Top 10 Accounts Payable System Software Comparison

By Dante Holloway | Published: 2025-03-16 | Category: Account Payable System Software

About Account Payable System Software

Accounts Payable (AP) system software automates the process of managing and paying short-term liabilities owed to suppliers and vendors. These systems streamline invoice capture, approval workflows, payment processing, and reporting, reducing manual effort and improving financial control.

Scoring Criteria

- → Automation Features

- → Integration Capabilities

- → User Experience

- → Payment Processing

- → Reporting & Analytics

- → Scalability

- → Customer Support

- → Pricing Value

The Best Account Payable System Software

#10

#10

Melio

By Melio Payments Inc.

Simple AP/AR solution designed specifically for US-based small businesses, focusing on ease of use for paying bills and getting paid.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Small business bill pay, Paying vendors via ACH/check, Receiving payments from customers, Accountant dashboards

Key Features

- ✓Free ACH Transfers: No fee for sending or receiving ACH payments.

- ✓Pay Bills with Credit Card: Allows paying bills via credit card (fee applies) even if vendor doesn't accept cards.

- ✓Simple Invoice Capture: Upload or snap photos of bills for processing.

- ✓Basic Approval Workflows: Simple user roles and payment approval options.

Scorecard (Overall: 7.3 / 10.0)

Pricing

Free Core Plan

Contact Vendor

- Unlimited users

- ACH payments

- Check payments ($1.50 fee)

- Basic integrations (QuickBooks, Xero)

Limitations: Transaction fees for card payments (2.9%) and expedited checks, Limited automation features

Accountant Dashboard

Contact Vendor

- Manage multiple clients

- Client collaboration tools

Limitations: Designed for accountants managing SMB clients

Pros

- + Extremely easy to use

- + Free for core ACH payment functionality

- + Flexible payment options (pay by card, vendor receives ACH/check)

- + Good for very small businesses

Cons

- - Limited automation and workflow capabilities

- - Reporting is basic

- - Not designed for complex AP needs or high volume

- - Primarily focused on US domestic payments

Verdict

"An excellent, cost-effective choice for US-based small businesses needing a simple, user-friendly way to manage and pay bills electronically."

#9

#9

Ramp

By Ramp Business Corporation

Spend management platform known for corporate cards, expense management, and increasingly robust bill payment (AP) features, targeting startups to mid-market.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Unified spend management, Corporate cards with integrated controls, Automated expense reporting, Bill payments via ACH, check, card

Key Features

- ✓Integrated Bill Pay: Manage and pay bills alongside card spend and reimbursements.

- ✓Automated Invoice Processing: OCR data capture and AI-powered coding suggestions.

- ✓Smart Corporate Cards: Cards with built-in spend controls and automated receipt matching.

- ✓Savings Insights: Platform identifies potential duplicate subscriptions and savings opportunities.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Free Tier

Contact Vendor

- Core platform

- Corporate cards

- Expense management

- Bill Pay (basic)

- Basic integrations

Limitations: Primarily funded via interchange fees

Ramp Plus

$12.00 / Monthly per user

- Advanced user roles

- Purchase orders

- Advanced integrations

- Custom controls

Limitations: Additional cost for premium features

Enterprise

$-1.00 / Custom

- Multi-entity

- Advanced security

- Premium support

- Custom implementation

Limitations: Quote-based

Pros

- + Often free core platform (funded by card interchange)

- + Modern, intuitive user interface

- + Excellent integration between cards, expenses, and bill pay

- + Focus on identifying savings

Cons

- - Bill pay features are newer and might be less mature than dedicated AP platforms

- - Heavily encourages use of Ramp corporate cards

- - International payment capabilities less extensive than some competitors

Verdict

"A compelling option, especially for startups and SMBs, offering a modern, integrated spend management platform with strong core AP features often at no direct software cost."

#8

#8

Nvoicepay (Corpay)

By Corpay (formerly FLEETCOR)

Payment automation specialist focusing on optimizing and securing outbound payments for mid-market and enterprise clients.

Platforms & Use Cases

Platforms: Web

Best For: Complex payment optimization, Payment fraud mitigation, Supplier enablement for ePayments, Integration with existing AP/ERP

Key Features

- ✓Intelligent Payment Optimization: Dynamically selects the optimal payment method (ACH, virtual card, check) for each supplier.

- ✓Supplier Enablement Services: Actively contacts and manages suppliers to transition them to electronic payments.

- ✓Comprehensive Payment Security: Advanced fraud detection and indemnification options.

- ✓ERP/Accounting System Integration: Connects with various systems to receive payment instructions.

