Top 10 AP Automation Platforms Reviewed

By Richard "Rick" Callahan | Published: 2024-10-27 | Category: Accounts Payable Automation Software

About Accounts Payable Automation Software

Accounts payable (AP) automation software streamlines and automates the process of managing supplier invoices and making payments. It helps organizations reduce manual data entry, improve accuracy, accelerate approvals, and enhance financial controls.

Scoring Criteria

- → Feature Set

- → Ease of Use

- → Integration Capabilities

- → Customer Support

- → Value for Money

The Best Accounts Payable Automation Software

#10

#10

Yooz

By Yooz Inc.

Cloud-based AP automation solution leveraging AI and machine learning for invoice processing and approval workflows.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Invoice Data Capture, Automated Approval Workflows, Duplicate Detection, Integration with Accounting Software

Key Features

- ✓Smart Data Extraction: AI-powered OCR capable of capturing line-level detail. (Accurate Capture)

- ✓Dynamic Approval Workflow: Customizable workflows based on various criteria. (Flexible Routing)

- ✓Search & Reporting: Advanced search capabilities and standard AP reports. (Visibility)

- ✓Seamless Integration: Connectors for over 250 ERP and accounting systems. (Broad Compatibility)

Scorecard (Overall: 7.6 / 10.0)

Pricing

Custom

Contact Vendor

- Unlimited Users

- AI Data Capture

- Approval Workflows

- Search & Export

- Standard Integrations

- Basic Reporting

Limitations: Pricing based primarily on invoice volume, Requires custom quote

Pros

- + Strong AI/OCR capabilities

- + User-friendly interface

- + Competitive pricing structure often based on volume, not users

- + Wide range of integrations

Cons

- - Payment functionality may be less robust than some competitors

- - Customer support experiences can vary

- - Advanced reporting might require higher tiers or customization

Verdict

"A solid, user-friendly AP automation choice with strong data capture technology, offering good value especially for companies with high invoice volumes rather than many users."

#9

#9

Medius

By Medius

Enterprise-focused source-to-pay platform including robust AP automation capabilities with strong integration potential.

Platforms & Use Cases

Platforms: Web

Best For: Global AP Automation, Invoice Processing, PO Matching, Supplier Management, Source-to-Pay Suite

Key Features

- ✓Touchless Invoice Processing: AI-driven data capture and matching aiming for high automation rates. (Efficiency at Scale)

- ✓Advanced Workflow Engine: Handles complex approval rules and exceptions. (Enterprise Control)

- ✓Strong ERP Integration: Pre-built connectors and experience with major ERPs (SAP, Oracle, Dynamics). (Seamless Connectivity)

- ✓Supplier Portal: Self-service options for suppliers to track invoice status. (Reduced Inquiries)

Scorecard (Overall: 7.6 / 10.0)

Pricing

Custom

Contact Vendor

- AP Automation Module

- Optional Sourcing

- Contract Management

- Supplier Management

- Payments

- Analytics

Limitations: Pricing based on modules, transaction volume, and complexity, Requires custom quote

Pros

- + Comprehensive feature set for large organizations

- + Scalable architecture

- + Strong integration capabilities with major ERPs

- + Part of a broader source-to-pay offering

Cons

- - Implementation can be complex and lengthy

- - Higher cost compared to SMB/Mid-market solutions

- - User interface may feel less modern than competitors

- - Primarily targets larger enterprises

Verdict

"A powerful choice for large, global enterprises needing robust, scalable AP automation with deep ERP integration, potentially as part of a full source-to-pay strategy."

