Top 8 Accounts Payable Automation Software Comparison

By Unknown Author | Published: 2024-10-27 | Category: Accounts Payable Automation Software Ap

About Accounts Payable Automation Software Ap

Accounts Payable (AP) Automation software streamlines and automates the process of receiving, processing, approving, and paying vendor invoices. These tools reduce manual data entry, improve accuracy, enhance control over spending, and accelerate payment cycles.

Scoring Criteria

- → Feature Set

- → Ease of Use

- → Integration Capabilities

- → Customer Support

- → Pricing & Value

The Best Accounts Payable Automation Software Ap

#8

#8

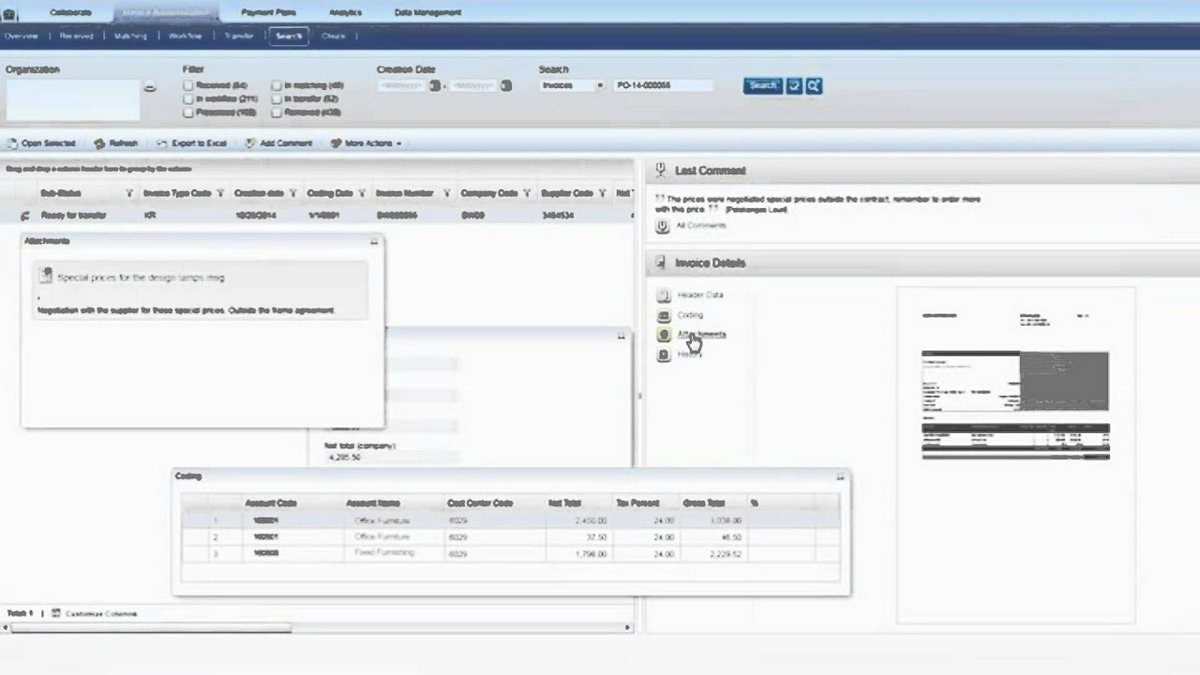

Medius AP Automation

By Medius

Cloud-based AP automation solution focused on efficient invoice processing, workflow automation, and strong ERP integration.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Mid-market to Enterprise, Manufacturing, Retail, Companies seeking strong workflow capabilities

Key Features

- ✓Invoice Capture: AI-driven data capture from various invoice formats. (High Accuracy)

- ✓Touchless Processing: Automated matching and coding for straight-through processing. (Efficiency Focused)

- ✓Workflow Automation: Flexible and powerful engine for complex approval routing. (Customizable)

- ✓ERP Integration: Pre-built connectors and robust integration framework for various ERPs. (Broad Compatibility)

- ✓Analytics: Provides dashboards and reports for process monitoring and optimization. (Performance Tracking)

Scorecard (Overall: 8.6 / 10.0)

Pricing

Custom

Contact Vendor

- Modules selected based on customer needs (AP, Procurement, Payments, etc.)

