Top 10 Payroll Services for Small Business

By Jordan Patel | Published: 2025-03-21 | Category: Payroll Company Small Business

About Payroll Company Small Business

Small business payroll companies automate employee payment processing, tax calculation, filing, and compliance. These services streamline payroll tasks, reducing errors and saving time for business owners.

How We Evaluated

Providers were evaluated based on core payroll features, ease of use, pricing transparency, HR integrations, customer support quality, and scalability for growing businesses. Ratings reflect suitability for typical small business needs.

Rating Criteria

- → Core Payroll Features

- → Ease of Use

- → Pricing & Value

- → HR & Benefits Integration

- → Customer Support

- → Scalability

The Best Payroll Company Small Business

#10

#10

Justworks

Visit Website →Professional Employer Organization (PEO) offering payroll, benefits, HR, and compliance support under a co-employment model.

Target Audience

Small to Medium Businesses, Companies seeking comprehensive HR support and access to large-group benefits

Service Offerings

PEO Services

Co-employment model providing full-service payroll, tax filing, compliance support (workers' comp, EPLI).

- Handles employer responsibilities

Benefits Access

Access to large-group health insurance plans, 401(k), wellness perks.

- Often a key differentiator

HR Platform & Consulting

Online platform for HR tasks (onboarding, PTO), access to HR consultants.

- Included in service

Scorecard (Overall: 8.3 / 10.0)

Pricing Model

Per Employee Per Month (PEPM)

Tiered pricing (Basic and Plus) based on the number of employees. Generally higher cost due to PEO nature.

Pros

- + Access to potentially better and cheaper benefits

- + Comprehensive HR and compliance support

- + Simplified administration under co-employment

- + Modern platform and good support

Cons

- - More expensive than non-PEO payroll services

- - Co-employment model isn't suitable for all businesses

- - Requires commitment to a broader service bundle

Verdict

"Best for businesses wanting to offload HR administration and gain access to enterprise-level benefits, justifying the higher PEO cost."

#9

#9

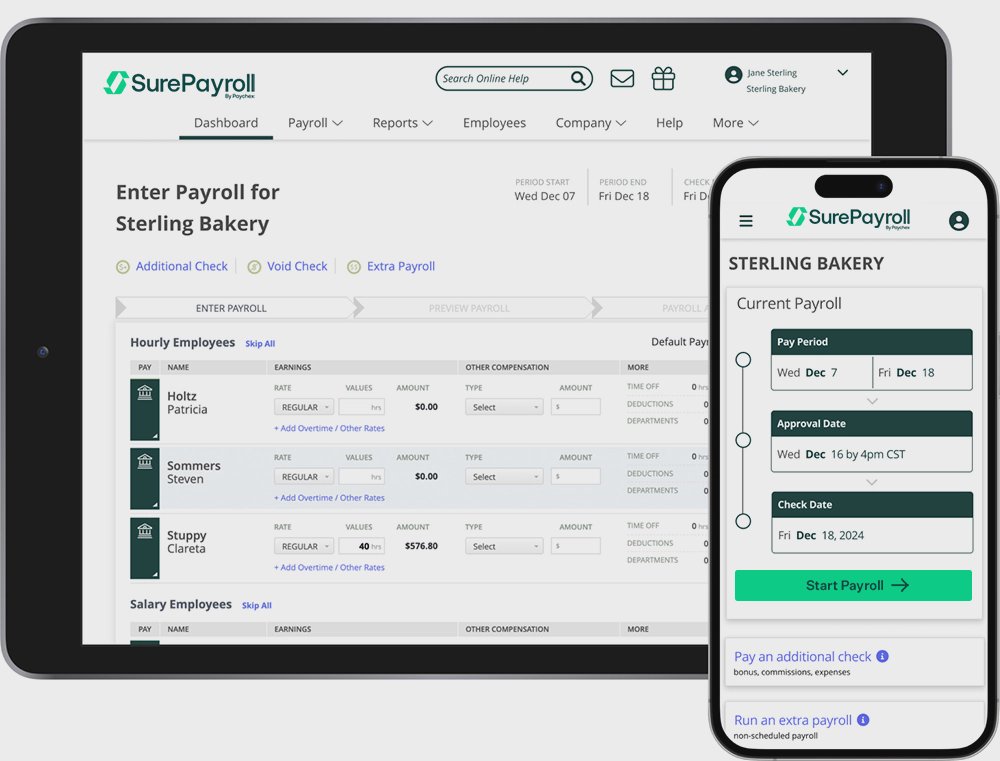

SurePayroll (by Paychex)

Visit Website →Online payroll service designed for simplicity, particularly for household employers and very small businesses, now owned by Paychex.