#8

#8

Quadient AP (formerly Beanworks)

By Quadient

AP automation solution known for its usability and focus on streamlining invoice capture, approval, and payment workflows.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Invoice Approval Workflows, Purchase Order Management, Payment Processing, Expense Management (Optional Module)

Key Features

- ✓SmartCapture: AI-powered invoice data extraction with high accuracy claims. (Efficient Capture)

- ✓Custom Approval Channels: Flexible rule-based routing for invoice approvals. (Tailored Workflows)

- ✓PO Matching: Automated 2-way and 3-way matching of POs, invoices, and receipts. (Spend Control)

- ✓Multi-Entity Management: Supports organizations with multiple legal entities. (Scalability)

Scorecard (Overall: 7.8 / 10.0)

Pricing

Core AP

Contact Vendor

- Invoice Automation

- Approval Workflows

- Basic Reporting

- Standard Integration

Limitations: Requires custom quote, Pricing typically based on invoice volume and modules

AP + PO

Contact Vendor

- Everything in Core AP

- Purchase Order Module

Limitations: Requires custom quote

AP + PO + Payments

Contact Vendor

- Everything in AP + PO

- Payment Automation Module

Limitations: Requires custom quote, Transaction fees may apply for payments

AP + PO + Payments + Expenses

Contact Vendor

- Full Suite including Expense Management Module

Limitations: Requires custom quote

Pros

- + User-friendly interface

- + Strong core AP automation features

- + Good integration with popular accounting systems

- + Responsive customer support often cited

Cons

- - Pricing isn't publicly listed

- - Payment options might be less extensive than some global payment specialists

- - Can get expensive as modules are added

Verdict

"A strong contender, particularly for mid-market companies valuing ease of use, solid AP/PO features, and good customer support."

#7

#7

Netsuite AP Automation

By Oracle

Built-in AP automation features within the Oracle NetSuite ERP platform, enhanced by add-on modules or partners.

Platforms & Use Cases

Platforms: Web

Best For: Integrated AP within NetSuite, Invoice Processing, Payment Processing (SuitePayments), PO Matching

Key Features

- ✓Native Integration: AP functions are inherently part of the NetSuite ERP. (Seamless Data Flow)

- ✓Vendor Bill Capture: Automated capture and entry of vendor bills (often via add-on/partner). (Efficiency)

- ✓Workflow & Approvals: Utilizes NetSuite's SuiteFlow engine for custom approval routing. (Customizable)

- ✓Payment Automation: Integrated payment processing capabilities via SuitePayments or partners. (End-to-End)

Scorecard (Overall: 7.6 / 10.0)

Pricing

NetSuite License Dependent

Contact Vendor

- Core AP Ledgers

- Basic Approvals

- Standard Reporting

Limitations: Requires existing NetSuite license, Advanced OCR/Automation often requires add-on modules (e.g., Bill Capture, AP Automation) or partner solutions which have separate costs.

Pros

- + Perfect integration for existing NetSuite users

- + Leverages the full power of the NetSuite platform (reporting, workflow)

- + Single vendor relationship (potentially)

- + Highly scalable as part of the ERP

Cons

- - Only relevant for NetSuite customers

- - Advanced automation features often require extra cost (add-ons/partners)

- - Can be complex to configure

- - User interface may not be as modern as standalone tools

Verdict

"The default choice for organizations heavily invested in NetSuite, offering seamless integration but potentially requiring add-ons for full automation."

#6

#6

AvidXchange

By AvidXchange, Inc.

AP automation and payment solution provider focusing on mid-market businesses, offering software and payment services.

Platforms & Use Cases

Platforms: Web

Best For: Invoice Automation, Bill Payment, Purchase Order Automation, Supplier Network Payments

Key Features

- ✓Multiple Invoice Capture Options: Supports paper, email, and EDI invoice submission. (Vendor Flexibility)

- ✓Payment Services: Offers various electronic payment methods through the AvidPay Network. (Streamlined Payments)

- ✓Integration Focus: Specializes in integration with mid-market accounting systems. (Targeted Connectivity)

- ✓Purchase Order Application: Automates PO creation and matching. (Procure-to-Pay)

Scorecard (Overall: 7.4 / 10.0)

Pricing

Custom

Contact Vendor

- Invoice Automation Module

- Payment Automation Module

- PO Automation Module

- Utility Bill Management

- ERP/Accounting Integration

- Supplier Network Access

Limitations: Pricing is modular and based on volume/features, Requires custom quote

Pros

- + Strong focus on the mid-market

- + Extensive supplier network for e-payments

- + Dedicated integration support for various accounting systems

- + Offers full invoice-to-pay cycle automation

Cons

- - User interface could be modernized

- - Pricing can be complex and not transparent

- - Some users report delays in payment processing occasionally

- - Less focused on global payments than some competitors

Verdict

"Solid choice for mid-market companies looking for an integrated AP automation and payment execution solution with good accounting system connectivity."

