Top 8 Title Loan Company Options

By Lucy Chen | Published: 2025-02-25 | Category: Title Loan Companies

About Title Loan Companies

Title loan companies provide short-term loans secured by the borrower's vehicle title. Borrowers receive cash quickly but risk losing their vehicle if they default on the high-interest loan.

How We Evaluated

Providers were evaluated based on factors including typical interest rate ranges, loan term flexibility, customer service reputation, application accessibility, and overall company standing. Scores reflect a composite assessment of these criteria based on publicly available information.

Rating Criteria

- → Interest Rates & Fees

- → Loan Terms & Flexibility

- → Customer Service

- → Application Process

- → Accessibility & Availability

- → Reputation & Transparency

The Best Title Loan Companies

#8

#8

Location: Mesa, AZ (Broker); Connects borrowers with lenders nationwide Get Directions

Founded: 2008

Max Cash Title Loans

Visit Website →A title loan broker or matching service that connects borrowers with a network of lenders across the United States.

Target Audience

Borrowers looking to compare options from multiple lenders, Individuals unsure where to start their title loan search

Service Offerings

Title Loan Matching Service

Connects applicants with third-party title loan lenders based on their application details and location.

- Single application potentially connects to multiple lenders

- Service is free to the borrower (paid by lender)

- Terms and rates determined by the actual lender

Scorecard (Overall: 7.2 / 10.0)

Pricing Model

Service Fee

Free service for borrowers. The actual loan obtained will have high APRs and fees set by the chosen lender.

Pros

- + Helps compare potential offers from different lenders

- + Wide potential availability through lender network

- + Convenient single point of application to reach multiple sources

Cons

- - Acts as a middleman, not a direct lender

- - Loan terms and quality depend on the matched lender

- - Borrowers still face high interest rates from the end lender

Verdict

"A useful service for comparing title loan options from various lenders, potentially saving time, though the underlying loan products still carry high costs."

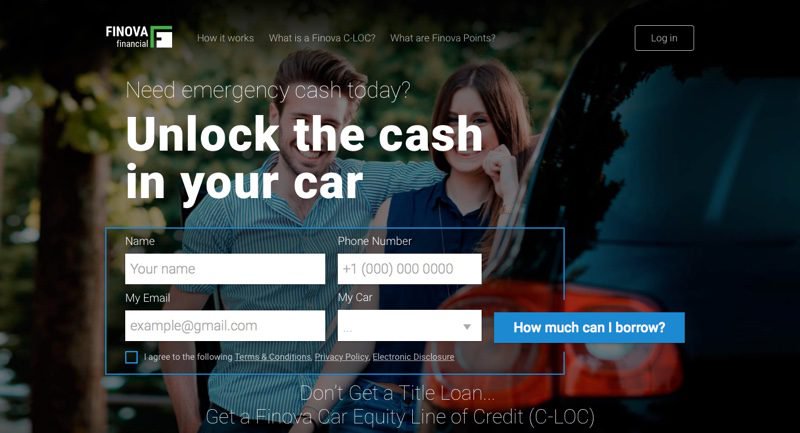

Finova Financial

Visit Website →An online lender offering car title loans with potentially more competitive rates and longer terms compared to traditional storefront lenders.

Target Audience

Borrowers seeking online convenience, Individuals looking for potentially lower rates within the title loan market, Tech-savvy consumers

Service Offerings

Car Title Loans (C-LOC - Car Equity Line of Credit)

Offers an equity line of credit secured by the vehicle title, allowing for draws as needed.

- Fully online application process

- Potentially lower APRs than traditional title loans (though still high)

- 12-month repayment terms with flexibility

Scorecard (Overall: 7.2 / 10.0)

Pricing Model

APR

APRs are high but marketed as being lower than many competitors. Specific rates depend on applicant and state. Fees may apply.

Pros

- + Fully online process

- + Potentially more favorable rates and terms (12 months)

- + Focus on technology and user experience

Cons

- - Not available in all states

- - Still carries high interest rates compared to traditional loans

- - Requires internet access and comfort with online processes

Verdict

"A modern, online-focused alternative that may offer better terms and rates than traditional title lenders, appealing to those comfortable with a digital process."

TitleBucks

Visit Website →Part of the same family as TitleMax, TitleBucks offers title loans and pawns with a focus on quick approvals and funding through physical locations.

Target Audience

Vehicle owners needing fast access to cash, Individuals comfortable with in-person applications

Service Offerings

Title Pawns/Loans

Short-term funding secured against a vehicle title.

- Primarily in-store application and approval

- Quick vehicle appraisal process

- Funds often available same day

Scorecard (Overall: 6.0 / 10.0)

Pricing Model

APR

Expect very high APRs and associated fees, consistent with TitleMax and industry standards.

Pros

- + Fast processing time in-store

- + Part of a large, established network

- + Simple application concept

Cons

- - Extremely high interest rates

- - Risk of vehicle repossession

- - Limited flexibility in loan terms typically

Verdict

"Similar to TitleMax, TitleBucks provides rapid title-based funding primarily through storefronts, but borrowers face steep costs and significant risks."

