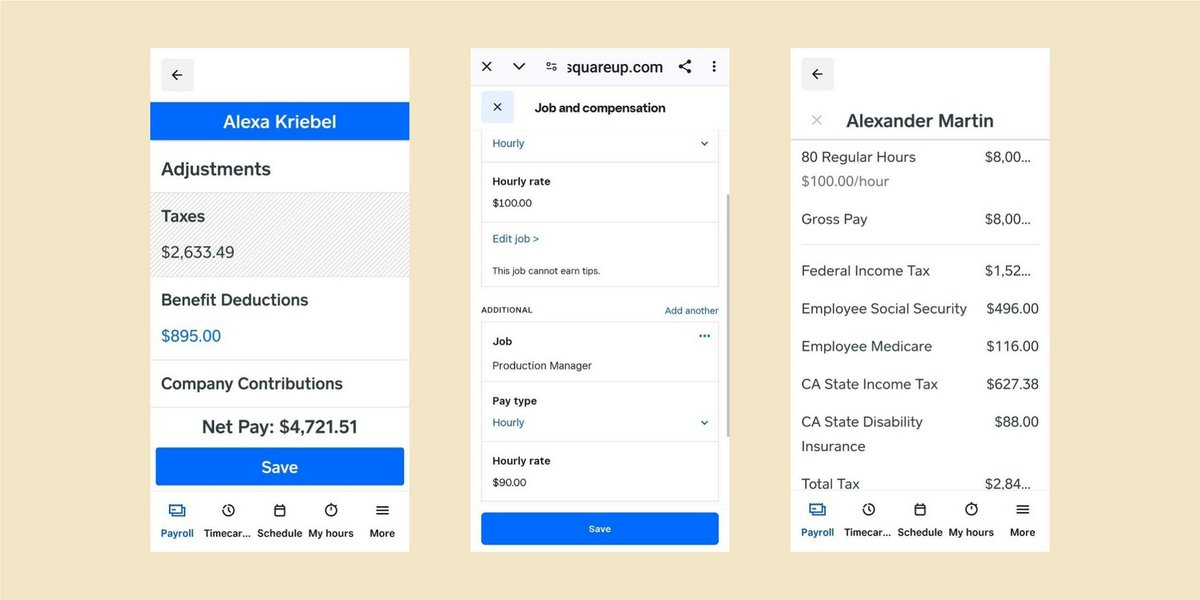

Square Payroll

By Square

Payroll service integrated into the Square ecosystem, ideal for businesses already using Square for payments or point-of-sale.

Platforms & Use Cases

Platforms: Web-based, Mobile (via Square ecosystem apps)

Best For: Retail businesses, Restaurants, Service businesses using Square POS, Paying contractors

Key Features

- ✓Square Ecosystem Integration: Seamlessly works with Square POS, timecards, and other Square tools. (Native)

- ✓Simple Pricing: Clear pricing structure, including a contractor-only plan. (Transparent)

- ✓Full-Service Payroll: Automated tax calculations, payments, and filings. (Included)

- ✓Time Tracking Integration: Syncs with Square Team Management for time tracking. (Built-in)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Pay Employees & Contractors

$6.00 / Per person paid per month + $35 base fee

- Full-service payroll

- Automated tax filings

- Employee self-service

- Multiple pay rates

- Time tracking integration

- Benefits admin (partners)

Pay Contractors Only

$6.00 / Per contractor paid per month (no base fee)

- Unlimited contractor payments

- 1099-NEC filing

- Direct deposit

Pros

- + Excellent integration for existing Square users

- + Very simple and transparent pricing

- + Easy to use, especially for simple payroll needs

- + Good option for businesses paying mostly contractors

Cons

- - Limited HR and benefits administration features

- - Reporting capabilities are basic

- - Customer support can be difficult to reach

- - Less suitable for businesses not using other Square products

Verdict

"A great, simple payroll solution for businesses already using the Square platform, particularly those in retail or services."

#7

#7

OnPay

By OnPay

Full-service payroll and basic HR solution designed for small businesses, offering a single, comprehensive plan with transparent pricing.

