Top 10 Business Insurance Providers

By Amanda Reyes | Published: Not Applicable | Category: Business Insurance

About Business Insurance

Business insurance protects companies from financial losses resulting from operational risks, such as property damage, liability claims, or employee injuries. Coverage types vary widely to address diverse business needs and potential exposures.

How We Evaluated

Providers were evaluated based on coverage options, financial strength ratings, customer service reputation, pricing competitiveness, and digital accessibility for quotes and policy management. Scores reflect a composite assessment across these key areas.

Rating Criteria

- → Coverage Options

- → Customer Service

- → Financial Strength

- → Pricing/Value

- → Digital Experience

The Best Business Insurance

Next Insurance

Visit Website →An insurtech company focused on providing simple, affordable, and tailored insurance for small businesses and self-employed individuals via an entirely online platform.

Target Audience

Small Businesses, Micro-Businesses, Self-Employed Professionals, Contractors, Retailers

Service Offerings

General Liability

Core liability coverage tailored by profession.

Professional Liability (E&O)

Coverage for errors in professional services.

Workers' Compensation

Covers employee work injuries.

Commercial Auto

Insurance for business vehicles.

Tools & Equipment Insurance

Inland marine coverage for business property.

Scorecard (Overall: 8.0 / 10.0)

Pricing Model

Customized

Transparent, competitive pricing with instant online quotes. Monthly payment options often available.

Pros

- + Fast, fully online quote and purchase process

- + Competitive pricing, tailored for small businesses

- + User-friendly platform and mobile app

- + Instant certificates of insurance

Cons

- - Newer company with less history than traditional carriers

- - Coverage options may not be as comprehensive for complex risks

- - Financial strength ratings are good but may not match legacy insurers (Backed by reputable carriers like Munich Re)

Verdict

"Ideal for small businesses and self-employed individuals who prioritize speed, affordability, and a seamless digital experience for standard coverages."

CNA Financial

Visit Website →A major commercial insurer focused on providing specialized insurance solutions for businesses across various industries, primarily through independent agents.

Target Audience

Mid-Sized Businesses, Large Businesses, Specific Industries (Construction, Healthcare, Technology, Professional Services)

Service Offerings

Industry-Specific Solutions

Tailored coverage programs for specific sectors.

- Deep expertise in target industries

Professional Liability (E&O)

Specialized E&O for various professions.

Management Liability

D&O, EPLI, Fiduciary coverage.

Cyber Insurance

Protection against cyber threats.

Scorecard (Overall: 7.2 / 10.0)

Pricing Model

Customized

Pricing reflects specialized coverage and risk expertise, obtained via agents.

Pros

- + Strong industry specialization and expertise

- + Wide range of commercial insurance products

- + Good financial strength (A rating from AM Best typical)

- + Offers risk control services

Cons

- - Primarily serves mid-to-large businesses

- - Less focus on small 'Main Street' businesses

- - Works through independent agents, limited direct interaction

Verdict

"A strong contender for mid-sized and larger businesses in specific industries needing tailored coverage and expert risk management."

Liberty Mutual

Visit Website →A large global insurer offering a wide range of business insurance products, including strong workers' compensation and commercial package policies.

Target Audience

Small Businesses, Mid-Sized Businesses, Large Corporations

Service Offerings

Workers' Compensation

Comprehensive coverage with risk control and claims management.

- Focus on return-to-work programs

Commercial Package Policy (CPP)

Customizable package of coverages for larger businesses.

Business Owner's Policy (BOP)

Standard package for smaller businesses.

Commercial Auto

Coverage for business fleets.

Scorecard (Overall: 7.4 / 10.0)

Pricing Model

Customized

Quotes available through independent agents, captive agents, or directly online for some small business products.

Pros

- + Broad range of products for various business sizes

- + Strong workers' compensation offerings

- + Multiple channels for purchasing (agent, direct)

- + Good financial strength (A rating from AM Best typical)

Cons

- - Customer service reviews can be inconsistent

- - Can sometimes be more expensive depending on the risk

Verdict

"A versatile provider suitable for many businesses, particularly those looking for robust workers' compensation coverage and flexible purchasing options."

