Top 10 Best Personal Loans for Borrowers

By Jordan Patel | Published: 2025-02-24 | Category: Best Personal Loans

About Best Personal Loans

Personal loans offer borrowers a lump sum of cash that can be used for various purposes, repaid in fixed monthly installments over a set period. These loans are typically unsecured, meaning they don't require collateral.

How We Evaluated

Providers were evaluated based on factors including annual percentage rate (APR) ranges, loan amount flexibility, applicable fees, minimum credit score requirements, repayment term options, and funding speed.

Rating Criteria

- → APR Range

- → Loan Amounts

- → Fees Structure

- → Credit Requirements

- → Repayment Terms

- → Funding Speed

The Best Best Personal Loans

Discover Personal Loans

Visit Website →Well-known financial services company offering no-fee personal loans with flexible repayment terms and direct debt payoff option.

Target Audience

Good to Excellent Credit, Debt Consolidation, Customers seeking no fees

Service Offerings

Personal Loan

Unsecured loans for various purposes like debt consolidation, home improvement, and major purchases.

- Loan amounts $2,500 to $40,000

- Terms from 3 to 7 years

- Funding can take up to 7 days, though sometimes faster

- Direct payoff option for consolidation

Scorecard (Overall: 7.7 / 10.0)

Pricing Model

APR Range

Competitive fixed rates for qualified borrowers.

Origination Fee

No origination fees.

Late Fee

May charge a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + No origination or prepayment fees

- + Flexible repayment terms (up to 7 years)

- + Direct payment option for debt consolidation

- + Generally positive customer service reputation

- + Soft credit check available

Cons

- - Requires good credit (typically 660+)

- - Lower maximum loan amount ($40,000)

- - Funding can be slower than top competitors

Verdict

"A reliable choice from a trusted brand, especially appealing for its lack of origination fees and flexible terms, suited for borrowers with good credit."

Prosper

Visit Website →A peer-to-peer lending platform connecting borrowers with investors for unsecured personal loans.

Target Audience

Fair to Good Credit (minimum 640 typical), Debt Consolidation, Home Improvement

Service Offerings

Personal Loan

Fixed-rate, unsecured loans funded by individual or institutional investors.

- Loan amounts $2,000 to $50,000

- Terms of 2, 3, 4, or 5 years

- Funding usually takes several business days

Scorecard (Overall: 6.3 / 10.0)

Pricing Model

APR Range

Rates dependent on Prosper Rating (based on credit and other factors).

Origination Fee

Charges an origination fee (1% to 5%).

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + Allows joint applications

- + Multiple term lengths available (2-5 years)

- + Soft credit check for pre-qualification

- + Considers factors beyond just credit score

Cons

- - Charges origination fees

- - Funding can be slower due to P2P model

- - Minimum credit score requirement (around 640)

Verdict

"A pioneer P2P lender suitable for borrowers with fair to good credit, offering joint applications, but factor in origination fees and potentially slower funding."

LendingClub

Visit Website →Originally a peer-to-peer platform, now operating as a bank, offering personal loans primarily for debt consolidation and credit card refinancing.

Target Audience

Fair to Good Credit, Debt Consolidation, Joint Applicants

Service Offerings

Personal Loan

Unsecured loans with options for joint applications and direct creditor payments for consolidation.

- Loan amounts $1,000 to $40,000

- Terms typically 3 or 5 years

- Funding takes a few days on average

Scorecard (Overall: 6.3 / 10.0)

Pricing Model

APR Range

Rates vary based on creditworthiness and loan characteristics.

Origination Fee

Charges an origination fee (3% to 8%).

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + Accepts joint applications

- + Direct payment to creditors for consolidation

- + Soft credit check for pre-qualification

- + Accessible minimum loan amount ($1,000)

Cons

- - Charges potentially high origination fees (up to 8%)

- - Lower maximum loan amount ($40,000)

- - Limited term options

- - Funding can be slower than some competitors

Verdict

"A decent option, particularly for debt consolidation with direct creditor payments or for joint applicants, but be mindful of the origination fees."

