Comparative Analysis of Leading Tax Software Providers

By Richard "Rick" Callahan | Published: 2025-03-02 | Category: Tax Software

About Tax Software

Tax software assists individuals and businesses in preparing and filing income tax returns electronically. These tools guide users through tax forms, perform calculations, and help identify potential deductions and credits.

How We Evaluated

Providers were evaluated based on ease of use, range of features, customer support options, pricing structure, and accuracy guarantees. Ratings reflect a synthesis of common user feedback and feature comparisons.

Rating Criteria

- → Ease of Use

- → Features & Forms Coverage

- → Customer Support

- → Pricing & Value

- → Accuracy & Guarantees

The Best Tax Software

OLT (OnLine Taxes)

Visit Website →An IRS Free File Alliance member offering a very low-cost or free option for qualified filers, with a basic interface.

Target Audience

Individuals, Cost-conscious filers

Service Offerings

Free File Edition

Free federal and potentially free state filing for filers meeting IRS Free File income/age criteria.

Premium Edition

Low flat fee for federal filing for those not qualifying for Free File; covers all forms.

Scorecard (Overall: 7.1 / 10.0)

Pricing Model

Free

For eligible IRS Free File users.

Paid Federal

$10.00 / per return

Low flat fee for federal returns.

Paid State

$10.00 / per return

Low flat fee per state return.

Pros

- + Extremely affordable, potentially free via IRS Free File

- + Flat low pricing for paid versions

- + Supports a wide range of forms

Cons

- - Very basic, dated interface

- - Minimal guidance and support

- - Less user-friendly than major competitors

Verdict

"A budget-focused option suitable for filers comfortable with minimal assistance and a no-frills interface, especially those qualifying for IRS Free File."

Liberty Tax Online

Visit Website →Similar to Jackson Hewitt, offers both online DIY filing and a large network of franchise locations for in-person assistance.

Target Audience

Individuals, Families, Self-Employed

Service Offerings

Basic

For simple returns, W-2 income, standard deduction.

Deluxe

Adds itemized deductions, homeowners, health savings accounts.

Premium

For freelancers, contractors, investors, rental property owners.

Scorecard (Overall: 7.2 / 10.0)

Pricing Model

Paid

Tiered pricing (Basic, Deluxe, Premium); state filing extra.

In-Person

Variable pricing based on complexity for filing at a location.

Pros

- + Large network of physical locations for support

- + Accuracy guarantee

- + Offers online and in-person options

Cons

- - Online software is less developed than competitors

- - No free filing option online

- - Pricing can be higher than value-focused online options

- - Interface may feel less modern

Verdict

"Primarily appeals to those who want the security of nearby physical locations for potential help, but its online offering lags behind the leaders."

Jackson Hewitt Online

Visit Website →Known for its extensive network of physical locations, Jackson Hewitt also offers online tax filing software with a focus on simplicity and support.

Target Audience

Individuals, Families

Service Offerings

Free Federal & State

For simple returns only.

Self-File Online

Handles more complex situations, including deductions, credits, investments.

File with a Tax Pro

Options to file in an office or virtually with a professional.

Scorecard (Overall: 7.7 / 10.0)

Pricing Model

Free

Free federal and state for very simple returns.

Paid Online

Competitively priced flat rate for federal filing covering complex situations; state filing extra.

In-Person/Virtual Pro

Higher cost based on complexity for professional preparation.

Pros

- + Option for in-person support and filing

- + Simple pricing for online self-filing

- + Lifetime accuracy guarantee

- + Relatively easy to use interface

Cons

- - Online software less feature-rich than TurboTax/H&R Block

- - Free version is highly limited

- - State filing fee for paid online version

- - Focus is more on assisted/in-person filing

Verdict

"A solid choice for those who value the option of in-person assistance alongside online filing, though its online software isn't as robust as some competitors."

Cash App Taxes

Visit Website →Formerly Credit Karma Tax, this service offers completely free federal and state tax filing, integrated within the Cash App ecosystem.

Target Audience

Individuals, Students, Gig Workers

Service Offerings

Free Filing

Completely free federal and state filing for supported situations.

- Accessed via Cash App mobile application.

Scorecard (Overall: 7.7 / 10.0)

Pricing Model

Free

Always free for both federal and state returns for supported forms.

Pros

- + Completely free federal and state filing

- + Simple, mobile-first interface

- + Integration with Cash App

- + Good for straightforward returns

Cons

- - Must use Cash App

- - Does not support all tax situations (e.g., multi-state filing, foreign income may be limited)

- - Customer support is limited

- - Fewer features and less guidance than paid options

Verdict

"An excellent free option for users with relatively simple returns who are already in the Cash App ecosystem. The limitations on complex situations are key."