State Farm

Visit Website →Largest US property and casualty insurer, offering business insurance primarily through its extensive network of captive agents.

Target Audience

Small Businesses, Main Street Businesses

Service Offerings

Business Owner's Policy (BOP)

Package policy for small businesses.

Commercial Liability Umbrella

Additional liability protection above underlying policies.

Workers' Compensation

Coverage for employee injuries (availability varies by state).

Commercial Auto

Insurance for business vehicles.

Scorecard (Overall: 7.6 / 10.0)

Pricing Model

Customized

Quotes obtained exclusively through State Farm agents.

Pros

- + Exceptional financial strength (A++ AM Best rating typical)

- + Vast network of local agents providing personalized service

- + Strong brand recognition and stability

- + Good customer satisfaction ratings generally

Cons

- - Must work through a captive agent (no direct online quotes/purchase)

- - Coverage options may be less specialized than some competitors

- - Digital tools primarily agent-focused

Verdict

"A reliable option for small businesses that value a personal relationship with a local agent and prioritize financial stability."

Progressive Commercial

Visit Website →Known primarily for commercial auto insurance, Progressive also offers BOP, general liability, and other coverages, often directly or through agents.

Target Audience

Small Businesses, Contractors, Trucking Businesses, Businesses with Vehicle Fleets

Service Offerings

Commercial Auto Insurance

Leading provider for various types of business vehicles.

- Covers trucks, vans, cars

- Specialized coverage for truckers

Business Owner's Policy (BOP)

Bundled property and liability.

General Liability

Third-party liability protection.

Professional Liability

Coverage for service-based errors or negligence.

Scorecard (Overall: 7.8 / 10.0)

Pricing Model

Customized

Often competitive, especially for commercial auto; online quotes available for some products.

Pros

- + Market leader in commercial auto insurance

- + Competitive pricing, particularly for auto

- + Good online tools and direct purchase options for some policies

- + Strong financial stability

Cons

- - Broader business coverage options may be less extensive than some competitors

- - Service experience can vary

Verdict

"An excellent choice for businesses where commercial auto insurance is a primary need, offering competitive rates and convenient online access."

Travelers

Visit Website →One of the largest commercial property casualty insurers in the US, offering extensive products and risk control services for businesses of all sizes.

Target Audience

Small Businesses, Mid-Sized Businesses, Large Corporations, Specific Industries (Construction, Technology, Public Sector)

Service Offerings

Business Owner's Policy (BOP)

Package policy combining key coverages.

General Liability

Core liability protection.

Cyber Insurance

Coverage for cyber risks and data breaches.

Surety Bonds

Bonds guaranteeing contractual obligations.

Risk Control Services

Resources and expertise to help businesses manage risk.

Scorecard (Overall: 7.8 / 10.0)

Pricing Model

Customized

Quotes generally provided via independent agents, tailored to specific business risks.

Pros

- + Very broad range of coverages and industry specializations

- + Excellent financial strength (A++ AM Best rating typical)

- + Strong risk control resources

- + Large network of independent agents

Cons

- - Customer service ratings can be mixed

- - Primarily works through agents, less direct online functionality for complex policies

Verdict

"A leading choice for businesses needing comprehensive coverage options, specialized industry expertise, and risk management support, typically accessed via agents."

Nationwide

Visit Website →A large, diversified insurance company offering a broad suite of business insurance products for various industries and sizes, often through agents.

Target Audience

Small Businesses, Mid-Sized Businesses, Specific Industries (e.g., Agriculture, Contractors)

Service Offerings

Business Owner's Policy (BOP)

Combined property and liability coverage.

Commercial Auto

Coverage for business vehicles.

- Telematics options may be available

Workers' Compensation

Covers employee work-related injuries.

Specialty Programs

Tailored insurance for specific industries like farms and ranches.

Scorecard (Overall: 7.6 / 10.0)

Pricing Model

Customized

Quotes typically obtained through agents, pricing varies by risk profile.

Pros

- + Strong financial stability (A+ AM Best rating typical)

- + Wide range of insurance products available

- + Offers specialized industry programs

- + Strong agent network for personalized service

Cons

- - Digital experience might not be as seamless as some competitors

- - Customer service experiences can vary depending on the agent

Verdict

"A solid, reliable choice for businesses seeking a wide array of coverages and preferring to work with a local agent."