#5

#5

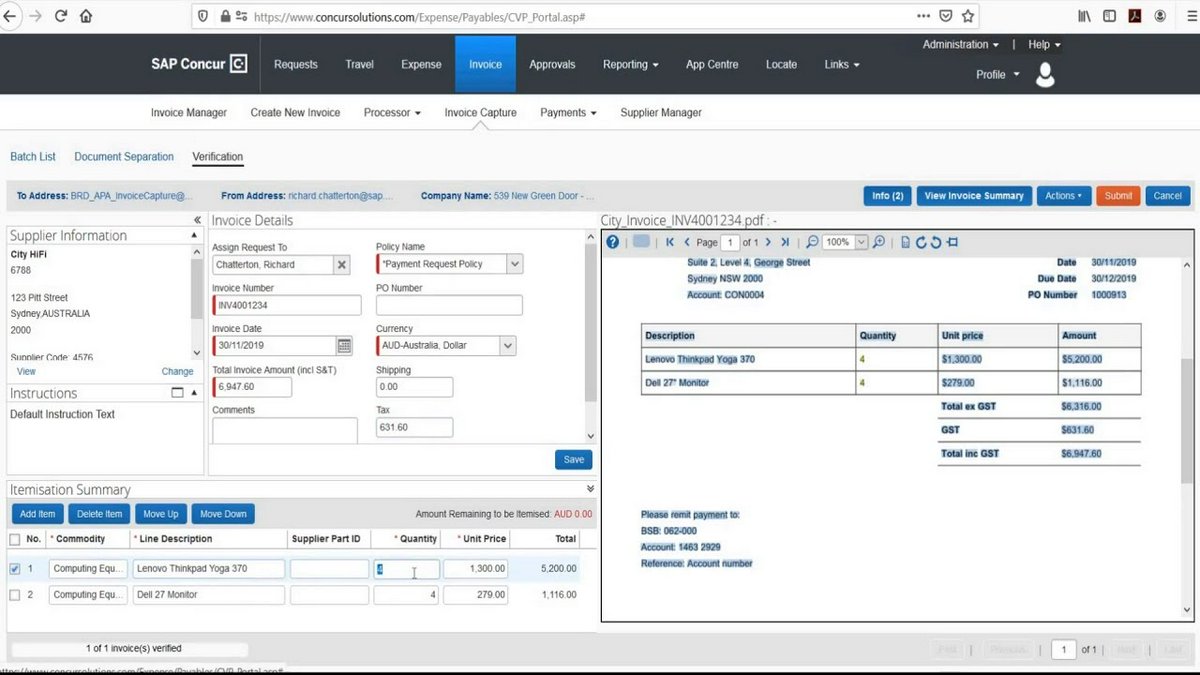

SAP Concur Invoice

By SAP

Enterprise-grade invoice management solution, part of the broader SAP Concur suite for travel, expense, and invoice.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Enterprise AP Automation, Global Invoice Management, Compliance & Audit Trail, Integration with SAP ERP

Key Features

- ✓Invoice Capture: Multiple methods including OCR, email, network. (Flexible Input)

- ✓Workflow Automation: Configurable workflows for complex approval chains. (Enterprise Scale)

- ✓Integration: Deep integration with SAP ERP systems (S/4HANA, ECC) and other finance systems. (SAP Ecosystem)

- ✓Reporting & Analytics: Visibility into AP processes, spend, and accruals. (Data Driven)

Scorecard (Overall: 7.4 / 10.0)