Upgrade

Visit Website →Fintech company offering personal loans, credit cards, and financial health tools, accessible to a wide range of credit scores.

Target Audience

Fair to Excellent Credit, Debt Consolidation, Credit Building

Service Offerings

Personal Loan

Fixed-rate personal loans, often used for debt consolidation or large purchases, with options for direct creditor payments.

- Loan amounts $1,000 to $50,000

- Terms from 2 to 7 years

- Funding within a few business days

- Secured and joint loan options available

Scorecard (Overall: 7.2 / 10.0)

Pricing Model

APR Range

Broad APR range accommodating various credit profiles.

Origination Fee

Charges an origination fee (1.85% to 8.99%).

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + Accessible to fair credit borrowers (minimum score around 560-600)

- + Wide range of loan terms (up to 7 years)

- + Direct payment option for debt consolidation

- + Secured and joint loans offered

- + Soft credit check for pre-qualification

Cons

- - Charges origination fees

- - APRs can be high for those with lower credit scores

Verdict

"A versatile option suitable for a broad range of borrowers, including those with fair credit, offering flexible terms and features like direct debt payoff."

Best Egg

Visit Website →Online lender offering fast funding for personal loans, primarily targeting borrowers with good to excellent credit.

Target Audience

Good to Excellent Credit, Debt Consolidation, Fast Funding Needs

Service Offerings

Personal Loan

Unsecured personal loans for various needs, known for quick application and funding process.

- Loan amounts $2,000 to $50,000

- Terms from 3 to 5 years

- Funding often possible within 1 business day

- Secured loan option available using vehicle equity

Scorecard (Overall: 7.0 / 10.0)

Pricing Model

APR Range

Competitive rates for strong credit profiles.

Origination Fee

Charges an origination fee (0.99% to 8.99%).

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + Very fast funding possible

- + Soft credit check for pre-qualification

- + Good customer service ratings generally

- + Secured loan option available

Cons

- - Charges an origination fee

- - Primarily serves borrowers with good credit (typically 640+)

- - Limited repayment term options

Verdict

"Excellent for borrowers with good credit who prioritize speed of funding, though origination fees apply."

Avant

Visit Website →Online lender focused on providing personal loans to borrowers with fair to average credit scores.

Target Audience

Fair Credit Borrowers (scores around 600-700), Debt Consolidation

Service Offerings

Personal Loan

Unsecured and secured personal loan options for debt consolidation, emergencies, and other expenses.

- Loan amounts typically $2,000 to $35,000

- Terms from 2 to 5 years

- Funding as soon as the next business day

Scorecard (Overall: 6.7 / 10.0)

Pricing Model

APR Range

APRs tend to be higher, reflecting the target credit profile.

Origination Fee

Charges an administration fee (origination fee) up to 4.75%.

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + Accessible for borrowers with fair credit (down to 580 reported)

- + Fast funding possible

- + Soft credit check for pre-qualification

- + Offers secured loan option

Cons

- - Higher APRs compared to prime lenders

- - Charges an administration (origination) fee

- - Lower maximum loan amount ($35,000)

Verdict

"A solid choice for those with less-than-perfect credit who need fast access to funds, despite potentially higher costs."