Speedy Cash

Visit Website →Offers quick access to various loan products, including title loans, payday loans, and lines of credit, both online and in-store.

Target Audience

Individuals needing fast cash for emergencies, Borrowers seeking flexibility with online/in-store options

Service Offerings

Title Loans

Secured loans based on vehicle value.

- Apply online or in-store

- Funding can be very fast, sometimes same-day

- Requires vehicle inspection

Payday Loans, Installment Loans, Lines of Credit

Additional short-term financial products.

Scorecard (Overall: 6.3 / 10.0)

Pricing Model

APR

High APRs and fees are standard practice, differing based on loan type and state laws.

Pros

- + Fast application and funding process

- + Offers online and in-store options

- + Provides a range of loan products

Cons

- - Expensive loan terms (high APRs)

- - Availability varies by state

- - Risk of losing vehicle

Verdict

"True to its name, Speedy Cash offers fast processing for title loans and other short-term credit, suitable for urgent needs if the high costs are understood."

Advance America

Visit Website →A large provider of various short-term credit products, including title loans, payday loans, and installment loans, with many physical locations.

Target Audience

Consumers needing immediate access to funds, Individuals seeking diverse short-term loan options

Service Offerings

Title Loans

Allows borrowing against a vehicle's title.

- Requires clear vehicle title

- Available at physical locations in certain states

- Loan amounts depend on vehicle value and state laws

Payday Loans & Installment Loans

Other short-term borrowing options offered.

Scorecard (Overall: 6.3 / 10.0)

Pricing Model

APR

High APRs and fees are characteristic, varying by state regulations and loan product.

Pros

- + Wide network of branches

- + Offers several different loan types

- + Long-standing presence in the industry

Cons

- - Very high borrowing costs

- - Title loan availability limited by state

- - Customer service experiences can vary

Verdict

"A major player with broad accessibility and multiple loan types, but shares the industry standard of high costs and potential risks associated with title loans."

Check Into Cash

Visit Website →Provides a range of short-term financial services, including title loans, both online and through physical storefronts.

Target Audience

Borrowers seeking various short-term loan options, Individuals needing funds before their next payday

Service Offerings

Title Loans

Loans secured by a car title, available in select states.

- Online pre-qualification available

- In-store completion often required

- Also offers payday loans, installment loans

Payday Loans

Short-term unsecured loans due on the borrower's next payday.

Scorecard (Overall: 6.5 / 10.0)

Pricing Model

APR

Carries high APRs typical for the short-term lending industry. Fees vary by state and loan type.

Pros

- + Offers multiple loan products

- + Established company with many locations

- + Online pre-qualification available

Cons

- - High interest rates and fees

- - Title loans not available in all states where they operate

- - Short repayment terms typical

Verdict

"A versatile short-term lender offering title loans alongside other products. Good accessibility, but costs remain very high."

TitleMax

Visit Website →One of the largest title lending companies in the nation, known for its widespread physical locations and quick processing.

Target Audience

Individuals needing immediate cash, Borrowers preferring in-person service, Owners of lien-free vehicles

Service Offerings

Car Title Loans/Pawns

Short-term loans secured by a vehicle title, often structured as pawns in some states.

- In-store application process primarily

- Quick approval and funding, often same-day

- Loan amount based on vehicle appraisal and income

Scorecard (Overall: 6.5 / 10.0)

Pricing Model

APR

Extremely high APRs, often in triple digits. Fees for origination and other services are common.

Pros

- + Extensive branch network for in-person service

- + Fast funding, often within 30 minutes in-store

- + Accepts various vehicle types

Cons

- - Very high interest rates and fees

- - Primarily relies on short repayment terms

- - Aggressive collection practices reported by some customers

Verdict

"Highly accessible due to numerous locations, offering very fast cash but at a significant cost and risk. Best suited for those prioritizing speed and in-person interaction."

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

LoanMart

Visit Website →Offers title loans with a focus on customer service and potentially longer repayment terms compared to some competitors.

Target Audience

Vehicle owners needing emergency funds, Individuals with less-than-perfect credit

Service Offerings

Car Title Loans

Secured loans using the equity in a borrower's vehicle.

- Loan amounts vary by vehicle value and state regulations

- Online and phone application options

- Funds potentially available within one business day

Scorecard (Overall: 7.0 / 10.0)

Pricing Model

APR

High interest rates apply, varying significantly by state and borrower profile. Origination and other fees may apply.

Pros

- + Potentially longer loan terms than some competitors

- + Strong online application process

- + Generally positive customer service feedback for the industry

Cons

- - Very high interest rates are standard

- - Not available in all states

- - Risk of vehicle repossession upon default

Verdict

"A well-established option with a focus on service and potentially more flexible terms, though still carrying the high costs and risks inherent in title loans."

Final Recommendation

Title loans offer fast cash but come with significant risks and very high costs. Providers vary in accessibility, application process, and customer service. Online options like Finova Financial and matching services like Max Cash Title Loans offer alternatives to traditional storefronts like TitleMax and Advance America.