Limitations: Pricing requires consultation

Pros

- + Strong focus on touchless invoice processing

- + Powerful workflow automation capabilities

- + User-friendly interface for its feature depth

- + Good integration support

Cons

- - Pricing not transparent

- - Can be complex depending on chosen modules

- - Payment features may require separate modules/partners

Verdict

"A strong contender for mid-market and enterprise customers needing robust, efficient AP workflow automation with good ERP connectivity."

#7

#7

Basware AP Automation

By Basware

Enterprise-grade procure-to-pay (P2P) suite with robust AP automation capabilities and a large global e-invoicing network.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Large Enterprise, Global Corporations, Complex P2P requirements, Supply Chain Finance

Key Features

- ✓E-Invoicing Network: One of the largest open business networks for electronic invoice exchange. (Global Reach)

- ✓AP Automation: Advanced invoice capture (AI/ML), matching (2/3/4-way), and workflow automation. (Highly Configurable)

- ✓Procurement: Integrated e-procurement functionality for spend control. (Full P2P)

- ✓Analytics & Reporting: Deep insights into spending patterns and process efficiency. (Actionable Data)

- ✓Global Compliance: Supports various international invoicing regulations. (Compliance Focused)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Enterprise Custom

Contact Vendor

- Full P2P suite tailored to enterprise needs

Limitations: Complex pricing model

Pros

- + Comprehensive procure-to-pay solution

- + Extensive global e-invoicing network

- + Highly scalable and configurable

- + Strong analytics capabilities

Cons

- - Can be very complex to implement and use

- - Expensive, targeting large enterprises

- - Interface may feel less intuitive than newer solutions

Verdict

"A powerful, albeit complex, solution for large global enterprises needing end-to-end P2P automation and e-invoicing."

#6

#6

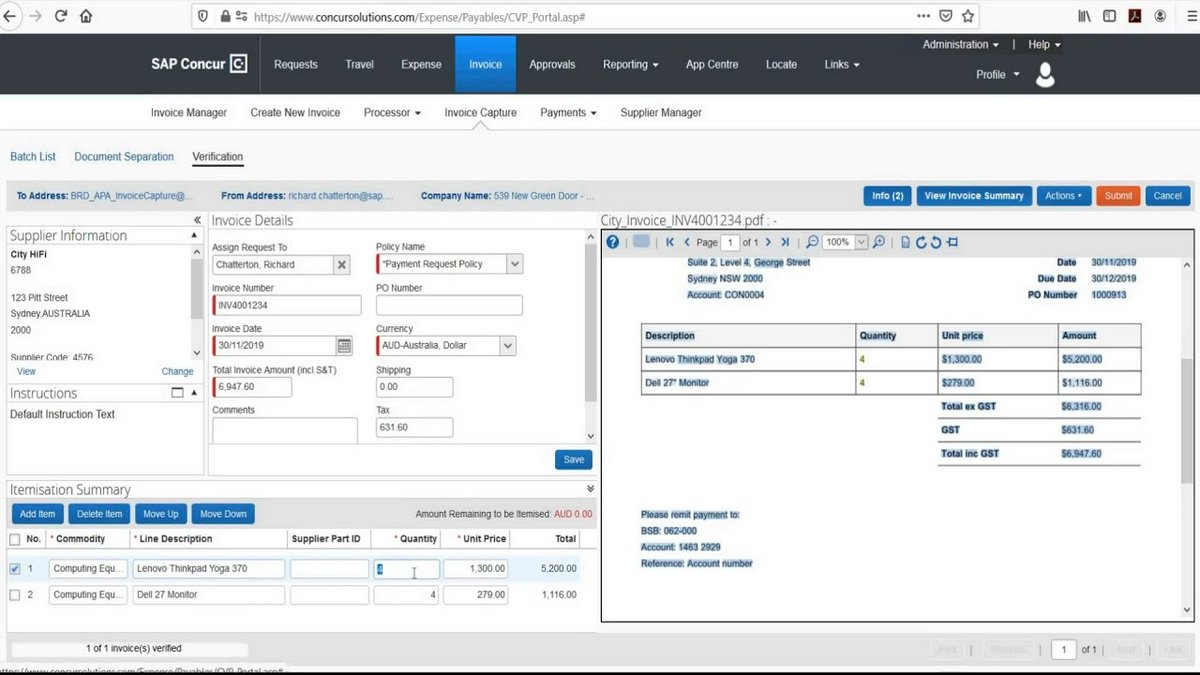

Concur Invoice

By SAP Concur

Invoice management solution integrated within the broader SAP Concur platform for travel, expense, and invoice.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Enterprise, Companies using SAP ERP, Organizations already using Concur Expense/Travel