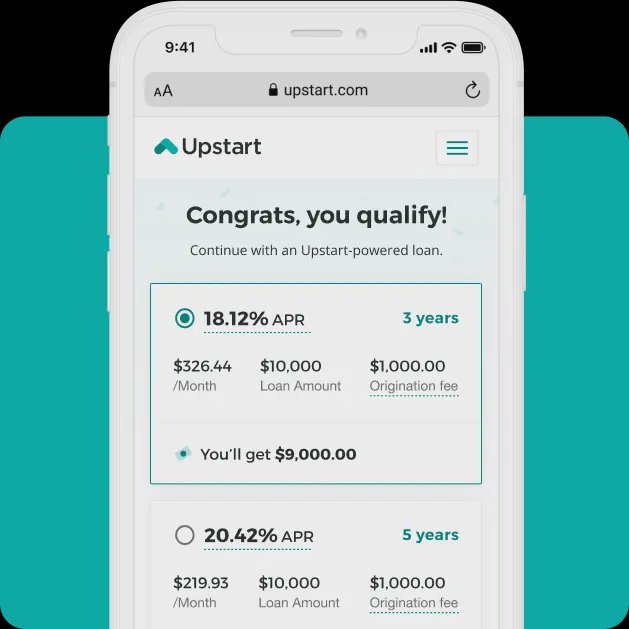

Upstart

Visit Website →An online lending platform using AI and alternative data (like education and employment) alongside credit scores for loan approval.

Target Audience

Fair to Good Credit, Thin Credit Files, Recent Graduates

Service Offerings

Personal Loan

Unsecured loans available for various purposes, considering factors beyond just credit score.

- Loan amounts $1,000 to $50,000

- Terms of 3 or 5 years

- Funding as fast as next business day

Scorecard (Overall: 7.3 / 10.0)

Pricing Model

APR Range

Wide range of APRs, potentially higher for lower credit scores.

Origination Fee

May charge an origination fee (0% to 12% of loan amount).

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + Considers factors beyond credit score

- + Accessible to borrowers with fair credit or limited credit history

- + Low minimum loan amount ($1,000)

- + Fast funding possible

- + Soft credit check for pre-qualification

Cons

- - Origination fees can be high (up to 12%)

- - Limited repayment term options (3 or 5 years)

- - APRs can be high for less qualified borrowers

Verdict

"Great option for borrowers with fair credit or thin files who might be overlooked by traditional lenders, but watch out for potential fees."

Marcus by Goldman Sachs

Visit Website →Online lending platform offering fixed-rate, no-fee personal loans, primarily for debt consolidation and home improvement.

Target Audience

Good to Excellent Credit, Debt Consolidation

Service Offerings

Personal Loan

Unsecured loans often used for consolidating credit card debt or funding home projects.

- Loan amounts $3,500 to $40,000

- Terms from 3 to 6 years

- On-time payment reward (defer one payment after 12 consecutive on-time payments)

Scorecard (Overall: 7.7 / 10.0)

Pricing Model

APR Range

Competitive fixed rates.

Origination Fee

No origination fees.

Late Fee

Charges a late fee if payment isn't made within grace period.

Prepayment Penalty

No prepayment penalties.

Pros

- + No origination or prepayment fees

- + On-time payment reward feature

- + Direct payment option for credit card consolidation

- + Soft credit check for pre-qualification

Cons

- - Lower maximum loan amount ($40,000) compared to some competitors

- - Not available in all states

- - Requires good credit

Verdict

"A strong contender for debt consolidation, especially for those who value a no-origination-fee loan and reward timely payments."

LightStream

Visit Website →Provides unsecured personal loans for nearly any purpose to borrowers with good to excellent credit. Known for Rate Beat program and no fees.

Target Audience

Excellent Credit, Home Improvement Loans, Auto Loans

Service Offerings

Personal Loan (AnythingLoan)

Fixed-rate loans for a wide variety of purposes, including unique ones like tiny homes or IVF.

- Loan amounts $5,000 to $100,000

- Terms from 2 to 12 years (depending on loan purpose)

- Potential same-day funding

Scorecard (Overall: 8.7 / 10.0)

Pricing Model

APR Range

Offers some of the lowest rates available, autopay discount possible.

Origination Fee

No origination fees.

Late Fee

No late fees.

Prepayment Penalty

No prepayment penalties.