Scorecard (Overall: 8.0 / 10.0)

Pricing

Custom Pricing

$-1.00 / Varies

- Payment automation

- Supplier services

- Security features

- Reporting

Limitations: Quote-based, Primarily focused on the payment execution part of AP

Pros

- + Excels at optimizing payment mix and maximizing rebates

- + Strong focus on payment security and fraud prevention

- + Handles supplier enablement effectively

- + Reduces burden of payment execution

Cons

- - Less focus on the front-end invoice capture and approval process compared to full AP suites

- - Can be viewed primarily as a payment service rather than a full AP solution

Verdict

"Highly recommended for organizations whose primary AP pain point is complex, high-volume payment execution, security, and supplier enablement."

#7

#7

Oracle NetSuite AP Automation

By Oracle

Built-in AP automation features within the NetSuite ERP platform, offering seamless integration for NetSuite users.

Platforms & Use Cases

Platforms: Web

Best For: NetSuite-centric organizations, Automated invoice processing within ERP, Streamlined procure-to-pay cycle

Key Features

- ✓Native NetSuite Integration: AP functions are part of the core ERP system.

- ✓Automated Invoice Data Capture: Scans and extracts data from vendor bills.

- ✓Workflow & Approval Engine: Leverages NetSuite's workflow capabilities for routing.

- ✓Electronic Payment Processing: Supports various electronic payment methods through SuitePayments or partners.

Scorecard (Overall: 7.9 / 10.0)

Pricing

Included Module/Add-on

$-1.00 / Varies

- Depends on NetSuite subscription level and add-ons purchased.

Limitations: Requires existing NetSuite subscription, Pricing tied to overall NetSuite cost

Pros

- + Seamless integration for existing NetSuite users

- + Unified data model within the ERP

- + Leverages NetSuite's robust reporting and workflow tools

- + Single vendor relationship

Cons

- - Only available to NetSuite customers

- - Features might be less advanced than best-of-breed standalone AP solutions

- - User experience tied to the overall NetSuite interface

Verdict

"The default choice for organizations heavily reliant on NetSuite ERP, providing tightly integrated AP automation within their existing system."

#6

#6

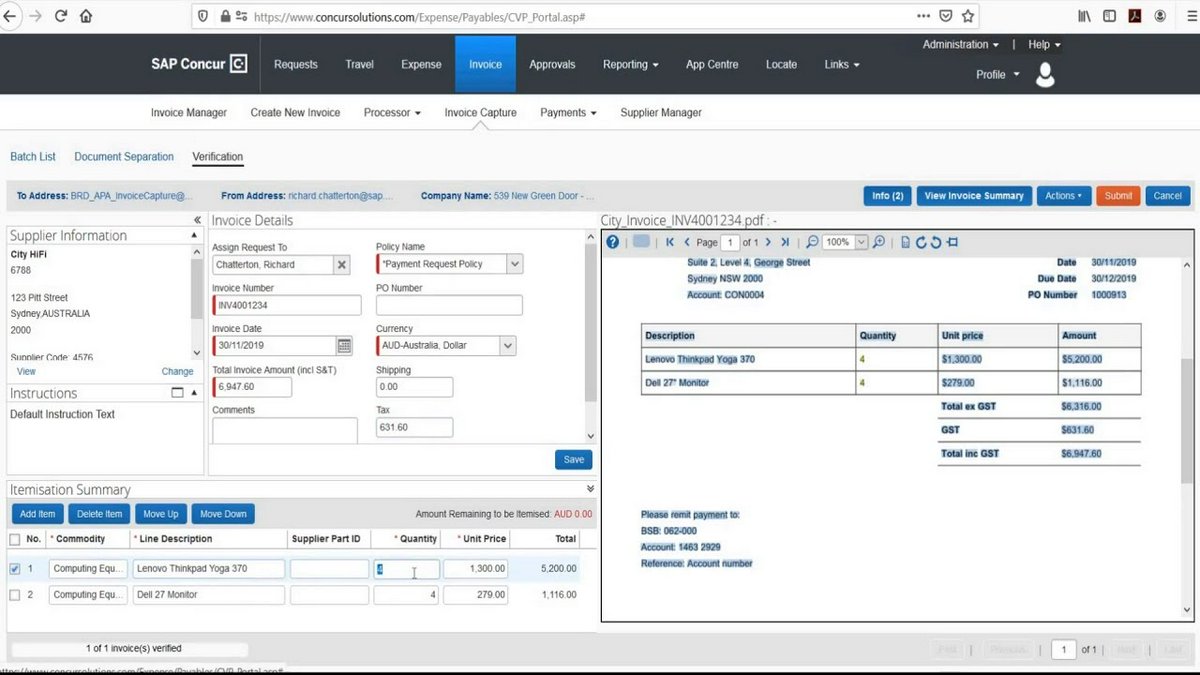

SAP Concur Invoice

By SAP SE

Part of the broader SAP Concur ecosystem for travel, expense, and invoice management, targeted at mid-size to large enterprises.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Enterprise invoice management, Integration with SAP ERP, Global AP operations, Compliance and control

Key Features

- ✓End-to-End Invoice Automation: From capture and coding to approval and payment initiation.