Target Audience

Very Small Businesses, Household Employers (Nannies, Caregivers), Self-Service Oriented Users

Service Offerings

Small Business Payroll

Online payroll processing, automated tax filing, direct deposit.

- Mobile app

- Multiple pay rates

Nanny Payroll

Specialized service for household employers, handling specific tax requirements.

- Schedule K-1 preparation

Add-ons

Workers' comp, health insurance, 401(k) options.

- Integrations available

Scorecard (Overall: 6.8 / 10.0)

Pricing Model

Subscription

Plans typically involve a base fee plus per-employee cost. Specific pricing often requires a quote.

Pros

- + Very easy to use for basic payroll

- + Strong offering for nanny/household payroll

- + Backed by Paychex infrastructure

- + Mobile payroll capabilities

Cons

- - Fewer features than Paychex Flex or ADP RUN

- - Pricing can be less transparent than some competitors

- - Limited HR functionality included

Verdict

"A good choice for very small businesses or household employers prioritizing simplicity and ease of use for core payroll tasks."

#8

#8

Patriot Software

Visit Website →Affordable online payroll and accounting software focused on simplicity for small businesses.

Target Audience

Budget-conscious Small Businesses, Businesses needing basic payroll or payroll + accounting

Service Offerings

Basic Payroll

Run payroll, direct deposit, employee portal. You handle tax filings.

- Lowest cost option

Full Service Payroll

Includes automated tax filings (federal, state, local).

- Most popular option

Add-ons

Time tracking, HR software.

- Optional modules

Scorecard (Overall: 7.3 / 10.0)

Pricing Model

Subscription

Choice between Basic and Full Service tiers. Very low base fee plus per-employee cost. Add-ons extra.

Pros

- + Highly affordable pricing, especially for basic needs

- + Easy-to-use interface

- + Good customer support reputation

- + Option for integrated accounting software

Cons

- - Basic Payroll requires manual tax filings

- - HR and benefits features are limited or require add-ons

- - Not as feature-rich as premium competitors

Verdict

"Best for budget-focused small businesses needing simple, reliable payroll without extensive HR features."

#7

#7

OnPay

Visit Website →Straightforward, all-in-one payroll and HR service with simple, transparent pricing.

Target Audience

Very Small Businesses, Specific industries like Restaurants, Farms, Non-profits

Service Offerings

Full-Service Payroll

Unlimited payroll runs, multi-state payroll, tax filings (all levels), W-2/1099 processing.

- Handles garnishments

- Direct deposit or checks

Basic HR Tools

Onboarding, offer letters, employee self-service, PTO tracking, compliance resources.

- Included in single plan

Benefits Integration

Health, dental, vision, 401(k), workers' comp.

- Integrated brokers or bring your own

Scorecard (Overall: 7.8 / 10.0)

Pricing Model

Subscription

Single comprehensive plan with a base fee plus a per-employee cost. No hidden fees.

Pros

- + Simple, transparent, all-inclusive pricing

- + Good feature set for the price

- + Strong handling of multi-state payroll and specific industry needs

- + Helpful customer support

Cons

- - Interface not as slick as some competitors

- - Limited advanced HR features

- - Fewer third-party integrations compared to larger platforms

Verdict

"Best value for very small businesses needing straightforward payroll and basic HR without complex tiers or hidden fees."