Pros

- + No fees (origination, late, prepayment)

- + High maximum loan amount

- + Long repayment terms available for certain loans

- + Rate Beat program may lower competitor's rate

- + Fast funding possible

Cons

- - Requires excellent credit history (typically 680+, often higher)

- - No pre-qualification; requires hard credit pull for rate check

- - Minimum loan amount is $5,000

Verdict

"Top-tier option for borrowers with excellent credit who want a fee-free experience and potentially very low rates."

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

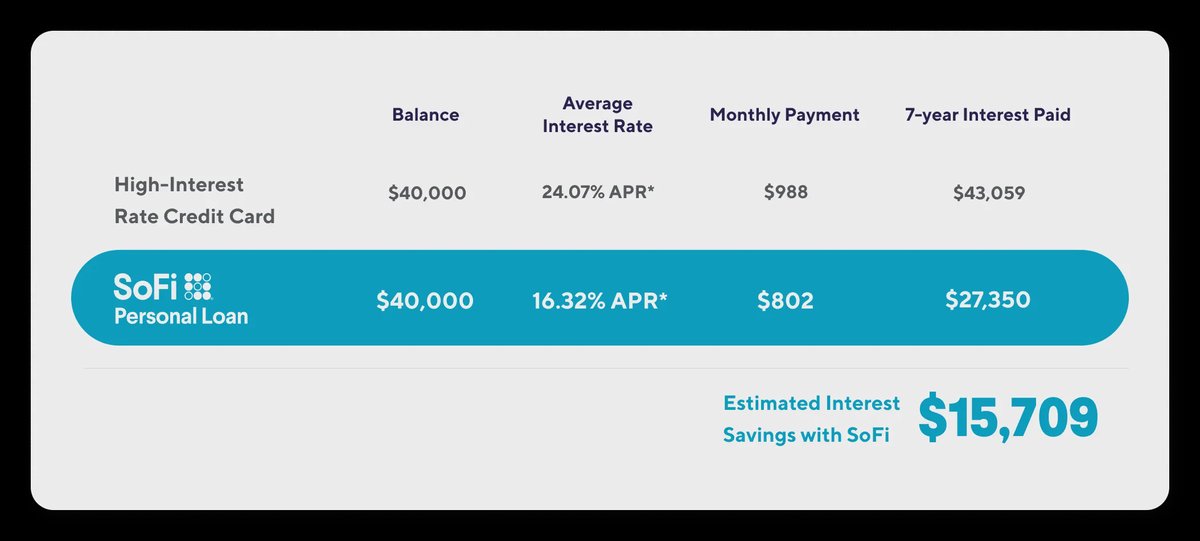

SoFi

Visit Website →Offers competitive rates on unsecured personal loans, particularly for borrowers with good to excellent credit. Known for member benefits and no fees.

Target Audience

Good to Excellent Credit, High-Income Earners, Debt Consolidation

Service Offerings

Personal Loan

Unsecured loans for debt consolidation, home improvement, major purchases, and more.

- Loan amounts typically $5,000 to $100,000

- Terms from 2 to 7 years

- Fast funding possible

- Unemployment protection available

Scorecard (Overall: 8.7 / 10.0)

Pricing Model

APR Range

Competitive variable and fixed rates, often requires good credit.

Origination Fee

No origination fees charged.

Late Fee

Charges a late fee.

Prepayment Penalty

No prepayment penalties.

Pros

- + No origination, prepayment, or late fees mentioned typically

- + High loan amounts available ($100,000)

- + Member benefits like career coaching

- + Unemployment protection feature

Cons

- - Requires good to excellent credit (typically 680+)

- - Income verification can be stringent

Verdict

"Excellent choice for borrowers with strong credit seeking large loan amounts and zero fees."

Final Recommendation

The personal loan market offers diverse options catering to various credit profiles and needs. Lenders like SoFi and LightStream excel for borrowers with strong credit seeking low rates and no fees, while Upstart and Avant provide valuable access for those with fair credit. Evaluating APRs, fees, loan amounts, and terms against individual circumstances is key to finding the best fit.