- ✓Concur Expense Integration: Unified platform for managing both T&E and AP spend.

- ✓Mobile App: Allows invoice review and approval on the go.

- ✓Robust Reporting & Analytics: Detailed insights into AP processes and spend.

Scorecard (Overall: 7.9 / 10.0)

Pricing

Concur Invoice Standard

$-1.00 / Varies

- Core invoice automation

- Mobile access

- Standard reporting

Limitations: Quote-based, Implementation fees apply

Concur Invoice Professional

$-1.00 / Varies

- Advanced features

- Custom configurations

- Enhanced integrations

Limitations: Quote-based, More complex setup

Pros

- + Deep integration with SAP ecosystem

- + Comprehensive feature set for large organizations

- + Strong reporting and analytics

- + Global capabilities

- + Combines well with Concur Expense

Cons

- - Can be expensive and complex to implement

- - User interface not always intuitive

- - Less flexible than some newer competitors

- - Payment execution often handled by ERP or third-party

Verdict

"A powerful choice for large enterprises already invested in the SAP ecosystem needing robust, scalable invoice management integrated with T&E."

#5

#5

AvidXchange

By AvidXchange, Inc.

AP automation and payment solution focused on the mid-market, offering a combination of software and services.

Platforms & Use Cases

Platforms: Web

Best For: Mid-market AP automation, Industry-specific solutions (Real Estate, Construction, HOA), Supplier payment services

Key Features

- ✓Multiple Invoice Submission Methods: Supports email, direct upload, and outsourced scanning services.

- ✓Purchase Order Matching: Automated 2-way and 3-way PO matching.

- ✓AvidPay Network: Large network for facilitating electronic payments to suppliers.

- ✓Industry Specialization: Tailored features for specific verticals like real estate.

Scorecard (Overall: 7.5 / 10.0)

Pricing

Custom Pricing

$-1.00 / Varies

- Invoice automation

- Payment automation

- PO Matching

- Integrations

Limitations: Quote-based, Pricing can depend on transaction volume and services used

Pros

- + Strong payment automation capabilities via AvidPay Network

- + Industry-specific expertise

- + Offers managed services options

- + Good PO matching features

Cons

- - User interface can feel dated compared to newer platforms

- - Pricing isn't transparent and can be high

- - Customer support reviews are mixed

Verdict

"A solid option for mid-market companies, particularly those in supported industries, looking for robust payment automation and PO matching."

#4

#4

Airbase

By Airbase, Inc.

Comprehensive spend management platform combining AP automation, corporate cards, and expense reimbursements.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Unified spend management, Corporate card programs, Employee expense reimbursement, AP automation

Key Features

- ✓Integrated Spend Platform: Combines bill payments, corporate cards, and reimbursements in one system.

- ✓Advanced Approval Workflows: Customizable rules across all spend categories.

- ✓Real-time Spend Visibility: Consolidated view of company spending as it happens.

- ✓Direct ERP Integration: Deep integrations with NetSuite, QuickBooks, Sage Intacct, Xero.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Standard

$-1.00 / Annually

- Core AP

- Guided Procurement

- Expense Management

- Basic integrations

Limitations: Quote-based, May have user/spend minimums

Premium

$-1.00 / Annually

- Advanced AP Features

- Purchase Order Management

- Advanced integrations

- Multi-subsidiary support

Limitations: Quote-based

Enterprise

$-1.00 / Annually

- Custom workflows

- Dedicated support

- API access

- Advanced security

Limitations: Quote-based

Pros

- + Holistic approach to spend management

- + Strong controls and visibility

- + Seamless integration between cards, expenses, and AP

- + Good fit for tech-forward companies

Cons

- - Can be more complex than standalone AP solutions

- - Pricing tailored to mid-market and larger companies

- - Less focus on global payments compared to Tipalti

Verdict

"A top choice for companies seeking a unified platform to manage all non-payroll spend, including AP, corporate cards, and expenses."

#3

#3

Stampli

By Stampli, Inc.