#6

#6

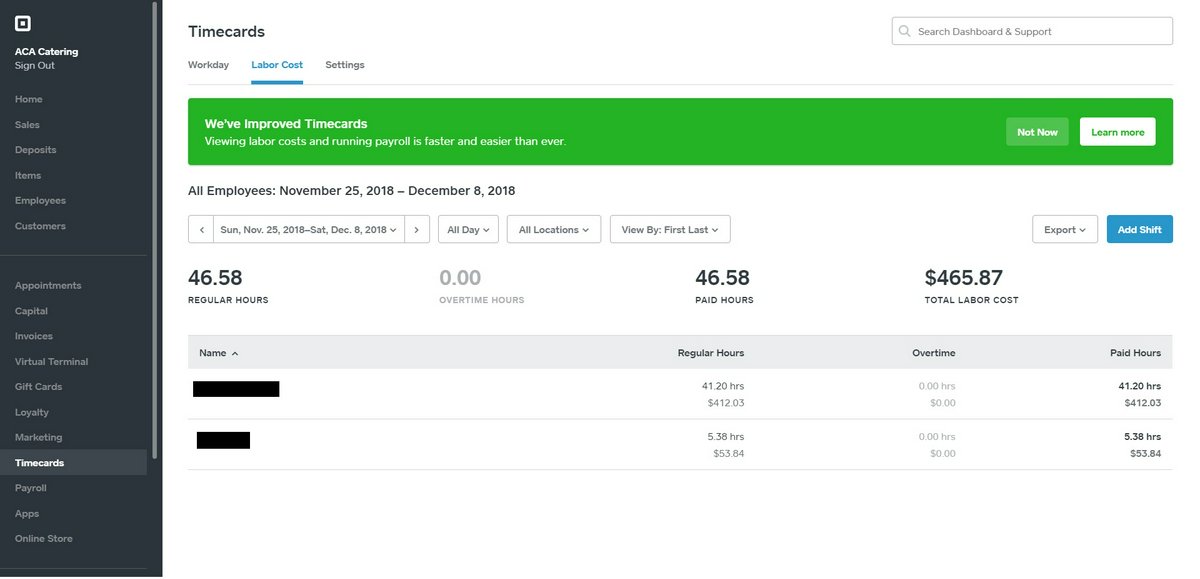

Square Payroll

Visit Website →Simple payroll solution integrated with the Square point-of-sale (POS) and business management system.

Target Audience

Businesses using Square POS, Retailers, Restaurants, Contractor-heavy businesses

Service Offerings

Payroll Processing

Payroll for W-2 employees and 1099 contractors, automated tax filings, direct deposit.

- Syncs with Square POS timecards

- Employee app

Benefits

Access to health insurance and workers' comp through partners.

- Basic benefits integration

Contractor Payments

Option to pay only 1099 contractors.

- Competitive pricing for contractor-only plan

Scorecard (Overall: 7.3 / 10.0)

Pricing Model

Subscription

Simple pricing with a base fee plus per-person paid cost. Separate, lower-cost plan for contractor-only payments.

Pros

- + Seamless integration with Square POS

- + Very simple and easy to use interface

- + Transparent and affordable pricing

- + Good option for businesses paying mostly contractors

Cons

- - Limited HR features and integrations

- - Reporting options are basic

- - Less ideal for businesses not using other Square products

Verdict

"Excellent value and simplicity for businesses already using Square, especially those in retail or food service, or primarily paying contractors."

#5

#5

QuickBooks Payroll

Visit Website →Payroll service integrated directly within the QuickBooks accounting ecosystem.

Target Audience

Existing QuickBooks users, Small businesses seeking integrated accounting and payroll

Service Offerings

Integrated Payroll

Payroll processing, automated tax calculation and filing, direct deposit.

- Seamless sync with QuickBooks accounting

- Employee portal

HR & Benefits

Basic HR support, workers' comp admin, health benefits integration (via partners).

- Varies by plan (Core, Premium, Elite)

Time Tracking

Integrated via QuickBooks Time (formerly TSheets).

- May require separate subscription or higher tier

Scorecard (Overall: 7.7 / 10.0)

Pricing Model

Subscription

Tiered plans with a base fee plus per-employee cost. Often bundled or discounted with QuickBooks accounting.

Pros

- + Excellent integration with QuickBooks accounting

- + Familiar interface for QuickBooks users

- + Automated tax features work well

- + Competitive pricing, especially when bundled

Cons

- - Best suited for those already using QuickBooks

- - HR features are less robust than dedicated HR platforms

- - Customer support quality can be inconsistent

Verdict

"The best choice for small businesses already heavily invested in the QuickBooks ecosystem."