Key Features

- ✓Invoice Capture: OCR and machine learning for extracting invoice data. (Integrated Capture)

- ✓Workflow Automation: Configurable approval workflows and exception handling. (Rule-based)

- ✓Integration with Concur Expense/Travel: Seamless data flow within the Concur ecosystem. (Platform Synergy)

- ✓SAP Integration: Native integration with SAP ERP systems. (Key Benefit for SAP users)

- ✓Reporting & Analytics: Visibility into invoice status and AP metrics. (Standard Reporting)

Scorecard (Overall: 8.1 / 10.0)

Pricing

Standard

Contact Vendor

- Core invoice management features

Limitations: Based on transaction volume

Professional

Contact Vendor

- Enhanced features, configurations, and integrations

Limitations: Higher volume/complexity

Pros

- + Strong integration with SAP ecosystem

- + Part of a unified T&E and Invoice platform

- + Scalable for large enterprises

- + Established vendor

Cons

- - User interface can be complex/dated

- - Can be expensive

- - Best suited for existing Concur/SAP customers

- - Customer support critiques

Verdict

"Most suitable for large enterprises already invested in the SAP or SAP Concur ecosystem seeking an integrated invoice solution."

#5

#5

AvidXchange

By AvidXchange

AP automation and payment solution with a large supplier network, strong in specific industries like real estate.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Mid-market to Enterprise, Real Estate, Construction, Financial Services, HOAs

Key Features

- ✓Invoice Automation: Automated invoice capture, management, and approval workflows. (Industry Tailored)

- ✓Payment Automation: Multiple electronic payment methods through the AvidPay Network. (Large Network)

- ✓Purchase Order Automation: Manages PO creation, approval, and 2/3-way matching. (PO Focus)

- ✓Supplier Network: Access to a large network of suppliers preferring electronic payments. (Over 700k Suppliers)

- ✓Industry Specialization: Specific workflow and integration capabilities for target verticals. (Deep Expertise)

Scorecard (Overall: 8.3 / 10.0)

Pricing

Custom

Contact Vendor

- Tailored based on invoice volume, features, and integrations

Limitations: Pricing complexity

Pros

- + Strong industry-specific solutions

- + Large supplier payment network

- + Robust payment automation

- + Good integration portfolio

Cons

- - Can feel less modern than some competitors

- - Pricing is opaque

- - Some users report usability challenges

Verdict

"A leading choice for mid-market companies in specialized industries like real estate, benefiting from its large supplier network."

#4

#4

Airbase

By Airbase

Comprehensive spend management platform combining AP automation, corporate cards, and expense reimbursements.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Mid-market Tech Companies, Startups, Consolidated Spend Management, Companies needing integrated cards/expenses

Key Features

- ✓Guided Procurement: Manages purchase requests before spending occurs. (Pre-approval Control)

- ✓Bill Payments: Automates invoice intake, approvals, and payments (ACH, check, virtual card, international). (Integrated AP)

- ✓Corporate Cards: Physical and virtual cards with built-in controls and automated reconciliation. (Expense Control)

- ✓Expense Reimbursements: Streamlines employee expense reporting and reimbursement. (Employee Focused)

- ✓Real-time Reporting: Consolidated view of all company spending. (Visibility)

Scorecard (Overall: 8.6 / 10.0)

Pricing

Standard

Contact Vendor

- Core spend management platform for smaller companies

Limitations: Feature caps

Premium

Contact Vendor

- Full suite for mid-market companies

Limitations: Higher volume focus

Enterprise

Contact Vendor

- Advanced features, multi-entity

Limitations: Custom pricing

Pros

- + Unified platform for all non-payroll spend

- + Strong controls and visibility

- + Modern interface

- + Integrated corporate cards

Cons

- - Primarily focused on tech/modern companies

- - Pricing not transparent

- - May be overly complex if only AP is needed

Verdict

"Excellent for companies seeking a single platform to manage AP, corporate cards, and expenses proactively."

#3

#3

BILL

By BILL Holdings, Inc.