Pricing

Concur Invoice Standard

Contact Vendor

- Core Invoice Automation

- Mobile App

- Standard Reporting

- Basic Integration

Limitations: Requires custom quote, pricing often based on transaction volume

Concur Invoice Professional

Contact Vendor

- Everything in Standard

- Advanced Workflow Configuration

- Purchase Order Matching

- Enhanced Integration

- Intelligence/Analytics

Limitations: Higher cost, Requires custom quote

Pros

- + Powerful features for large enterprises

- + Seamless integration with SAP ecosystem

- + Strong compliance and audit capabilities

- + Handles global complexity

Cons

- - Can be complex and expensive to implement and maintain

- - User interface often considered dated or less intuitive

- - Less agile than some newer platforms

- - Support quality can vary

Verdict

"A robust solution for large enterprises, especially those already invested in the SAP ecosystem, needing comprehensive, global invoice management."

#4

#4

Airbase

By Airbase Inc.

Comprehensive spend management platform combining AP automation, corporate cards, and expense reimbursements.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Invoice Processing, Bill Payments, Corporate Card Management, Employee Expense Reimbursements, Procurement

Key Features

- ✓Unified Platform: Manages bills, card spend, and reimbursements in one place. (Single Source of Truth)

- ✓Guided Procurement: Built-in purchase order system and intake. (Controlled Spending)

- ✓Real-time Reporting: Consolidated view of all company non-payroll spend. (Visibility)

- ✓Advanced Approvals: Multi-level, conditional approval workflows across all spend types. (Granular Control)

Scorecard (Overall: 8.0 / 10.0)

Pricing

Standard

Contact Vendor

- AP Automation

- Expense Reimbursements

- Basic Corporate Cards

- Standard Integrations

Limitations: Suited for smaller orgs or those new to spend management, Requires custom quote

Premium

Contact Vendor

- Everything in Standard

- Advanced Corporate Card Controls

- Purchase Order Management

- Advanced Integrations

Limitations: For mid-market companies, Requires custom quote

Enterprise

Contact Vendor

- Everything in Premium

- Multi-entity Support

- Advanced Subsidiaries Management

- Custom Reporting

- SSO

Limitations: For larger, complex organizations, Requires custom quote

Pros

- + All-in-one spend management solution

- + Strong controls over spending

- + Real-time visibility

- + Good user experience

Cons

- - Can be more expensive than standalone AP tools

- - Implementation might be more involved

- - Pricing not transparent

Verdict

"Excellent for companies seeking a unified platform to manage all non-payroll spend, including AP, cards, and expenses."

#3

#3

Stampli

By Stampli, Inc.

AP automation focused on communication and collaboration around invoices, integrating deeply with accounting systems.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Invoice Processing & Approvals, AP Communication, PO Matching, Vendor Management

Key Features

- ✓Invoice-Centric Collaboration: Communications (questions, clarifications) happen directly on top of the invoice. (Contextual Communication)

- ✓Billy the Bot (AI): AI assistant for coding, approvals, duplicate detection, and fraud prevention. (Automation & Control)

- ✓Flexible Approvals: Supports complex, multi-step approval workflows. (Adaptable)

- ✓Deep ERP Integration: Strong focus on seamless integration with systems like NetSuite, Sage Intacct, QuickBooks. (Real-time Sync)

Scorecard (Overall: 8.2 / 10.0)

Pricing

Custom

Contact Vendor

- Core AP Automation

- Unlimited Users

- Unlimited Entities

- AI Features

- ERP Integration

- Implementation & Support

Limitations: Pricing based on invoice volume and specific needs, Requires custom quote

Pros

- + Excellent collaboration features streamline approvals

- + Intuitive interface for both AP teams and approvers

- + Fast implementation times reported

- + Strong customer support reputation

- + Deep integration capabilities

Cons

- - Pricing is not transparent and can be higher than some competitors

- - Payment processing features might be less extensive than dedicated payment platforms

- - Primarily focused on AP, less so on AR or broader spend management

Verdict

"Ideal for companies prioritizing communication and collaboration within the AP process, especially those using mid-market ERPs."