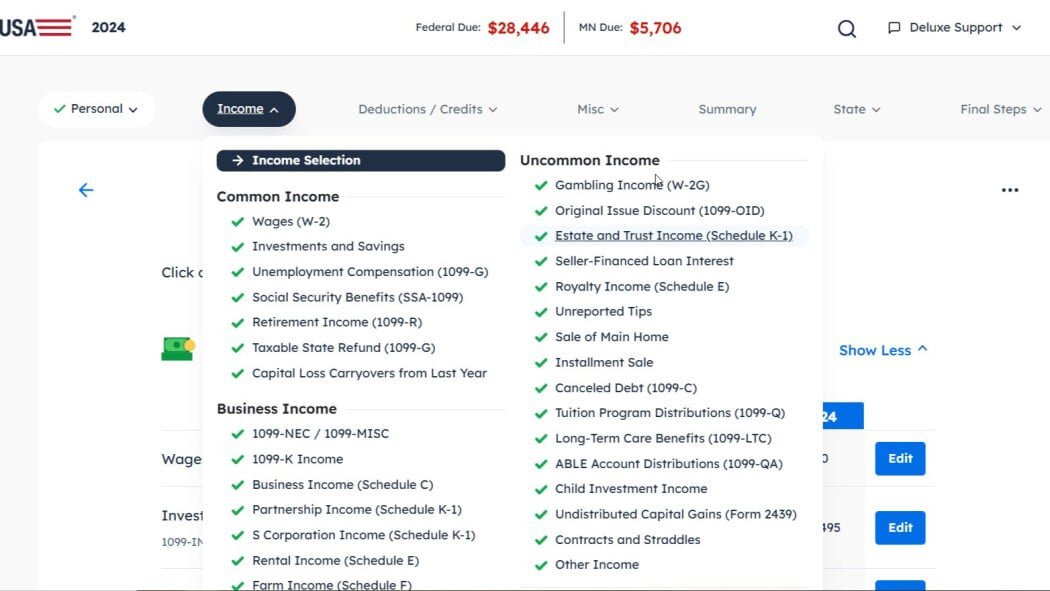

FreeTaxUSA

Visit Website →Offers completely free federal tax filing for all situations, with a flat, low fee for state returns. Focuses on affordability and broad form support.

Target Audience

Individuals, Self-Employed, Investors, Rental Property Owners

Service Offerings

Free File

Handles simple and complex returns including itemized deductions, investments, self-employment income.

- Supports virtually all IRS forms.

Deluxe Add-on

Optional upgrade for priority support, live chat, audit assist, and unlimited amended returns.

Scorecard (Overall: 8.1 / 10.0)

Pricing Model

Free

Federal filing is always free, regardless of complexity.

State

$15.00 / per state return

Low, flat fee per state filed.

Deluxe

$8.00 / per return

Optional low-cost upgrade for enhanced support features.

Pros

- + Free federal filing for all situations

- + Supports a vast range of forms and schedules

- + Extremely affordable state filing

- + Clear interface, though less polished than some

Cons

- - User interface is basic

- - Limited guidance and explanations compared to premium options

- - Support primarily via email unless Deluxe is purchased

Verdict

"The undisputed leader for value, offering comprehensive free federal filing. Ideal for confident filers who prioritize cost savings."

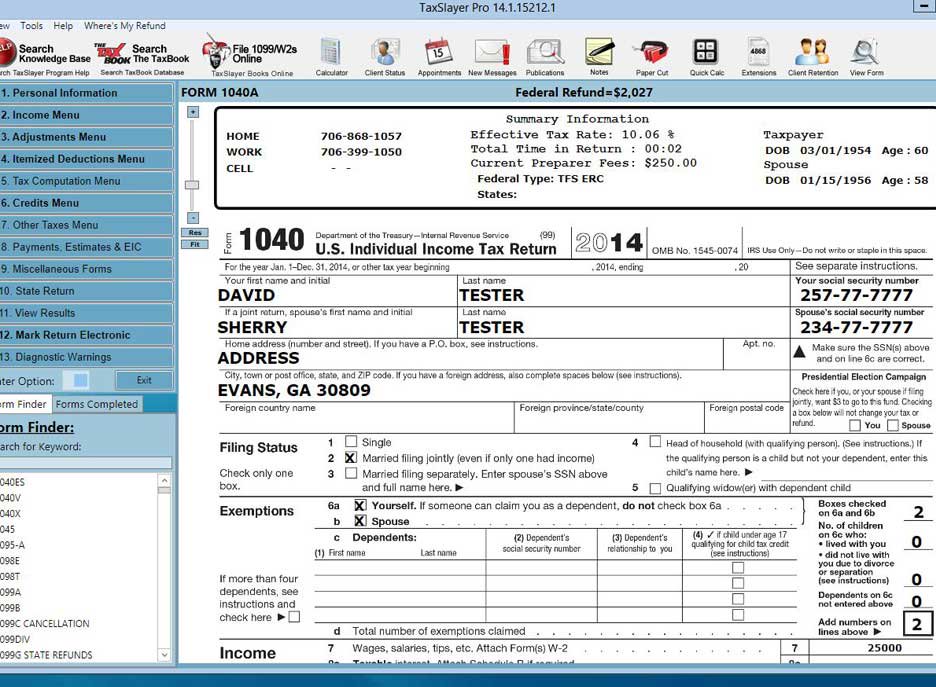

TaxSlayer

Visit Website →Known for its affordability and straightforward interface, particularly appealing to filers comfortable with minimal guidance.