AP automation software emphasizing collaboration and communication, integrating directly on top of existing accounting systems.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Collaborative invoice approval, AP process visibility, Integration with existing ERP/Accounting, Communication hub for AP

Key Features

- ✓Centralized Invoice Communication: Conversations happen directly on top of the invoice, involving relevant stakeholders.

- ✓Billy the Bot (AI Assistant): Automates coding, approval routing, and fraud detection.

- ✓Flexible Approval Workflows: Adapts to existing company processes.

- ✓Seamless ERP/Accounting Integration: Works closely with NetSuite, Sage Intacct, QuickBooks, SAP, etc.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Custom Pricing

$-1.00 / Annually

- Core AP automation

- Unlimited users

- Standard integrations

- Billy the Bot AI

Limitations: Quote-based, Pricing often based on invoice volume

Pros

- + Excellent collaboration features

- + Intuitive user interface

- + Strong focus on integrating with existing workflows

- + Responsive customer support

- + Unlimited users often included

Cons

- - Payment processing (Stampli Direct Pay) is an add-on and might be less robust than dedicated payment platforms

- - Pricing not transparent

Verdict

"Best suited for companies prioritizing collaboration and communication within the AP process, offering a user-friendly layer over existing accounting systems."

#2

#2

Tipalti

By Tipalti, Inc.

Comprehensive, end-to-end global payables automation solution targeting mid-market and enterprise businesses with complex AP needs.

Platforms & Use Cases

Platforms: Web

Best For: Global mass payments, Multi-entity AP management, Supplier onboarding, Tax compliance (W-9/W-8)

Key Features

- ✓Global Payment Infrastructure: Supports payments in 196 countries and 120 currencies via multiple methods.

- ✓Self-Service Supplier Portal: Streamlines supplier onboarding, management, and communication.

- ✓Advanced OCR & Invoice Processing: Automated data capture and PO matching.

- ✓Tax Compliance Automation: Automated collection and validation of W-9/W-8 forms, 1099/1042-S preparation.

Scorecard (Overall: 8.8 / 10.0)

Pricing

Platform Fee

$-1.00 / Monthly/Annually

- Core platform access

- Supplier management

- Invoice processing

- Global payments

Limitations: Requires quote, Minimum processing volume may apply

Pros

- + Handles complex global payments exceptionally well

- + Robust feature set including tax compliance

- + Highly scalable for growing/large enterprises

- + Strong supplier management features

Cons

- - Can be expensive, especially for smaller businesses

- - Interface can be complex due to extensive features

- - Primarily focused on payables, less on AR

Verdict

"Ideal for mid-market to enterprise companies with significant international payment volume, complex workflows, and multi-entity structures."

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

Bill.com

By Bill Holdings, Inc.

Popular AP/AR automation platform for SMBs and mid-market businesses, focusing on simplifying invoice processing and payments.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: SMB invoice management, Mid-market AP automation, Digital payments, Accountant collaboration

Key Features

- ✓Intelligent Invoice Capture: AI-powered data entry from invoices.

- ✓Automated Approval Workflows: Customizable multi-step approval routing.

- ✓Multiple Payment Options: Supports ACH, check, virtual card, and international wires.

- ✓Accounting Software Sync: Two-way synchronization with QuickBooks, Xero, NetSuite, etc.

Scorecard (Overall: 8.0 / 10.0)

Pricing

Essentials

$45.00 / Monthly per user

- Core AP/AR

- Standard approvals

- Basic integrations

Limitations: Limited users, Basic support

Team

$55.00 / Monthly per user

- Role-based access

- Custom approvals

- Sync with QuickBooks Premier/Enterprise, Xero

Limitations: Higher cost per user

Corporate

$79.00 / Monthly per user

- Full AP/AR automation

- API access

- Sync with NetSuite, Sage Intacct

Limitations: Designed for larger teams

Enterprise

$-1.00 / Custom

- Advanced controls

- Multi-entity support

- Dedicated support

Limitations: Quote-based pricing

Pros

- + User-friendly interface

- + Strong integration ecosystem

- + Extensive payment options

- + Widely adopted by accountants

Cons

- - Per-user pricing can become expensive

- - Reporting could be more robust

- - Support quality can vary

Verdict

"Excellent choice for SMBs and mid-market companies seeking a user-friendly, integrated AP/AR solution with strong payment capabilities."

Final Thoughts

The Accounts Payable software market offers diverse solutions catering to different needs. Leaders like Tipalti excel in global, complex payments for enterprises, while Bill.com provides a strong all-around solution for SMBs and mid-market. Stampli focuses on collaboration, Airbase and Ramp offer unified spend management, and solutions like Melio provide simple, cost-effective options for small businesses. Integration capabilities, payment flexibility, automation depth, and scalability are key differentiators.