#4

#4

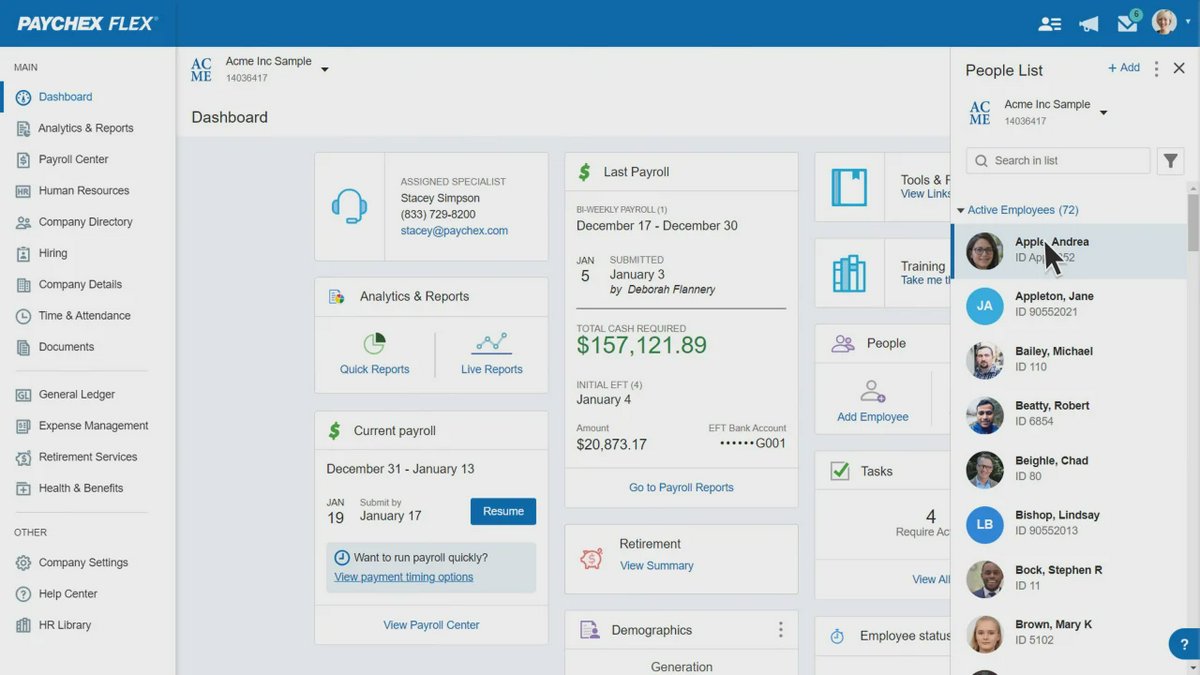

Paychex Flex

Visit Website →Comprehensive payroll and HR platform from another industry giant, scalable from small businesses to enterprises.

Target Audience

Small to Medium Businesses, Businesses needing scalable HR and payroll

Service Offerings

Payroll & Taxes

Online payroll, tax administration, direct deposit, reporting.

- Mobile access

- Multiple input methods

HR Solutions

Hiring, onboarding, performance management, benefits admin, compliance services.

- Modular approach based on plan

Time & Attendance

Integrated time tracking solutions.

- Web and hardware options

Scorecard (Overall: 8.0 / 10.0)

Pricing Model

Quote-Based

Tiered plans (Essentials, Select, Pro) requiring a custom quote based on needs.

Pros

- + Highly scalable platform

- + Extensive range of HR services available

- + Strong compliance features and support

- + Dedicated specialists often assigned

Cons

- - Pricing lacks transparency and can be expensive

- - Interface can be complex for simple needs

- - Add-on costs can accumulate

Verdict

"Ideal for growing businesses needing a scalable solution with extensive HR capabilities and strong support, similar to ADP."