Platforms & Use Cases

Platforms: Web-based

Best For: Small businesses, Businesses in specific industries (e.g., restaurants, farms - specialized features), Companies wanting straightforward pricing

Key Features

- ✓All-Inclusive Plan: One plan includes full-service payroll, multi-state filing, tax payments, and basic HR tools. (Simple Pricing)

- ✓Industry Specializations: Features tailored for industries like agriculture, restaurants, non-profits. (Niche Support)

- ✓HR Tools Included: Onboarding, offer letters, PTO tracking, compliance resources. (Built-in)

- ✓Integrations: Integrates with popular accounting and time tracking software. (Good Selection)

Scorecard (Overall: 8.4 / 10.0)

Pricing

All-Inclusive

$6.00 / Per employee per month + $40 base fee

- Full-service payroll (all 50 states)

- Automated tax filings & payments

- Unlimited payroll runs

- Employee self-service

- Integrated HR tools (onboarding, PTO)

- Benefits integration support

- Multi-state payroll included

Limitations: HR features are basic compared to larger HCM suites, Mobile app functionality is limited compared to some competitors

Pros

- + Simple, transparent, all-inclusive pricing

- + Easy-to-use interface

- + Handles multi-state payroll at no extra cost

- + Good customer support

- + Specialized features for certain industries

Cons

- - HR tools are relatively basic

- - Benefits administration is more focused on integration than built-in brokering

- - Less scalable for very large enterprises

Verdict

"An excellent value proposition for small businesses needing straightforward, full-service payroll with basic HR tools and transparent pricing."

#6

#6

Paylocity

By Paylocity

A comprehensive HCM suite focusing on payroll, HR, talent management, and employee experience, targeted mainly at mid-market companies.

Platforms & Use Cases

Platforms: Web-based, Mobile (iOS, Android)

Best For: Mid-sized businesses, Companies needing robust HR and talent tools, Organizations focusing on employee engagement

Key Features

- ✓Payroll & Tax Services: Accurate payroll processing, tax filing, compliance management. (Comprehensive)

- ✓Human Capital Management (HCM): Includes HR, benefits admin, time & labor, talent acquisition, performance management. (Extensive Suite)

- ✓Employee Engagement Tools: Features like community forums, peer recognition, surveys. (Integrated)

- ✓Data Insights: Analytics and reporting across the HCM spectrum. (Robust)

Scorecard (Overall: 8.1 / 10.0)

Pricing

Custom Bundles

Contact Vendor

- Payroll

- HRIS

- Benefits Administration

- Time & Labor

- Talent Management modules

- Bundled based on company needs

Limitations: No transparent pricing, Can be complex

Pros

- + Comprehensive HCM suite with strong feature depth

- + Good focus on employee experience and engagement

- + Well-regarded customer support

- + Scalable for growing mid-market companies

Cons

- - Pricing is not transparent and typically higher

- - Can be complex to implement and navigate all features

- - Primarily targeted at mid-market, may be too much for small businesses

Verdict

"A strong contender for mid-sized businesses needing a full HCM suite with robust payroll and a focus on employee engagement."

#5

#5

Rippling

By Rippling

A modern, unified workforce platform that combines HR, IT, and Finance, including a powerful payroll module.

Platforms & Use Cases

Platforms: Web-based, Mobile (iOS, Android)

Best For: Tech startups, Mid-sized businesses, Companies needing integrated HR, IT, and payroll, Global companies

Key Features

- ✓Unified Platform: Connects employee data across HR, IT (app provisioning, device management), and Finance (payroll, expenses). (Highly Integrated)

- ✓Global Payroll: Capabilities to pay employees and contractors internationally. (Available)

- ✓Automation Workflows: Build custom workflows triggered by employee events (e.g., onboarding triggers app provisioning). (Powerful)

- ✓Time & Attendance: Integrated time tracking tools that sync directly with payroll. (Integrated)

Scorecard (Overall: 8.6 / 10.0)

Pricing

Rippling Unity Platform

$8.00 / Per user per month (starting price, modules extra)

- Core platform (Employee Directory, Basic Reporting, Permissions)

- Payroll is an add-on module (additional cost)

- Other modules (HR Cloud, IT Cloud, Finance Cloud) priced separately

Limitations: Modular pricing can add up, Requires using the core platform

Pros

- + Truly unified platform connecting HR, IT, and Finance

- + Modern, intuitive user interface

- + Strong automation capabilities

- + Excellent for managing app provisioning and device management alongside HR/payroll

- + Global payroll capabilities

Cons

- - Pricing is modular and can become expensive depending on needed features

- - Might be overkill for very small businesses needing only basic payroll

- - Relatively newer compared to ADP/Paychex, though well-established

Verdict

"A cutting-edge platform ideal for tech-savvy businesses, especially mid-sized ones, looking for a unified solution beyond just payroll and HR."