Widely used AP/AR automation platform popular with SMBs, offering streamlined invoice processing and domestic payments.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Small to Medium Businesses (SMBs), US Domestic Payments, Integration with QuickBooks/Xero

Key Features

- ✓Invoice Capture & Coding: Email-based invoice submission and automated data entry (OCR/AI). (Multiple Methods)

- ✓Approval Workflows: Customizable approval rules and routing. (Standard)

- ✓Payment Processing: Multiple payment options (ACH, check, virtual card, international wires). (Flexible)

- ✓Accounting Software Sync: Strong two-way sync with popular accounting systems. (Key Strength)

- ✓Accounts Receivable: Includes AR features for invoicing customers and receiving payments. (Dual Functionality)

Scorecard (Overall: 8.6 / 10.0)

Pricing

Essentials

$45.00 / per user/month

- Core AP/AR

- Standard Approvals

- Basic Sync

Limitations: Limited users, Basic features

Team

$55.00 / per user/month

- Custom User Roles

- Enhanced Sync Options

Limitations: Higher cost per user

Corporate

$79.00 / per user/month

- Advanced AP Automation

- Multi-entity support option

Limitations: Targeted at larger SMBs

Enterprise

Contact Vendor

- API Access

- Advanced Controls

Limitations: Quote-based

Pros

- + User-friendly interface

- + Excellent integration with SMB accounting software

- + Large payment network

- + Includes AR functionality

Cons

- - Per-user pricing can get expensive

- - International payments can be costly

- - Customer support reviews are mixed

Verdict

"A strong choice for SMBs, particularly those using QuickBooks or Xero and focusing primarily on domestic AP/AR."

#2

#2

Stampli

By Stampli

AI-powered AP automation focused on invoice processing, communication, and collaboration within the AP workflow.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Mid-market, Companies needing strong collaboration tools, Complex approval workflows

Key Features

- ✓Billy the Bot™ AI: Automates invoice capture, coding, approval routing, and fraud detection. (Core AI Feature)

- ✓Centralized Communication: Invoice-centric communication hub keeps all conversations, documents, and activities together. (Contextual)

- ✓Flexible Approval Workflows: Supports complex, multi-step, conditional approval processes. (Highly Customizable)

- ✓ERP Integration: Deep integrations with major ERP and accounting systems. (Seamless Sync)

- ✓Stampli Card: Integrated corporate card providing control over spending. (Optional Add-on)

Scorecard (Overall: 8.9 / 10.0)

Pricing

Custom

Contact Vendor

- Based on invoice volume and features needed

Limitations: Pricing not publicly listed

Pros

- + Intuitive user interface

- + Excellent collaboration features

- + Powerful AI for automation

- + Fast implementation time

Cons

- - Pricing not transparent

- - Payment features might be less robust than dedicated payment platforms

Verdict

"Ideal for organizations prioritizing ease of use, communication clarity, and efficient invoice processing with complex approvals."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Tipalti

By Tipalti

End-to-end global AP automation platform with strong payment capabilities, supplier management, and tax compliance features.

Platforms & Use Cases

Platforms: Web, Mobile

Best For: Mid-market to Enterprise, Global Payments, Companies with large supplier bases, Royalty Payments, Influencer Payments

Key Features

- ✓Invoice Management: Automated invoice capture (OCR), coding, and approval workflows. (AI-powered)

- ✓Global Payments: Supports payments in 196 countries and 120+ currencies via multiple methods. (Extensive Coverage)

- ✓Supplier Management: Self-service supplier onboarding portal with automated validation. (Reduces admin)

- ✓Tax Compliance: Collects and validates W-9, W-8 forms, generates 1099/1042-S reports. (Built-in)

- ✓Multi-Entity Support: Manages AP across multiple subsidiaries or business units. (Consolidated View)

Scorecard (Overall: 8.8 / 10.0)

Pricing

Platform Fee

$149.00 / monthly

- Core AP Automation

- Supplier Portal

- Basic Integrations

Limitations: Transaction fees apply, Advanced features extra

Pros

- + Comprehensive end-to-end solution

- + Excellent global payment capabilities

- + Strong tax compliance features

- + Scalable for growth

Cons

- - Can be expensive for smaller businesses

- - Implementation can be complex

Verdict

"Best for businesses with complex, high-volume global payment needs and stringent compliance requirements."

Author information could not be loaded for this review.

Final Thoughts

The AP Automation market offers a range of solutions, from SMB-focused tools like BILL to comprehensive enterprise P2P suites like Basware and specialized platforms like Tipalti (global payments) and AvidXchange (industry focus). Stampli stands out for its collaborative features and AI, while Airbase provides a unified spend management approach. Medius offers robust workflow automation, and SAP Concur Invoice is a natural fit for existing SAP users.