#3

#3

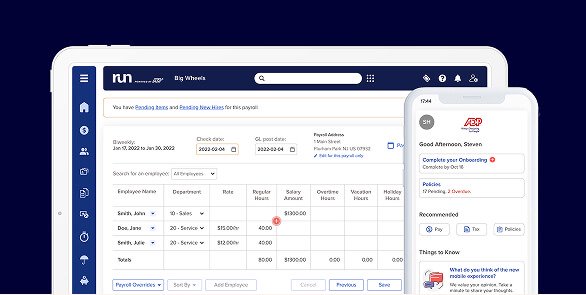

ADP RUN

Visit Website →Payroll and HR solution from a large, established provider, specifically tailored for small businesses.

Target Audience

Small Businesses (1-49 employees), Businesses seeking established brand and compliance expertise

Service Offerings

Payroll Processing

Automated payroll, tax filing, direct deposit, reporting.

- Multiple package options

- Mobile app available

HR Services

Hiring tools, background checks, compliance database, HR support.

- Varies by package level

Add-ons

Time tracking, benefits administration, workers' compensation.

- Integrates with ADP ecosystem

Scorecard (Overall: 8.0 / 10.0)

Pricing Model

Quote-Based

Customized pricing based on package, number of employees, and selected features. Often requires contacting sales.

Pros

- + Strong compliance support and expertise

- + Robust feature set, especially in higher tiers

- + Scalable within the ADP ecosystem

- + Dedicated support often available

Cons

- - Pricing is not transparent and can be high

- - Interface can feel dated or complex compared to newer platforms

- - Can feel like upselling for additional features

Verdict

"A solid choice for businesses prioritizing compliance and brand reputation, willing to pay for robust features and support."

#2

#2

Rippling

Visit Website →Unified workforce platform combining Payroll, HR, IT, and Finance management.

Target Audience

Tech-savvy SMBs, Companies seeking integrated workforce management

Service Offerings

Global Payroll

Payroll processing across multiple countries, automated tax filing, compliance management.

- Real-time calculations

- Direct deposit

HR Cloud

Onboarding/offboarding automation, time tracking, performance management, benefits admin.

- Highly customizable workflows

IT Cloud

App and device management integrated with employee lifecycle.

- Unique offering among payroll providers

Scorecard (Overall: 8.7 / 10.0)

Pricing Model

Modular Subscription

Starts with a core platform fee plus per-employee costs; modules (Payroll, HR, IT) are add-ons.

Pros

- + Extremely powerful integration across HR, IT, and Payroll

- + Highly scalable for growth and complexity

- + Strong automation capabilities

Cons

- - Can be more expensive, especially with multiple modules

- - Complexity might be overkill for very small businesses

- - Requires buying the core platform

Verdict

"Best for businesses needing a comprehensive, integrated platform for HR, Payroll, and IT."

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

#1

#1

Gusto

Visit Website →Modern, user-friendly payroll platform with strong emphasis on employee experience and integrated HR tools.

Target Audience

Startups, Small Businesses, Tech Companies

Service Offerings

Full-Service Payroll

Automated payroll processing, tax filing (federal, state, local), direct deposit, W-2s/1099s.

- Unlimited payroll runs

- Employee self-service portal

- New hire reporting

HR Tools

Onboarding, employee directory, time tracking, PTO management.

- Available on higher tiers

- Compliance assistance

Benefits Administration

Health insurance, 401(k), workers' comp integration.

- Broker integration available

Scorecard (Overall: 8.8 / 10.0)

Pricing Model

Subscription

Tiered plans (Simple, Plus, Premium) with a base fee plus a per-employee cost.

Pros

- + Exceptionally intuitive interface

- + Excellent employee self-service features

- + Good integration of payroll, basic HR, and benefits

Cons

- - Phone support can have wait times

- - Higher tiers required for advanced HR features

- - Can become pricey for larger teams compared to some basic processors

Verdict

"Best overall for modern small businesses prioritizing ease of use and integrated HR/benefits."

Final Recommendation

Choosing a small business payroll provider involves balancing cost, ease of use, features, and support. Modern platforms like Gusto offer excellent usability, while established players like ADP and Paychex provide robust compliance and scalability. Integrated solutions like QuickBooks Payroll and Square Payroll appeal to existing platform users, and value options like OnPay and Patriot Software cater to budget-conscious businesses. PEOs like Justworks offer comprehensive HR outsourcing and benefits access at a higher price point.