#4

#4

QuickBooks Payroll

By Intuit

Payroll solution integrated directly within the QuickBooks accounting software ecosystem, ideal for existing QuickBooks users.

Platforms & Use Cases

Platforms: Web-based (within QuickBooks Online), Mobile (via QuickBooks apps)

Best For: Small businesses already using QuickBooks Online, Companies prioritizing accounting integration, Self-employed individuals needing simple payroll

Key Features

- ✓Seamless QuickBooks Integration: Payroll data automatically syncs with QuickBooks accounting. (Native)

- ✓Automated Payroll & Taxes: Calculates paychecks, federal and state taxes, and handles filings. (Automated (Tier-dependent))

- ✓Direct Deposit: Offers next-day or same-day direct deposit options. (Fast Options Available)

- ✓Basic HR Support: Includes employee self-service, workers' comp admin, basic HR advisory (higher tiers). (Included (Tier-dependent))

Scorecard (Overall: 8.0 / 10.0)

Pricing

Core

$5.00 / Per employee per month + $45 base fee

- Full-service payroll

- Automated taxes & forms (limited)

- Next-day direct deposit

- Employee portal

Premium

$8.00 / Per employee per month + $80 base fee

- Core features

- Same-day direct deposit

- Automated tax filing (federal & state)

- Workers' comp admin

- HR support center access

- Time tracking via QuickBooks Time

Elite

$10.00 / Per employee per month + $125 base fee

- Premium features

- Expert setup review

- Tax penalty protection

- Personal HR advisor

- 24/7 expert product support

Pros

- + Excellent integration with QuickBooks accounting

- + Relatively easy to use, especially for existing QB users

- + Competitive pricing for basic payroll needs

- + Fast direct deposit options

Cons

- - HR features are less robust than dedicated HR platforms

- - Best value proposition is primarily for existing QuickBooks customers

- - Customer support quality can be inconsistent

- - Full tax automation only available on higher tiers

Verdict

"The best choice for businesses already embedded in the QuickBooks ecosystem needing streamlined payroll and accounting."

#3

#3

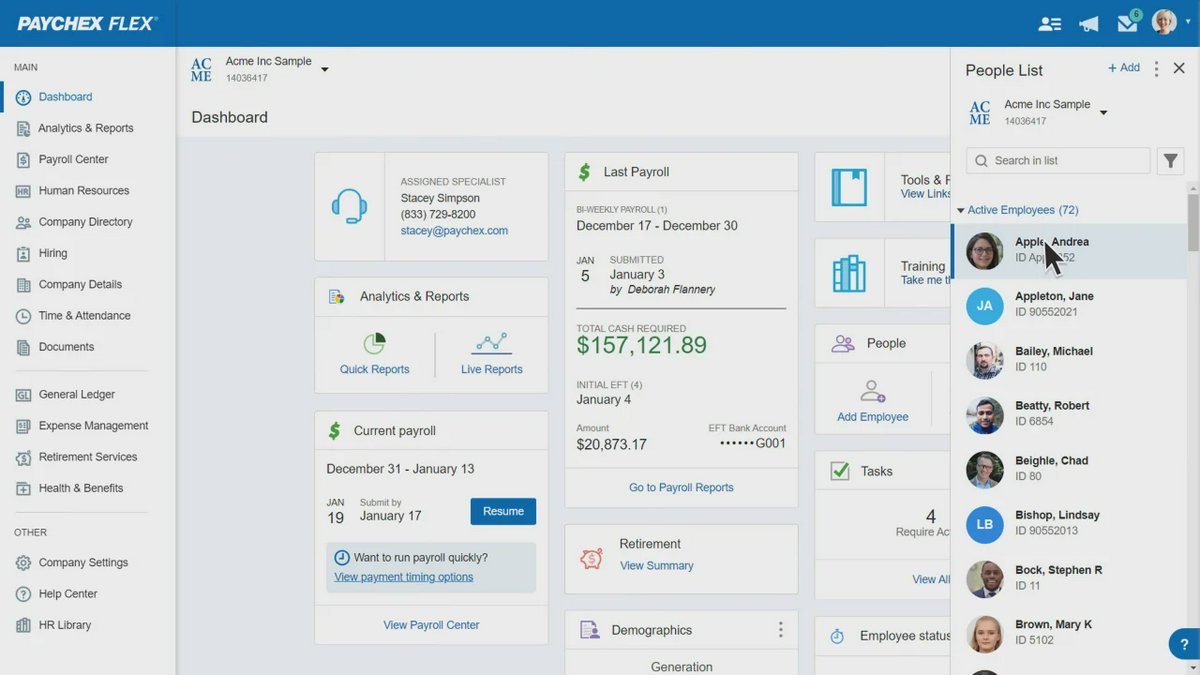

Paychex Flex

By Paychex

A scalable, cloud-based platform offering payroll, HR, and benefits solutions, suitable for small businesses to larger enterprises.