Target Audience

Individuals, Self-Employed, Active Duty Military

Service Offerings

Simply Free

For basic tax situations; includes one free state return.

Classic

Covers all tax situations including deductions/credits; suitable for most filers.

Premium

Adds live chat support, tax pro assistance, and audit assistance.

Self-Employed

Specific guidance and forms for 1099 income and business expenses.

Scorecard (Overall: 8.0 / 10.0)

Pricing Model

Free

Includes free federal and one free state return for simple filings.

Paid

Very competitively priced paid tiers (Classic, Premium, Self-Employed); state filing extra beyond free tier.

Military Offer

Often offers free federal filing for active duty military via Classic.

Pros

- + Very affordable pricing

- + Free federal and state for simple returns

- + Covers complex situations in lower-cost tiers

- + Military discount/offer

Cons

- - Less guidance and hand-holding than top competitors

- - Interface feels somewhat dated

- - Support options can be limited on lower tiers

Verdict

"Great value choice, especially for cost-conscious filers who don't need extensive assistance. The free state return in the basic tier is a plus."

TaxAct

Visit Website →Offers comprehensive tax filing software at a lower price point than the top two competitors, focusing on value and accuracy.

Target Audience

Individuals, Self-Employed, Investors

Service Offerings

Free

Covers simple returns, including W-2 income, unemployment, and retirement income.

Deluxe

Adds itemizations, deductions, credits, adjustments.

Premier

Includes investments, rental property, and foreign bank accounts.

Self-Employed

Handles freelance, contract, and small business income/expenses.

Scorecard (Overall: 8.2 / 10.0)

Pricing Model

Free

Covers basic situations; state filing extra.

Paid

Significantly cheaper paid tiers than TurboTax/H&R Block; state filing costs extra.

Xpert Assist

Optional add-on for access to tax experts at additional cost.

Pros

- + Lower prices than TurboTax and H&R Block

- + Accuracy guarantee ($100k)

- + Good range of forms supported

- + Clear navigation

Cons

- - Interface not as polished as top competitors

- - Free version is somewhat limited

- - State filing fees can add up

- - Support options less robust than H&R Block

Verdict

"A strong value proposition for filers needing more than the basic free options but seeking lower costs than the market leaders."

H&R Block

Visit Website →A major competitor offering online software, downloadable software, and in-person filing options, balancing features with cost.

Target Audience

Individuals, Self-Employed, Investors, Small Business Owners

Service Offerings

Free Online

Handles W-2 income, unemployment income, and student loan interest.

Deluxe

Adds features for homeowners and itemized deductions.

Premium

Suitable for freelancers, contractors, and investors.

Self-Employed

Tailored for small business owners and self-employed individuals.

Tax Pro Assist

Option for on-demand help from tax professionals.

Scorecard (Overall: 8.6 / 10.0)

Pricing Model

Free

Covers more situations than TurboTax Free; state filing extra.

Paid

Tiered pricing for Deluxe, Premium, Self-Employed; state filing usually extra.

Assisted

Higher pricing for Tax Pro assistance or full-service filing.

Pros

- + User-friendly interface

- + Strong free offering

- + Multiple ways to file (online, software, in-person)

- + Good customer support options including physical locations

- + Competitive pricing compared to TurboTax

Cons

- - Slightly less intuitive than TurboTax for some users

- - State filing costs extra for most online versions

- - Upselling exists

Verdict

"Excellent all-around choice offering a great balance of features, usability, support (including in-person), and value."

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

TurboTax

Visit Website →A market leader known for its user-friendly interface, extensive guidance, and comprehensive features catering to various tax situations.

Target Audience

Individuals, Self-Employed, Investors, Small Business Owners

Service Offerings

Free Edition

For simple tax returns only (Form 1040).

Deluxe

Maximizes deductions and credits, handles itemization.

Premier

For investment and rental property income.

Self-Employed

Designed for freelancers, contractors, and small business owners.

TurboTax Live

Provides access to live tax experts for assistance or review.

Scorecard (Overall: 8.5 / 10.0)

Pricing Model

Free

For simple returns; state filing extra.

Paid

Tiered pricing for Deluxe, Premier, Self-Employed; state filing usually additional cost.

Live Assist

Higher cost tiers for access to tax professionals.

Pros

- + Highly intuitive interface

- + Comprehensive guidance and explanations

- + Robust features for complex situations

- + Strong mobile app

- + Live expert assistance available

Cons

- - Most expensive option

- - Free version is very limited

- - Upselling can be persistent

- - State filing costs extra for most versions

Verdict

"Best overall for ease of use and comprehensive features, especially for complex returns, but comes at a premium price."

Final Recommendation

The tax software market offers a diverse range of options, from premium, feature-rich platforms like TurboTax and H&R Block to extremely budget-friendly services like FreeTaxUSA and Cash App Taxes. Key differentiators include the level of user guidance, support options (online vs. in-person), form coverage, and pricing models. Choosing the right provider depends on individual tax complexity, budget, and desired level of support.