Hiscox

Visit Website →Specializes in small business insurance, particularly for professional services, consultants, and technology firms, offering tailored policies and a strong online platform.

Target Audience

Small Businesses, Micro-Businesses, Consultants, Freelancers, Professional Services

Service Offerings

Professional Liability (E&O)

Covers claims of negligence or errors in professional services.

- Industry-specific tailoring

General Liability

Protection against third-party injury or property damage claims.

Cyber Security Insurance

Covers costs associated with data breaches and cyber attacks.

Business Owner's Policy (BOP)

Bundled property and liability coverage for small businesses.

Scorecard (Overall: 8.0 / 10.0)

Pricing Model

Customized

Competitive pricing for target professions, often with online quote options.

Pros

- + Excellent online quote and purchase process

- + Specializes in professional services and small businesses

- + Competitive pricing for target markets

- + Tailored E&O policies

Cons

- - Limited appetite for high-risk industries or large businesses

- - Coverage options may be less broad than larger carriers

Verdict

"A great option for small businesses, consultants, and tech startups needing core coverages like E&O and GL, with a convenient online experience."

Chubb

Visit Website →A global leader recognized for its specialized coverage options, catering to businesses of all sizes, including complex and international risks.

Target Audience

Small Businesses, Mid-Sized Businesses, Large Corporations, Multinational Companies

Service Offerings

Customized Industry Solutions

Tailored insurance programs for specific industries like technology, finance, and manufacturing.

Cyber Insurance

Comprehensive coverage for data breaches and cyber threats.

- Incident response services included

Management Liability (D&O, EPLI)

Protection for directors, officers, and the company against management-related lawsuits.

Global Casualty

Liability coverage for businesses operating internationally.

Scorecard (Overall: 8.4 / 10.0)

Pricing Model

Customized

Reflects tailored coverage and high service levels; generally positioned as premium.

Pros

- + Superior coverage breadth and depth

- + Exceptional financial strength (A++ AM Best rating typical)

- + Excellent claims service reputation

- + Expertise in complex and international risks

Cons

- - Typically higher premiums than average

- - May be overly comprehensive for very small/simple businesses

Verdict

"Top-tier provider for businesses needing specialized, robust coverage and willing to pay a premium for quality and service."

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

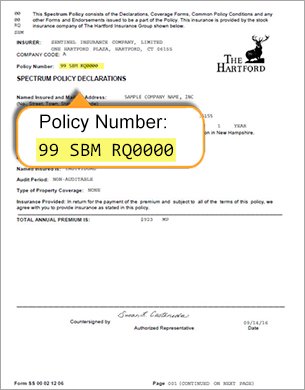

The Hartford

Visit Website →A leading provider known for its wide range of business insurance products, particularly strong in small business coverage and workers' compensation.

Target Audience

Small Businesses, Mid-Sized Businesses

Service Offerings

Business Owner's Policy (BOP)

Combines general liability and property insurance into one package.

- Customizable coverage

- Industry-specific endorsements available

Workers' Compensation

Covers medical expenses and lost wages for employees injured on the job.

- Strong claims management

- Risk management services

General Liability

Protects against third-party claims of bodily injury or property damage.

Commercial Auto

Covers vehicles used for business purposes.

Scorecard (Overall: 8.2 / 10.0)

Pricing Model

Customized

Quotes tailored based on business size, industry, risk factors, and coverage needs.

Pros

- + Strong reputation, especially for small businesses

- + Wide range of customizable coverages

- + Excellent financial stability (A+ AM Best rating typical)

- + Good customer service and claims handling

Cons

- - Can be more expensive than some competitors

- - Digital tools may lag behind some newer insurtechs

Verdict

"Excellent all-around choice, particularly strong for small businesses seeking comprehensive coverage and reliable service."

Final Recommendation

Choosing the right business insurance provider depends heavily on your company's size, industry, specific risks, and preference for service interaction (agent vs. online). Leading providers offer strong financial backing and broad coverages, while newer entrants excel in digital convenience and competitive pricing for smaller businesses.