Platforms & Use Cases

Platforms: Web-based, Mobile (iOS, Android)

Best For: Small to large businesses, Companies needing integrated HR and benefits, Organizations requiring dedicated support options

Key Features

- ✓Flexible Payroll Processing: Online and mobile payroll submission, direct deposit, paper checks, paycards. (Versatile)

- ✓Tax Services: Automatic calculation, payment, and filing of federal, state, and local payroll taxes. (Comprehensive)

- ✓HR Administration: Onboarding, performance management, HR records, compliance resources. (Integrated)

- ✓Dedicated Support: Access to payroll specialists for support (often dedicated). (Available)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Paychex Flex Essentials

$6.00 / Per employee per month + $39 base fee

- Online Payroll Processing

- Tax Services

- Direct Deposit/Paycards

- Standard Reporting

- Employee Self-Service

Limitations: Limited HR features

Paychex Flex Select

Contact Vendor

- Essentials features

- Dedicated Payroll Specialist

- More HR features (e.g., onboarding)

- Learning Management System access

Paychex Flex Pro

Contact Vendor

- Select features

- Workers' Comp Reporting

- State Unemployment Insurance (SUI) service

- Integrated HR administration tools

Pros

- + Scalable platform suitable for growing businesses

- + Strong customer support reputation, often with dedicated specialists

- + Comprehensive suite of HR and payroll features

- + Good mobile app functionality

Cons

- - Pricing becomes quote-based quickly and can lack transparency

- - Interface may feel slightly dated compared to some competitors

- - Add-on costs for various modules can increase total expense

Verdict

"A solid, scalable choice particularly strong in customer support and suitable for businesses planning to grow and needing integrated HR services."

#2

#2

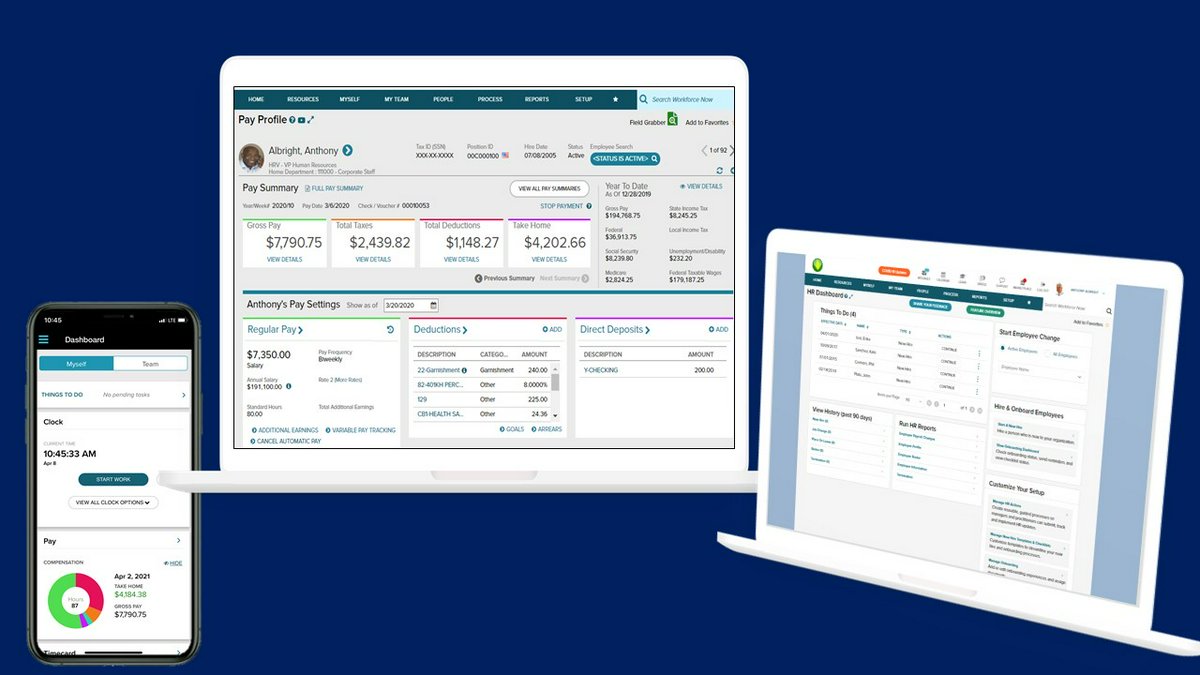

ADP Run / Workforce Now

By ADP

Scalable payroll and HR solutions from a major industry player, offering different products (RUN for small businesses, Workforce Now for mid-to-large) with extensive features.