#2

#2

Tipalti

By Tipalti, Inc.

Comprehensive, end-to-end global payables automation platform designed for high-growth and mid-market companies.

Platforms & Use Cases

Platforms: Web

Best For: Global Mass Payments, Invoice Management, Tax Compliance (W-9/W-8), Supplier Onboarding, Multi-Entity AP

Key Features

- ✓Supplier Management: Self-service supplier onboarding portal with tax form collection. (Reduces AP workload)

- ✓Global Payments: Supports payments in 196 countries and 120+ currencies. (Extensive Reach)

- ✓Tax Compliance: Automated collection and validation of W-9/W-8 forms, 1099/1042-S preparation. (Built-in)

- ✓OCR & Invoice Processing: AI-powered data capture and multi-way invoice matching. (Touchless Processing)

- ✓Multi-Entity Support: Manages AP across multiple subsidiaries or business units. (Centralized Control)

Scorecard (Overall: 8.0 / 10.0)

Pricing

Platform Fee

$149.00 / Monthly

- Core AP Platform Access

- Invoice Management

- Supplier Portal

- Basic Approval Workflows

- Standard Integrations

Limitations: Base fee, additional costs per module/feature often apply, Minimum monthly fee likely applies, Transaction fees usually apply

Custom

Contact Vendor

- All features available based on selection

- Advanced Modules (Multi-entity, Tax, FX, PO Matching)

- Premium Integrations

- Dedicated Support

Limitations: Requires custom quote based on modules and volume

Pros

- + Handles complex global payments and tax compliance effectively

- + Robust supplier onboarding and management features

- + Scalable for high transaction volumes and multi-entity businesses

- + Strong integration with ERPs like NetSuite, Sage Intacct

Cons

- - Can be complex to implement and configure

- - Pricing structure can be opaque and expensive

- - User interface less intuitive than some competitors

- - Primarily focused on larger companies

Verdict

"Top-tier solution for mid-market and enterprise companies with complex global payment needs and high invoice volumes."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Bill

By Bill Holdings, Inc.

Popular AP/AR automation platform primarily for small to medium-sized businesses, offering invoice processing and payment solutions.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Invoice Management, Approval Workflows, Domestic & International Payments, SMB AP/AR Automation

Key Features

- ✓AI Data Entry: Automated invoice data capture using AI. (High Accuracy)

- ✓Approval Workflows: Customizable rules for invoice review and approval. (Flexible)

- ✓Payment Options: Supports ACH, check, virtual card, and international wires. (Multiple Methods)

- ✓Accounting Sync: Integrates with QuickBooks, Xero, NetSuite, etc. (Bi-directional Sync)

Scorecard (Overall: 8.0 / 10.0)

Pricing

Essentials

$45.00 / Monthly per user

- AP Automation

- Standard Approval Policies

- Basic Roles

- Accounting Software Sync

Limitations: Limited users, Basic integrations

Team

$55.00 / Monthly per user

- Everything in Essentials

- Custom User Roles

- Basic API Access

Limitations: Higher cost per user

Corporate

$79.00 / Monthly per user

- Everything in Team

- Multi-entity/Multi-location workflows

- Faster ACH & Check Payments

Enterprise

Contact Vendor

- Everything in Corporate

- API Access

- ERP Integration (NetSuite, Sage Intacct)

- Single Sign-On (SSO)

Limitations: Requires custom quote

Pros

- + User-friendly interface

- + Strong core AP automation features

- + Wide range of payment options

- + Good integration with major accounting software

Cons

- - Per-user pricing can become expensive

- - Customer support can be slow at times

- - Advanced features limited to higher tiers

Verdict

"Excellent choice for SMBs seeking straightforward AP and AR automation with strong accounting software integration."

Final Thoughts

The AP automation market offers diverse solutions catering to different business sizes and needs. Leading platforms provide robust invoice processing, approval workflows, payment execution, and ERP integration. Key differentiators include the depth of global payment capabilities, the user experience, integration strength, approach to spend management (unified vs. standalone), and pricing models.