Platforms & Use Cases

Platforms: Web-based, Mobile (iOS, Android)

Best For: Small businesses (RUN), Mid-sized to large enterprises (Workforce Now), Companies needing robust compliance support, Businesses seeking comprehensive HCM suite

Key Features

- ✓Comprehensive Payroll: Handles complex payroll scenarios, multi-state processing, tax filing, garnishments. (Robust)

- ✓HR Suite: Includes HR management, talent acquisition, benefits administration, time & attendance. (Extensive (Modular))

- ✓Compliance Expertise: Strong focus on regulatory compliance, tax support, and HR legal resources. (High)

- ✓Reporting & Analytics: Advanced reporting capabilities for payroll, HR, and workforce insights. (Detailed)

Scorecard (Overall: 8.3 / 10.0)

Pricing

Multiple Tiers (RUN & Workforce Now)

Contact Vendor

- Vary significantly by package

- Core Payroll

- Tax Filing

- Direct Deposit

- HR Tools (optional/tiered)

- Benefits Admin (optional/tiered)

- Time Tracking (optional/tiered)

Limitations: Pricing not transparent, Can be complex to navigate packages

Pros

- + Highly scalable solutions for businesses of all sizes

- + Comprehensive feature set covering payroll, HR, benefits, talent

- + Strong compliance and tax support

- + Extensive reporting capabilities

Cons

- - Pricing is quote-based and often perceived as expensive

- - Interface can be less intuitive than newer competitors

- - Customer service experiences can be inconsistent

- - Multiple product lines (RUN vs WFN) can be confusing

Verdict

"A powerful, scalable solution for businesses needing robust payroll and comprehensive HR, especially mid-sized and larger companies prioritizing compliance."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Gusto

By Gusto

An intuitive, all-in-one platform focusing on payroll, benefits, and HR for small to medium-sized businesses, known for its user-friendly interface.

Platforms & Use Cases

Platforms: Web-based, Mobile (iOS, Android)

Best For: Small businesses, Startups, Businesses seeking simple HR/Benefits integration

Key Features

- ✓Full-Service Payroll: Automated payroll processing, tax calculation, filing, and payments across all 50 states. (Automated)

- ✓Employee Self-Service: Portal for employees to access pay stubs, W-2s, and manage personal information. (Included)

- ✓Benefits Administration: Integrated health benefits, 401(k), workers' comp administration. (Integrated)

- ✓HR Tools: Onboarding, time tracking, PTO management, compliance assistance. (Available)

Scorecard (Overall: 8.6 / 10.0)

Pricing

Simple

$6.00 / Per employee per month + $40 base fee

- Full-service single-state payroll

- Employee self-service

- Basic hiring & onboarding

- Integrations

Plus

$12.00 / Per employee per month + $80 base fee

- All Simple features

- Multi-state payroll

- Next-day direct deposit

- Advanced hiring & onboarding

- PTO management

- Time tracking

Premium

Contact Vendor

- All Plus features

- Dedicated support

- HR Resource Center

- Compliance alerts

- Full-service payroll migration

Pros

- + Extremely user-friendly interface

- + Transparent pricing for lower tiers

- + Strong integration of payroll, basic HR, and benefits

- + Good employee self-service portal

Cons

- - Can become expensive for larger businesses

- - Advanced HR features might be limited compared to dedicated HCM platforms

- - Customer support responsiveness can vary

Verdict

"Excellent choice for small businesses prioritizing ease of use and integrated payroll/HR basics."

Final Thoughts

The payroll provider landscape offers diverse options, from simple, affordable solutions for small businesses to comprehensive Human Capital Management suites for larger enterprises. Key differentiators include ease of use, breadth of HR and benefits features, integration capabilities (especially with accounting or HRIS), pricing models, and customer support quality. Leading providers often balance robust payroll functionality with user-friendly interfaces and scalable feature sets.